Bitcoin and Ethereum, which were recovering in price, plummeted due to the effects of military conflict between Russia and Ukraine. While concerns over an interest rate hike from the US have risen once more, military conflicts between Russia and Ukraine have escalated, leading to a further decline even following returning all gains. In particular, Bitcoin and Ethereum plunged close to 5 million won and 400,000 won, respectively, from their highs this week.

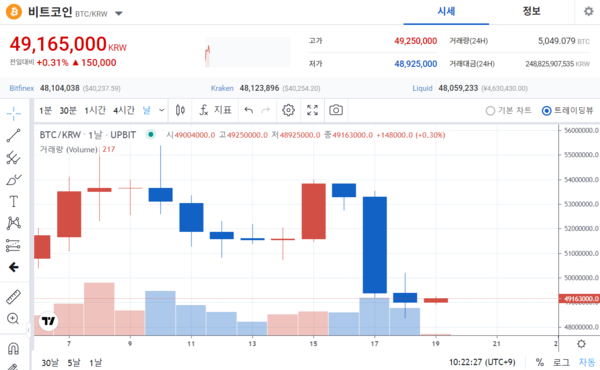

According to Upbit, a virtual asset exchange, as of 9 am on the 19th, bitcoin was traded at 49 million won, down 5.6% from the same time last week. The price seems to have had a big impact on the growing concern over Russia’s invasion of Ukraine as the military conflict between Russia and Ukraine intensifies.

Fluctuating global situation, fluctuating bitcoin

On the 14th, as concerns regarding an interest rate hike from the US and Russia’s invasion of Ukraine escalated, the bitcoin price weakened. However, according to data from The Economics, whale addresses with between 10,000 and 10,000 bitcoins are accumulating bitcoins. Institutions have begun placing capital in Bitcoin, diagnosing that the current price is a good entry point for long-term holders, although Bitcoin is likely to decline with the stock market crash.

Tensions also eased on the 15th (local time) when news broke that Russian troops had withdrawn from the Ukrainian border. Putin and German Chancellor Olaf Scholz met in Moscow to discuss ways to ease tensions over Ukraine. “We don’t want war,” Putin said on the same day, adding that “this is why we’re coming up with a deal.” “The news that Russian troops have withdrawn from the Ukrainian border is a good sign,” Scholz said. With the easing of the conflict between the two countries, the price of bitcoin also turned upward and rose to 53 million won.

However, on the 17th (local time), Russian media reported that Ukrainian forces had launched an artillery attack on the Lugansk region, where pro-Russian rebels are stationed, raising concerns over Russia’s invasion of Ukraine. The Ukrainian government, on the other hand, denied the attack and said it had been attacked. U.S. President Joe Biden said on the 17th (local time) that it is highly likely that Russia will invade Ukraine in the next few days. The three major U.S. stock indices also closed lower amidst such a sense of war. The Dow fell 1.78%, the S&P 500 fell 2.14% and the Nasdaq Composite fell 2.88%.

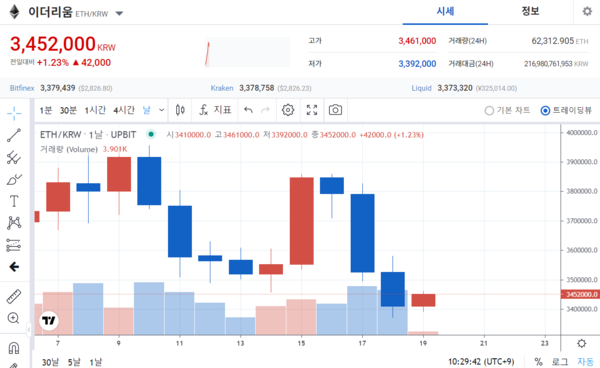

Ethereum and Ripple being dragged along… Virtual asset investment is also rapidly deteriorating

Ethereum and Ripple also returned their gains. Ethereum was traded at 3408,000 won per unit, down 4.75% from the same time last week. As with Bitcoin, it has fallen further even following returning all the increase. On the other hand, Ripple was traded at 961 won per unit, up 2.34% from the same time last week. It appears that the return of the uptrend did not lead to the downtrend.

The two virtual assets have moved according to Bitcoin price and global issues without any special news throughout the week. The virtual asset ‘Clay’ issued by Ground X, an affiliate of Kakao, was traded at 1528 per unit, up 7.6% from the same time last week. In Naver’s affiliate Line, the virtual asset ‘Link’ was traded at $125 each, down 4.58% from the same time last week.

Investor sentiment froze rapidly. The self-estimated ‘fear and greed index’ of Alternative, a virtual asset data provider, fell 5 points from the previous day to 25, changing from the fear stage to the extreme fear stage. The index closer to 0 indicates extreme fear in the market, and closer to 100 indicates extreme optimism.

Reporter Lee Seong-woo [email protected]