It is like a drama that the founder, the largest shareholder of the company, is kicked out of the company. It’s not even an insolvent company. Producer Lee Soo-man, the founder and largest shareholder (18%) of SM Entertainment, was caught in a similar situation. He is a pioneer who made K-pop a global industry. SM was derived from his first name, Suman. Even so, he was ‘involuntarily resigned’ from the company.

Instead of receiving an official salary from the company, he signed a production service contract and received money, which was large. It is 24 billion won in 2021 alone. It is known as a company called Like Planning, but it is exactly the trade name of Lee Soo-man, an individual entrepreneur. In 2020, SM suffered a loss of 80.3 billion won, but Like Planning (Lee Soo-man) was paid 12.9 billion won. It was claimed to be a fair price for creative work, but shareholders’ dissatisfaction accumulated. It has become a target of activist funds that actively advocate for shareholder rights.

━

Lee Soo-man gained fame but lost shareholder trust

At the SM shareholders’ meeting in March of last year, the company’s proposed appointment of directors and auditors was not adopted. Instead, a person from Align Partners, which has only a 1% stake, was appointed as an auditor. Institutional investors such as the National Pension Service sided with Align, and the approval rate exceeded 80%. I gained fame, but I guess I lost my heart? Under pressure from Align, SM announced in October of last year that it would terminate its contract with Like Planning early at the end of the year. When the contract ends, Lee Soo-man is the only major shareholder. The SM registered director resigned in 2010.

SM management announced the SM 3.0 plan at a company briefing on the 3rd. It was a blueprint to get away from relying on Lee Soo-man and pursue multi-production and allocate 20% of net profit. An activist fund with only a 1% stake took control of the SM board within a year, so it can be said to be a great success.

The two co-CEOs, who were appointed by Lee Soo-man, also stood on the side of Align. The pressure from Align to be unwilling to file a lawsuit in relation to past opaque transactions was effective. There is also a side of self-interest that created this situation and made the management turn its back.

Lee Ki-hoon, an analyst at Hana Securities, pointed out in a report dated the 7th, “The company’s failure to share its performance with shareholders and executives and employees, and missed numerous golden times even though there were ample opportunities to correct them, are returning like boomerangs.”

━

Acquisition of new shares instead of Kakao Lee Soo-man shares

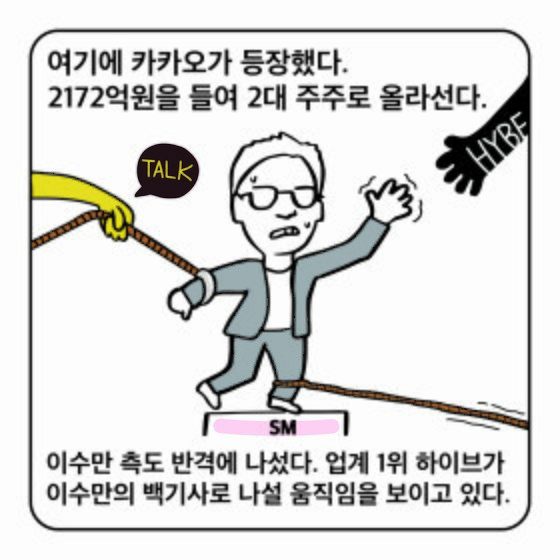

Here comes cacao. It will invest 217.2 billion won to participate in capital increase and acquire convertible bonds to become the second largest shareholder. Kakao had been negotiating with Lee Soo-man to secure a stake in SM, but he turned to acquiring Shinju. Apart from Lee Soo-man’s mistake, there is also a view that Kakao’s behavior is close to ‘robbing an empty house’.

Lee Soo-man’s side also launched a counterattack. Claiming that allocating new shares only to Kakao is an illegal act that infringes on the interests of existing shareholders, it filed an application with the court for a provisional injunction to prohibit the issuance of new shares. At next month’s shareholders’ meeting, the terms of all four existing directors expire, and a vote battle is expected between the two sides to dominate the board.

━

If Hive participates in the war, ‘the first war in the K-pop industry’

Here, the industry’s No. 1 hive is showing a move to become a white knight for Lee Soo-man. On the 9th, in response to the Korea Exchange’s request for public disclosure, Hive said, “We are reviewing a tender offer for SM shares, and nothing has been confirmed yet.” that there is a will. If so, it is likely to purchase more shares in addition to Lee Soo-man’s shares. When Hive officially participates, the ‘first war in the K-pop industry’ begins.

For founders who think they have been betrayed and kicked out, the priority is to come back and punish them. Except for the main enemy, the rest are allies. If Lee Soo-man sent an SOS to Bang Si-hyeok, chairman of the Hive board, this is a declaration that SM will never be handed over to Kakao.

Hive raised its stock price with BTS, but SM’s history and tradition, and the group it belongs to, are bound to appeal. In addition, you can save Lee Soo-man who is in trouble and become a legitimate successor to the K-pop head family house that is recognized by him. In addition, it can prevent the emergence of strong potential competitors such as Kakao and SM Union and conquer the domestic industry.

Of course, Kakao, which has decided to receive an investment of 1 trillion won from Saudi Arabia’s sovereign wealth fund, will not be able to back down easily. If you don’t, you can lose both justification and practicality. This dispute means that the size of the K-pop industry has grown that much, and it is also a sign that it is moving into a new phase.

━

Concerns over damage to SM capabilities if the dispute is prolonged

If Lee Soo-man joins hands with Bang Si-hyuk and competes with Kakao, the inside of SM will become much more complicated than it is now. If this fight is prolonged, there is a possibility that SM’s basic capabilities will be damaged as internal divisions intensify. Unlike manufacturing, people are important. Considering the future of the K-pop industry, it is good to end the management dispute as soon as possible.

Written by Kim Won-bae, Editorial Writer Illustration = Intern Reporter Ahn Eun-joo

Wonbae Kim ([email protected])