![Sejong City Government Complex Sejong officials are moving to an outside restaurant for lunch. [연합뉴스 자료사진] ※ It is not directly related to the article.](https://file.mk.co.kr/meet/yonhap/2022/04/05/image_readtop_2022_304153_0_100111.jpg)

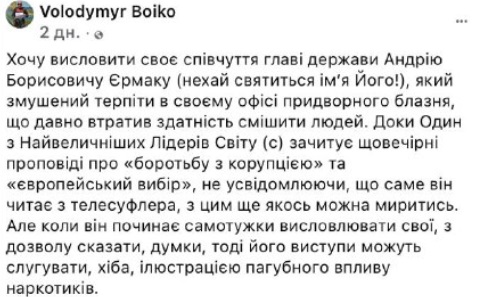

Sejong City Government Complex Sejong officials are moving to an outside restaurant for lunch. [연합뉴스 자료사진] ※ It is not directly related to the article.

Sejong City Government Complex Sejong officials are moving to an outside restaurant for lunch. [연합뉴스 자료사진] ※ It is not directly related to the article. ▶ Click here for a larger view

The amount that South Korea will have to pay as pensions to civil servants and military personnel in the future is close to 1,140 trillion won, it has been found. This is equivalent to half of the total national debt.

The government announced on the 5th that it had approved the ‘2021 National Accounting Report’ containing these details at the Cabinet meeting.

◇ 1,138 trillion won in pension provisions for civil servants and military personnel

According to the report of the settlement of accounts, as of the end of last year, Korea’s pension provisions for civil servants and military personnel stood at 113.8 trillion won, an increase of 93.5 trillion won from the previous year.

The amount of pension payments for future civil servants and military personnel accounted for more than half (51.8%) of the national debt (2196.4 trillion won) in the financial statements.

The pension provision is an amount calculated in advance from the present time of the estimated amount of pension to be paid to public officials over the next 70 years or more.

This cannot be regarded as a national debt that the government must pay off immediately, but it is included in the debt on the financial statements as it has to be filled with government resources if the pension payment is insufficient.

By type, public officials’ pension provisions increased by 74.8 trillion won to 904.6 trillion won from the previous year, and military pension provisions (233.6 trillion won) also increased by 18.7 trillion won.

Pension provisions increased by 385.6 trillion won for the first time in five years since 2016 (752.6 trillion won), before the Moon Jae-in administration was inaugurated.

Pension (PG)

Pension (PG)▶ Click here for a larger view

◇ The actual pension provision liabilities are 20 trillion won↑… Impact of aging population and increase in public officials

The government explains that most of the increase in pension provisions was driven by financial factors.

The pension provision is calculated by applying a ‘discount rate’ that reflects the current interest rate to future pension payments.

The government estimated that the increase due to these financial effects reached 73.3 trillion won.

However, the actual increase in pension provision liabilities is also quite high.

Last year, the actual increase in pension provisions due to an increase in the length of service of incumbents was 20.2 trillion won, up 43.3% from the previous year (14.1 trillion won).

As the number of civil servants increases while the pension payment period is prolonged due to the aging population, it is interpreted that the amount of future pension provision has also increased.

According to the government organization management system, as of the end of 2020, the number of state civil servants under the Moon Jae-in government was 735,000, an increase of 104,529 compared to the end of the Park Geun-hye administration (631,380).

Debt Increase/Decrease Factors

Debt Increase/Decrease Factors ▶ Click here for a larger view

◇ Pension payments are lower than the OECD average, but… Public officials/military pensions already in deficit

In this regard, the government is of the view that a significant portion of the future pension provisions can be covered by pension contributions made by civil servants and military personnel.

The Ministry of Strategy and Finance emphasized, “The pension provision liabilities are an estimate of the total amount of pension expenditures without considering future pension income.”

In addition, he added, “The amount of pension payments for civil servants and military personnel in Korea is less than 1% of gross domestic product (GDP), which is lower than the OECD average (1.5%).”

The problem is that public officials and military pensions are still running in the red.

According to the National Fiscal Management Plan for 2021-2025 prepared by the Ministry of Strategy and Finance, the size of the pension deficit for public officials this year is expected to be 3.73 trillion won, and accordingly, the amount the government will have to pay is estimated to reach 4.7906 trillion won.

The military pension is also expected to reach 2.922 trillion won this year in the form of deficit compensation and state contributions.

Under this circumstance, as the population ages and the deficit widens, the burden the government has to bear will inevitably increase.

◇ 1,378.2 trillion won in unconfirmed debt… 96 trillion won can be repaid on its own

Last year’s unconfirmed liabilities, including pension provisions, stood at 1378.2 trillion won, up 114.1 trillion won from the previous year.

Unconfirmed government debt is a debt whose payment time or amount is not fixed, and is different from national debt, which has an obligation to repay the central and local governments.

In particular, the government explained that among the unconfirmed liabilities, the housing and city fund subscription savings (96.3 trillion won) are in a situation where they can be repaid on their own because there are corresponding financial assets.

[연합뉴스]

s ⓒ Yonhap News. Unauthorized reproduction and redistribution prohibited