With the acquisition of De Valk Machinefabriek, Anvil Industries is also entering additive manufacturing. Together with KMWE and K3D, the group will be 3D printing at the MetalFab 1 on the Brainport Industries Campus. Jan Adams (CEO) and Jack Vromans (CTO) have no doubts regarding the business case being there. “We think additive manufacturing is necessary in the future to be complete,” says the Chief Technology Officer. The strength of the group provides the necessary backbone if customers want to scale up in AM.

The group of companies that Anvil Industries has brought together has grown once more at the end of last year. Up to eight companies in the high-tech manufacturing industry. The group’s turnover growth has accelerated in recent years. Jan Adams: “It falls into our lap. Customers ask for certain competencies to be further developed and then you follow suit.” As a Tier 1 supplier you have to grow with your customers, adds Jack Vromans, CTO since 2015. “Or you have to have a niche competence with which you can make a good margin.”

The cover never happens all at once; additive manufacturing does not differ from other production techniques in that respect

AM technology is ripe

However, it is too short-sighted to say that the group will grow on its own. “You have to learn to grow,” says Jan Adams, who previously worked at Philips Lightning, VDL and Hqpack, among others, before making the switch to Anvil in 2016. “We are guaranteed to grow; double in a few years, but be careful not to trip.” Vado, the investment vehicle of the van Doorn family, as a shareholder helps with this. Although Vado benchmarks the companies in its portfolio like any other equity fund, there is no exit strategy. “We can calmly build up the added value.” Last year the group invested more than € 8 million; this year it will be regarding € 10 million. Investments mainly in new machines and automation, such as a Fastems cell including a Mazak Integrex 630V/6 at Jansen Machining Technology. Additive manufacturing is also included in Anvil Industries’ technology roadmap. Ten years ago, Jack Vromans, then director of Rols Machine Parts, thought it was too early and therefore did not participate in AddLab, the Additive Industries initiative. “That was too early; then you would have started pioneering.” However, as a manufacturing company you always have to be open to new technology; see if it offers opportunities. The cover never happens all at once; additive manufacturing does not differ from other production techniques in that respect.

In additive manufacturing, the engineering competence is more important than the machine itself

Jack Vromans

From pioneering to business

Now he thinks it’s time to invest in AM technology. “We are seeing companies move from trying to real business with additive manufacturing.” He is not just referring to competitors; he also points to international OEMs. John Deere, for example, that uses 3D metal printing for manifolds instead of casting; ASML, which now uses a few hundred 3D printed parts in every machine. Not to mention the medical industry, another focus market of the group, where additive manufacturing is gaining a foothold. Anvil Industries also focuses on the market for machinery for the food industry. Weight savings might just stimulate the demand for additive manufacturing there. “We don’t know whether we cannibalize 10 or 15 percent of other techniques with AM,” says Vromans. “But even if it is 5 percent, it is already a lot.”

Do it yourself or take over

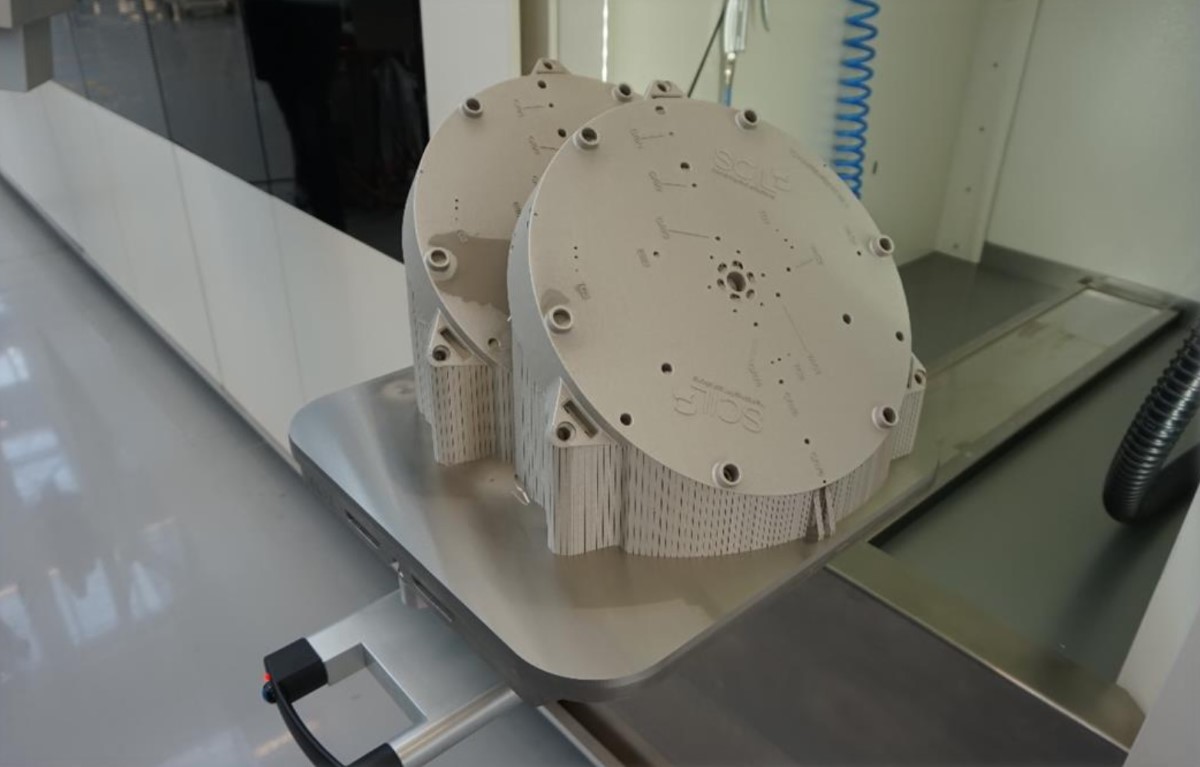

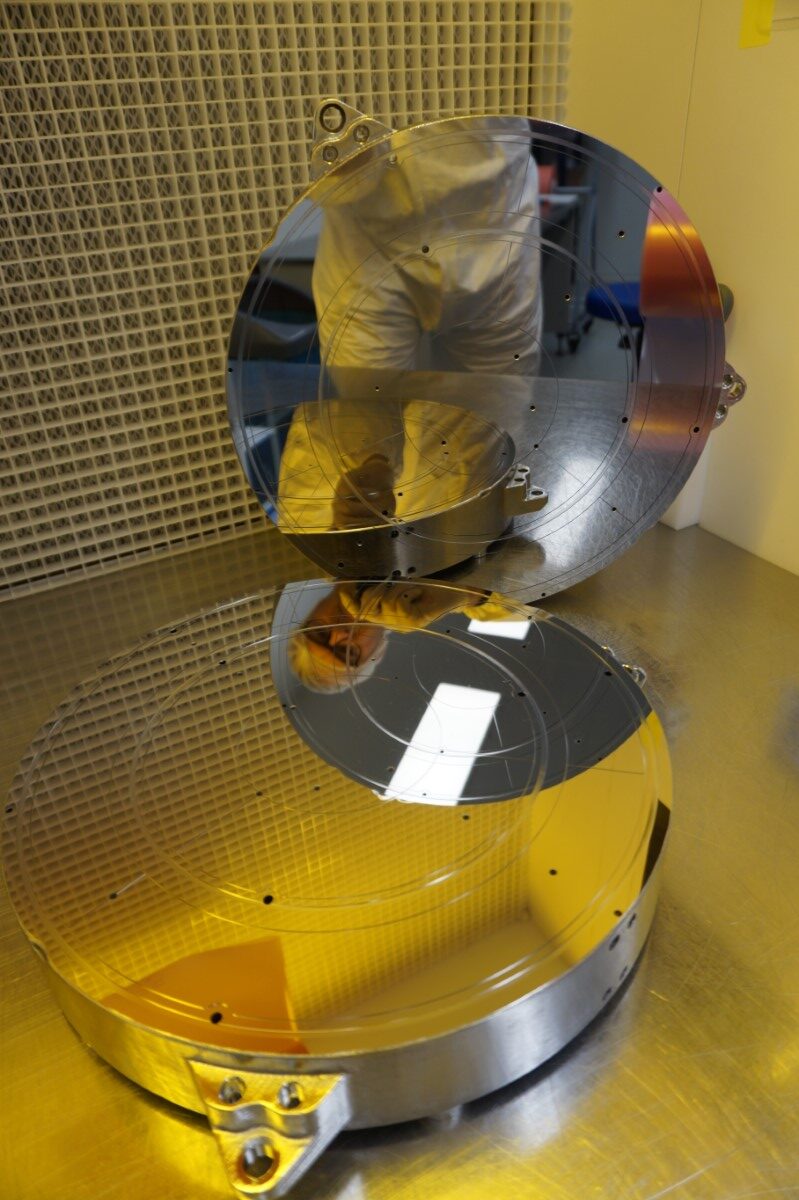

Fellow town De Valk Machinefabriek did join AddLab ten years ago. Successfully. John Hagelaars’ team has produced several components for the high-tech industry with AM, including a large and complex manifold for a semiconductor customer and a wafer chuck for a start-up. At the end of 2022, Anvil Industries took over the supplier. Jan Adams: “We might have chosen to buy an AM machine and build the technology ourselves. But in additive manufacturing, the engineering competence is more important than the machine itself.” Building knowledge takes time. And outsourcing does not provide the knowledge you need as a group. Jack Vromans: “We are a manufacturing company. We have to learn that ourselves and then we know how to scale up.” Major steps can be taken through the takeover, although Jan Adams and Jack Vromans emphasize that the company is in a learning curve as far as AM is concerned. “But we smell that there is business.”

Read Solutions Magazine digitally

Anvil strategy

The Valk Machinefabriek will not only become the AM competence center of the group. The supplier in Valkenswaard will also function as a QRM shop. “We were still looking for a QRM shop for ASML’s fastlane; quickly make small series, including prototypes if necessary.” With such a QRM shop, Anvil can also better bind start-ups and smaller customers. Due to the rapid growth of the other factories in the group, they sometimes receive too little attention there. “They now get them at De Valk and if they continue to grow they can go back to the other factories.”

Organizational backbone

Conversely, the acquisition of De Valk Machinefabriek provides the means to grow faster in the field of additive manufacturing. Learning to use and apply the technology is one side of the coin; having the financial and organizational backbone to grow quickly is the downside. Jan Adams is convinced that scale is an advantage for AM. As a result, you will be more likely to get OEMs involved in AM. “If customers want five AM machines, they will come. We are an enabler for our customers; their business is our business. We grow with them.” The group is also looking at other metal printing techniques than just Laser Powderbed Fusion, the technology in which De Valk has built up expertise. “Not all high tech is high tech. The level of complexity is not the same for all parts. We always look at a product to see if we can use a cheaper machine with a lower hourly rate.”

In Anvil Industries different companies in mechanical processing work together. This allows customers to offer both a production environment for high mix low volume and for high volume low mix. The group’s strategy is to integrate vertically as much as possible. The group includes Job Precision, Rols Machine Parts, Jansen Machining Technology, Inclose, Contour, BKL Engineering and recently De Valk Machinefabriek.

Not all high tech is high tech. The level of complexity is not the same for all parts.

Jan Adams

Collaboration in the Brainport region

De Valk Machinefabriek, together with KMWE and K3D, manage the MetalFab 1 of Additive Industries that is on the BIC. This 3D metal printer from Dutch soil will remain on campus. Anvil Industries will continue to collaborate on AM with KMWE and K3D. “We feel comfortable with this collaboration. As a result, we can build up knowledge even faster and we can offer more metals,” explains the CEO.

So the group will be collaborating in a new area of competence with a direct competitor in the high-tech industry?

The two group managers see it differently. Of course, KMWE and the companies in the Anvil group sometimes compete with each other. “But our common goal in Southeast Brabant is enabling the growth of OEMs. Worldwide there are billions to forgive; here in the region we only get millions from that market,” says Jan Adams. “You can’t give each other the light in the eyes or make the network stronger together. If the major OEMs are doing well, we are doing well too.” The cooperation is also a signal of confidence towards customers, believes Vromans. “We also outsource to each other.”

The drivers for AM

The pre- and post-processing steps will be done by the Anvil companies themselves. This makes the work more attractive for the engineers. All drawings that come in now will be screened through the lens of additive manufacturing. Could the part be printed better? It is now well known that you can integrate cooling channels with additive manufacturing. The challenge is to find other drivers, for example weight optimization by moving towards organic shapes. Jack Vromans expects the 3D printing market to “explode” if you can convert normal products into an AM product. He holds the cards which drivers become important to his chest for a while. “We smell opportunities, but we are going to learn first.”

CO2 certificates

Sustainability, and CO2 emissions in particular, might well become such a driver. Weight savings per se to save material costs will probably never justify AM. But if you can demonstrate that the CO2 emissions of the end product decrease during its lifespan, you do have a “hook” on which to hang the technology. Especially if from 2025 large companies will have to deal with stricter ESG rules (Environmental, Social & Governance, legislation that forces large companies to reduce their energy and raw material consumption and CO2 emissions, among other things). If CO2 certificates start to rise sharply in price from 2030, this might just become a driver for additive manufacturing. Jack Vromans: “Then additive manufacturing has an advantage. We need to find these kind of brackets.”

Read Solutions Magazine digitally:

URL Copied