2024-03-22 11:30:00

A Nomad recently promoted an excellent update to the Nomad Passits loyalty program that provides benefits to users who accumulate points with exchange transactions carried out through the company’s application fintech. Now there are even more ways to get along!

In addition to traditional exchange operations, which continue to yield 1 point for every dollar converted to the Nomad account, users can also obtain points in Husky payments. This modality earns one point for each dollar (or equivalent value in other currencies) sent or received by the account.

According to Nomad, for the amounts to be recorded, the CPF used in the Husky account must be the same as that registered in the Nomad account. As with foreign exchange transactions, points acquired through this modality are valid for 12 months following completion of the transaction.

Invest your money in investment account from Nomad or even just leave it as balance in your global account They can also be a good way to accumulate points. This is because now, at the end of each month, you earn one point for every dollar invested or present in the account balance.

Points automatically renew if you keep or add money to your Global Account or Investment Account. On the first day of the month, the points corresponding to the balance available on the previous day are recorded, which replace the points earned a month earlier, which expire.

Accumulate more points and level up in Nomad Pass

Nomad also updated the table of points needed to advance to the next level. When you reach level 5, it’s worth remembering, you get a 50% discount on the exchange rate, which becomes just 1%.

Check out the new table:

| Level | Number of points | Service charge |

|---|---|---|

| 1 | Up to 1,000 points | 2% |

| 2 | Between 1,000 and 5,000 | 1,8% |

| 3 | Between 5,000 and 10,000 | 1,6% |

| 4 | Between 10,000 and 20,000 | 1,3% |

| 5 | 20,000 points or more | 1% |

In addition to the exchange rate discount, advancing through the Nomad Pass levels can give you other benefits, such as lounge exclusive to Nomad (at Guarulhos Airport) and the physical debit card (compatible with Apple Pay) with free shipping — benefits that are granted from level 2 onwards.

Don’t have a Nomad account yet?

Don’t waste time and open now — with the right to cashback, also! 🤑

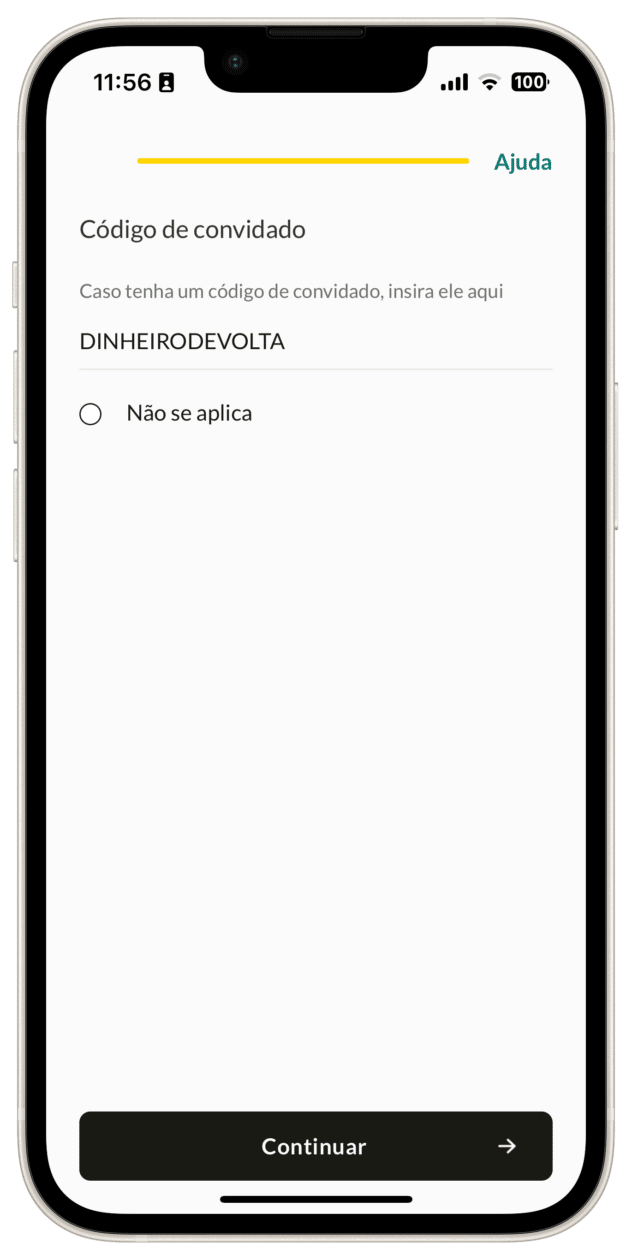

To the download the app and register using your ID or CNH, just type DINHEIRODEVOLTA in the “guest code” field to get a cashback up to US$20 on top of the value of your first exchange transaction — the amount will be deposited the following day.

DINHEIRODEVOLTA to win up to $20 off cashback.

DINHEIRODEVOLTA to win up to $20 off cashback.

DINHEIRODEVOLTA to win up to $20 off cashback.It works like this: you will earn 2% of cashback upon the first exchange transaction on your account, limited to US$20. This way, making a US$500 operation, for example, will earn US$10; if it’s $1,000, you’ll win $20!

About Nomad

Nomad was the first to offer a US-based dollar account, with no opening, annual or maintenance fees. The company’s card is accepted in more than 180 countries, offering, as mentioned, much lower rates than those of Brazilian credit cards.

In addition to being able to make purchases, with it you can invest in the American stock markets (NYSE and NASDAQ), buy shares, ETFs, fixed income ETFs and REITs… all from US$1 and zero brokerage, insured up to US$250 thousand by the FDIC (US Government Deposit Guarantee Fund) in the current account and investment account, in addition to a SIPC guarantee for up to US$500 thousand invested.

The Nomad account also allows you to make/receive transfers from other Nomad accounts at no cost, and to make/receive transfers to US accounts (via Wire Transfer) and others paying much less than the rates charged in the USA.

And it doesn’t stop there: with your Nomad account you have access to discounts at partner stores and you can also take advantage of the Nomad Lounge, which grants access to one of the best VIP lounges in Terminal 3 at Guarulhos International Airport (SP).

Only at Nomad can you have an international account with no monthly maintenance fees, dollars insured by the FDIC, up to 10% savings on purchases and IOF of 0.38%.

TRANSPARENCY NOTE: MacMagazine receives a small commission on sales completed through links in this post, but you, as a consumer, pay nothing more for the products by purchasing through our affiliate links.

1711112289

#earn #points #ways #Nomad #Pass