2024-03-25 05:01:03

Even following the Bank of Japan raised interest rates for the first time in 17 years, yen selling pressure has not subsided, and the dollar-yen exchange rate is approaching the level at which the yen-buying intervention was implemented in October 2022. Markets are once once more wary of intervention, and there is growing interest in comments by currency officials such as Finance Minister Shunichi Suzuki and Finance Minister Masato Kanda to check the yen’s depreciation.

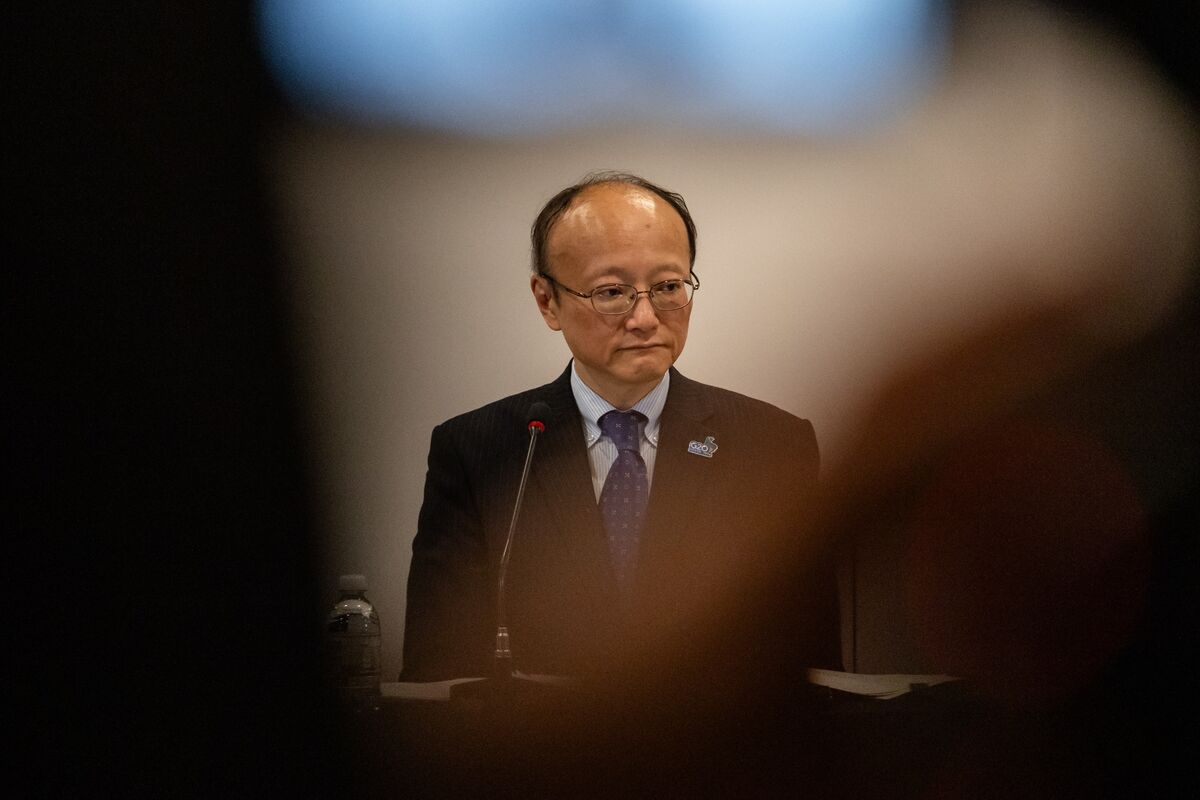

Finance Minister Kanda told reporters on the morning of the 25th, “This is not a direction that is in line with fundamentals, but is clearly based on speculation.” He said, “Excessive fluctuations due to speculation have a major negative impact on the national economy and cannot be tolerated, and we will take appropriate action once morest excessive fluctuations without eliminating all means.” Ta.

“The current depreciation of the yen is clearly due to speculation.” – Finance Minister Kanda at 151 yen level

On the 19th, the Bank of Japan decided to lift large-scale easing, including ending negative interest rates, and on the 20th, the U.S. Federal Open Market Committee (FOMC) maintained its outlook for three interest rate cuts this year, but the trend of a weaker yen remains. in the process of. In the foreign exchange market, the exchange rate was at one point on the 22nd at 151.86 yen to the dollar, approaching the 151.90 yen level at which the yen-buying intervention was carried out two years ago, and the market was nervous regarding the information being released by the authorities. There is.

Finance Minister Kanda said that the difference in interest rates between Japan and the United States, which is behind the weaker yen, is “obviously narrowing” and is “expected to continue narrowing further.” He pointed out that he is “always ready” to intervene in foreign exchange rates in response to excessive fluctuations. Regarding the level at which he will intervene, he says, “I am not conscious regarding it. Above all, I consider whether the fluctuation is excessive and how much of an impact it will have on the economy.” I stopped it.

The effectiveness of lip-service interventions is limited. After Finance Minister Kanda’s statement on the morning of the 25th, the dollar-yen pair strengthened by around 30 sen, but continues to hover in the low-151 yen range. On the 22nd, Finance Minister Suzuki said, “We are watching the market with a high sense of nervousness” and made a statement with the same level of caution as usual, but the yen actually moved towards a weaker yen, with the market declining in 2022 and 2023. (151.95 yen and 151.91 yen, respectively) were noticed.

On September 22, 2022, when the Japanese government decided to intervene to buy the yen for the first time in 24 years, the yen’s depreciation accelerated following former Governor Haruhiko Kuroda’s statement that he was once morest interest rate hikes for the time being. “We cannot overlook excessive fluctuations caused by this,” he said in a firm stance. On October 21 of the same year, the next intervention, the yen hit a new low once morest the dollar for the first time in 32 years. Authorities did not say whether they would intervene, but said, “We will take the necessary measures when necessary.”

In a survey conducted by Bloomberg on the 21st of this month, the median exchange rate at which the government is expected to intervene in the foreign exchange rate was 155 yen.

We have summarized the implications of the comments regarding foreign exchange by stage.

Some fluctuations can be seen

- I won’t comment on the market price.

- Don’t be concerned regarding market trends

fluctuations continue

- It is desirable for the exchange rate to remain stable.

- It is desirable for market prices to reflect the fundamentals of the Japanese economy.

- Continue to monitor foreign exchange market trends and their impact on the economy

start watching

- We are closely monitoring market trends

- We are closely monitoring market trends

- We are watching market trends with great interest.

start to worry

- Sudden/rapid/excessive market fluctuations are not desirable

- Market prices that do not reflect economic fundamentals are undesirable.

- Watch market trends with caution

- Excessive exchange rate fluctuations have an unfavorable/adverse effect on the Japanese economy

- Note: The Ministry of Finance, the Financial Services Agency, and the Bank of Japan may hold a tripartite meeting to exchange opinions on the foreign exchange market.

growing concerns

- Market prices do not reflect economic fundamentals

- The yen is depreciating rapidly

- Movements in the yen exchange rate are excessive/one-sided

Add expression to emphasize

- We are concerned regarding excessive fluctuations as we see rapid and unilateral movements.

- Excessive fluctuations and disorderly movements in foreign exchange rates are harmful to the economy and finances.

- We need to be extremely cautious regarding the impact on prices and the economy.

- Note: Words such as “obvious” and “excessive” are used to emphasize rapid fluctuations in exchange rates.

Warning for intervention

- Take decisive action in case of excessive fluctuations

- speculative movements are unacceptable

- Take appropriate measures if necessary

- If sudden and unilateral movements continue, take necessary measures.

intervention comes into view

- Be prepared to take appropriate action without excluding all options

- We have no choice but to take necessary measures once morest excessive fluctuations due to speculation.

- You can think of it as a constant standby situation.

- I’m always ready to do it

- It is also possible to intervene by stealth (masked).

- Note: The Bank of Japan may conduct a “rate check” in which market participants are asked regarding market levels.

If monetary officials’ statements reach the highest level of alarm, it is likely that it will not be long before actual intervention is implemented. The intervention in September of the year before last took place regarding two weeks following Finance Minister Kanda said he would not rule out any measures and was “prepared to take the necessary measures.” The rate check was regarding a week ago.

1711346831

#Yens #depreciation #approaches #intervention #levels #increasing #attention #key #figures #statements #Currency #Intervention #Guide #Bloomberg