On the 4th, the New York foreign exchange market saw the yen rise by more than 1% against the dollar, briefly reaching 143.76 yen per dollar. Traders were increasingly expecting a major interest rate cut by the Federal Reserve in response to new economic indicators showing a slowdown in the U.S. labor market. The dollar index fell for the first time in six trading days.

| money order | Latest price | Compared to previous business day | Percentage of change |

|---|---|---|---|

The number of U.S. job openings fell to 7.673 million in July, down from the median forecast of 8.1 million among economists surveyed by Bloomberg. The yen was trading at the high 144 yen level against the dollar before the data was released.

U.S. job postings fall short of all economists’ expectations, hitting lowest level since January 2021

Monetary policymakers have made it clear they would not welcome a further slowdown in the labor market, and the Federal Open Market Committee is widely expected to cut interest rates when it meets this month.

“The probability of a 50 basis point cut in September has risen to about 50 percent, up from 25-30 percent earlier this week,” said Win Thin, global head of currency strategy at Brown Brothers Harriman.

“Trading this week has been good old-fashioned risk-off,” said Skyler Montgomery Conning, a currency strategist at Barclays. “That’s driving safe-haven currencies higher, but the yen is favored by expectations of policy divergence between the Bank of Japan and other major central banks.”

Government bonds

Table of Contents

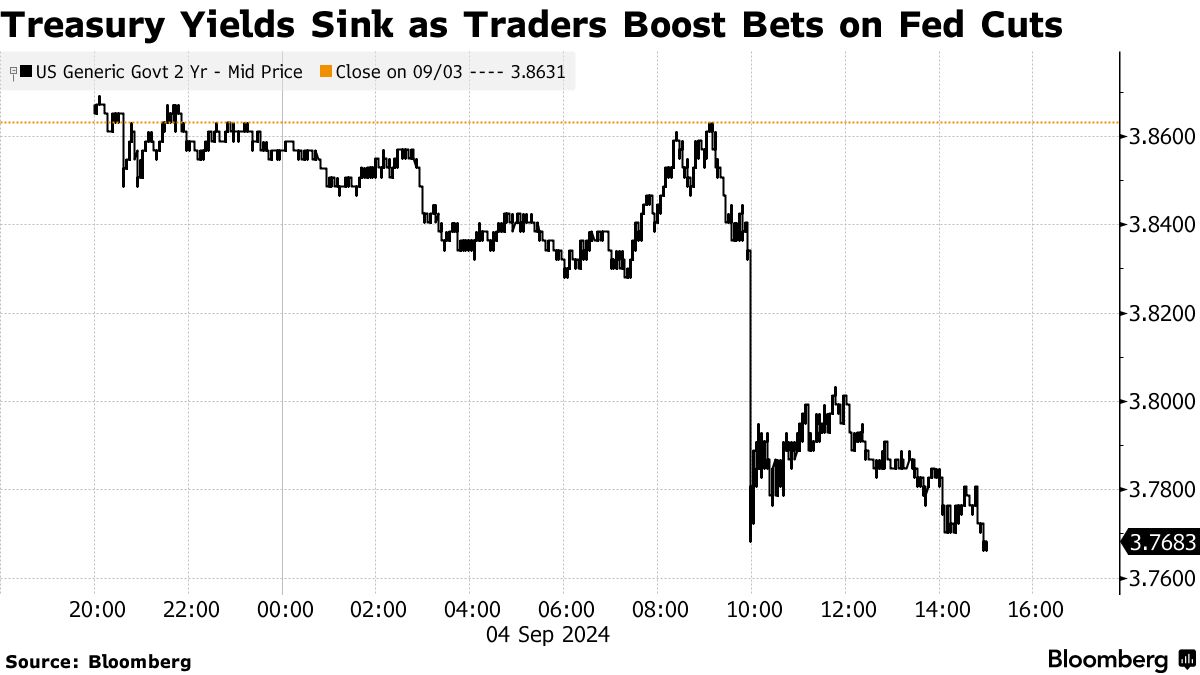

U.S. Treasury yields immediately fell in response to the data, with the 2-year yield briefly falling below the 10-year yield. This marks only the second time the yield curve has inverted since 2022.

Expectations of a major US interest rate cut grow stronger in response to weak job data – inverted yield curve temporarily disappears

| Government bonds | Latest price | Change from previous business day (bp) | Percentage of change |

|---|---|---|---|

“The market may not be as nervous as it was a month ago, but it’s still looking for confirmation that the economy isn’t cooling too much,” said Chris Larkin, chief executive officer at Morgan Stanley’s E*Trade Financial. “So far this week, we haven’t seen that yet.”

With the start of interest rate cuts in the U.S. now almost certain, the market is on edge as to how large the initial cut will be. Investors are closely watching the August employment report due to be released on the 6th, as concerns about the U.S. economy have grown following the release of the July employment report last month.

The interest rate swap market is pricing in a 25 basis point cut at the September FOMC meeting as a certainty, a 50 basis point cut with a 30% or higher probability, and a total of over 100 basis point cuts over the remaining three meetings this year.

2-Year Bond Yield

Source: Bloomberg

“Given how focused Fed Chairman Powell has been on the labor market, any indication of labor market weakness would have a huge impact on rates and rate cut expectations,” said Dennis DeBusschere of 22V Research. “That’s why the rates market is reacting, but it’s all about the jobs data this week.”

Krishna Guha of Evercore ISI said the July U.S. jobs report was “weak” overall, but doesn’t signal a rapid deterioration in the labor market. “Layoffs remain low and hiring is growing modestly, suggesting the labor market hasn’t cracked,” he said. “Netting out the jobs report, the bar for a half-point rate cut in September is slightly lower, but not by much.”

Yield spread between 2-year and 10-year bonds

stock

The S&P 500 index fell. There were times during the day when it rose to positive territory compared to the previous day, but selling intensified toward the end of the day. Semiconductor giant Nvidia continued to fall. It was the largest two-day drop since October 2022.

| stock | closing price | Compared to previous business day | Percentage of change |

|---|---|---|---|

Among other individual stocks, U.S. Steel fell sharply. U.S. President Biden is preparing to block Nippon Steel Corp.’s proposed takeover of U.S. Steel, according to people familiar with the matter. U.S. telecommunications giant Verizon Communications Inc. also fell. According to people familiar with the matter, Verizon is seeking to acquire Frontier Communications Inc. Parent and the two companies are in advanced stages of negotiations.

Goldman Sachs Group Inc.’s Scott Rubner said the stock market could enter a correction if the August employment report is weak.

Bank of America Corp. clients sold U.S. stocks on a net basis for the second week in a row, with institutional investors, hedge funds and retail clients all selling $8 billion in the week ended Aug. 30, according to a client note compiled on the 4th by Jill Carey Hall and other quantitative strategists at the bank.

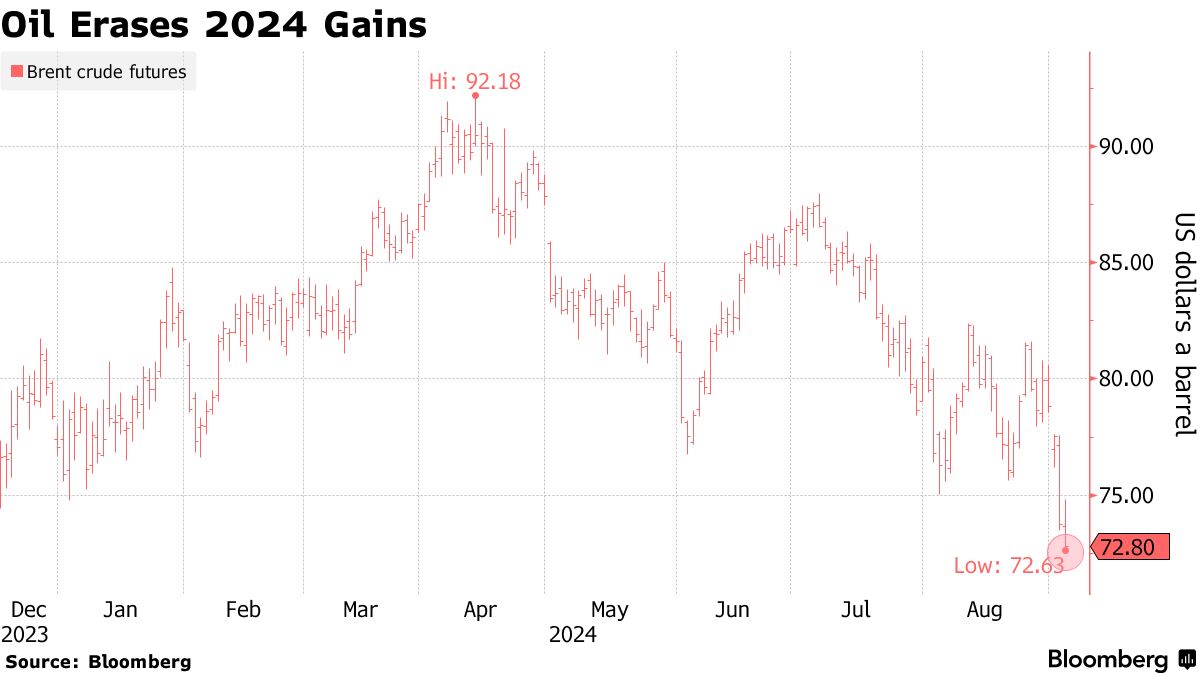

crude

Oil futures slumped to their lowest in nearly a year as worries about fading demand persisted despite the possibility that OPEC+, the group made up of the Organization of the Petroleum Exporting Countries and non-OPEC producers, might delay production increases.

The international benchmark Brent crude closed at its lowest since June 2023. OPEC+ is close to agreeing to delay a planned October supply increase, the representatives said, asking not to be identified discussing private information.

OPEC+, led by Saudi Arabia and Russia, had planned to pump an extra 180,000 barrels per day (bpd) of oil starting in October, but has repeatedly said it could “pause or reverse” the supply if necessary.

“News that OPEC+ may withdraw additional supply gave the market some early breathing space, but momentum from systematic and macro funds is very strong at the moment and this is likely to continue until more clarity emerges,” said Frank Moncam, senior portfolio manager at Antimo.

Oil futures also fell sharply on the 3rd, as weak economic data from China and the United States has worried about demand in the two biggest oil consumers, fuelling fears of a supply glut next year.

Also weighing on the picture is the possibility of a resolution in Libya, where a power struggle is ongoing. The country’s central bank governor, Kabir, said on Tuesday that a deal to resolve the dispute and restart oil production appeared to be near.

Brent Crude Oil Futures

Source: Bloomberg

London ICE’s November Brent crude contract fell $1.05, or 1.4%, to $72.70 a barrel. New York Mercantile Exchange’s (NYMEX) October West Texas Intermediate (WTI) futures fell $1.14, or 1.6%, to close at $69.20.

gold

Spot gold prices were reversing losses as U.S. job openings data showed growing signs of a slowdown in the labor market, paving the way for the Federal Reserve to cut interest rates soon.

After the jobs report, Treasury yields and the dollar fell sharply, while gold reversed its earlier decline and rose 0.3% at one point. The interest rate swaps market is currently pricing in a one-point rate cut this year.

Naeem Aslam, chief investment officer at Zay Capital Markets, said gold’s morning decline was due to some investors selling gold to raise cash after they needed to pay margin calls following the sharp drop in Nvidia shares.

Traders are now focused on the U.S. employment report for August, due to be released on the 6th. Economists surveyed by Bloomberg expect nonfarm payrolls to rise by about 165,000 from the previous month. Any signs of a weakening in the labor sector could support a more aggressive shift in monetary policy from the Federal Reserve, which could be positive for gold.

As of 2:52 pm New York time, the spot price of gold was up 98 cents (less than 0.1%) from the previous day to $2,493.89 an ounce. The December gold futures contract on the New York Mercantile Exchange (COMEX) closed at just $2,526, up $3 (0.1%).

Treasuries Soar as Jobs Fuel Bets on Jumbo Fed Cut: Markets Wrap

US Yields Sink as Jobs Fuel Bets on Jumbo Fed Cut: Markets Wrap

Dollar Drops as Labor Data Fuels Fed Rate-Cut Bets: Inside G-10

Oil Falls as Demand Woes Overshadow Possible OPEC Supply Delay

Gold Erases Losses as Weak US Jobs Data Bolsters Rate Cut Bets

US Dollar Weakens as Job Openings Fall, Boosting Chances of Federal Reserve Interest Rate Cut

The US dollar weakened significantly on the 4th, with the yen rising by more than 1% against the dollar, briefly reaching 143.76 yen per dollar. This came as traders increasingly expected a major interest rate cut by the Federal Reserve in response to new economic indicators showing a slowdown in the U.S. labor market.

According to the latest data, the number of U.S. job openings fell to 7.673 million in July, down from the median forecast of 8.1 million among economists surveyed by Bloomberg. This significant drop has raised concerns about the labor market, which has been a key focus for the Federal Reserve in its monetary policy decisions.

The dollar index fell for the first time in six trading days, with the Bloomberg Dollar Index dropping by 0.34% to 1232.99