the yen’s Unexpected Resilience in the Face of Global Uncertainty

Table of Contents

In a surprising turn of events, the Japanese yen has bucked the trend of global currency volatility, holding its ground against the surging US dollar even as trade tensions escalate. While other currencies like the euro, Canadian dollar, Australian dollar, and New Zealand dollar plummeted in response to President Trump’s declaration of new tariffs, the yen remained relatively stable, even showing a brief surge of 0.3% against the greenback.

This resilience isn’t a one-off event. The yen is the only Group-of-10 currency to have appreciated against the dollar in 2025, a stark contrast to its weakening trend over the past four years. gareth Berry, a strategist at Macquarie Bank Ltd. in Singapore, attributes this unexpected strength to two key factors: the Bank of Japan’s recent shift towards raising interest rates, and the increased risk aversion among investors causing US Treasury yields to dip, thereby weakening the dollar.

“The yen is rediscovering its safe haven credentials,” Berry stated. ”It’s mainly due to the Bank of Japan being on a hiking path,but also US Treasury yields are now so elevated that they dip on risk-off,and that sends dollar-yen lower.”

Bloomberg strategists echoed this sentiment,observing,”Amid Monday’s steep selloffs in a slew of currencies,the Japanese yen is standing out as a relative oasis of calm. The yen is the only G-10 currency advancing versus the dollar right now, with traders likely to be leaning into its performance during the first Trump presidency when it attracted attention by climbing when most of its peers fell.”

This newfound stability in the yen could provide the Bank of Japan (BOJ) with valuable versatility in managing monetary policy. Akira Takei, a fixed-income manager at Asset Management one Co. in Tokyo,believes that “A stronger yen may now give the BOJ more leeway when deciding to add to its recent series of interest rate hikes,thus narrowing the rates gap with the US.” While economists surveyed by Bloomberg predict the next BOJ interest rate hike will likely occur in July to September, Takei argues that with import prices becoming less burdensome, there’s no urgent need to rush rate increases. Previously,rising import costs due to a weaker yen had posed a challenge to BOJ’s tightening policies.

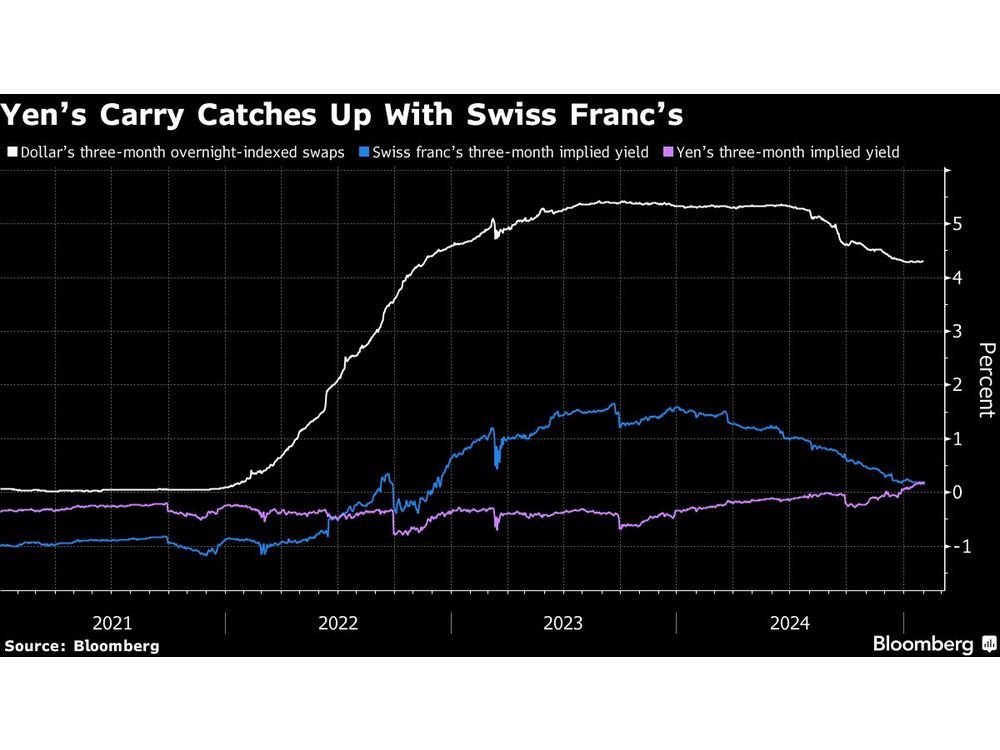

Despite retaining a yield advantage,the dollar is facing competition from the yen,particularly as a safe-haven asset.Investors are increasingly drawn to the yen,particularly against currencies like the Swiss franc,as its forward-implied yields have risen above zero. Gareth Berry notes, “the yen is so cheap and the franc is so strong that the yen is preferred. It helps the yen’s case too that the BOJ is still in tightening mode, while the Swiss central bank is easing.”

What is the key factor Gareth Berry believes will ultimately determine the future direction of the yen?

The Yen’s Unexpected Resilience in the Face of Global Uncertainty

In a surprising turn of events, the Japanese yen has bucked the trend of global currency volatility, holding its ground against the surging US dollar even as trade tensions escalate. While other currencies like the euro, Canadian dollar, Australian dollar, and New Zealand dollar plummeted in response too President Trump’s declaration of new tariffs, the yen remained relatively stable, even showing a brief surge of 0.3% against the greenback.

This resilience isn’t a one-off event. The yen is the only Group-of-10 currency to have appreciated against the dollar in 2025, a stark contrast to its weakening trend over the past four years. We spoke with Gareth berry, a strategist at Macquarie Bank Ltd. in Singapore, to understand this unexpected strength.

An Interview with Gareth Berry

archyde: Gareth, the yen’s performance has been nothing short of surprising. Can you shed light on the factors driving this resilience in the face of global uncertainty?

Gareth Berry: Certainly. The yen is rediscovering its safe-haven credentials. This is primarily due to two key factors. firstly, the bank of Japan’s recent shift towards raising interest rates is making the yen more attractive to investors seeking higher returns. Secondly, heightened risk aversion among investors is leading to a dip in US Treasury yields, which in turn weakens the dollar.

Archyde: As Bloomberg strategists have noted, the yen seems to be attracting investors who see it as a haven in times of turmoil, reminiscent of its performance during the first Trump presidency. Are we seeing a return to those patterns?

Gareth Berry: You’re right to highlight that parallel. The yen’s appeal as a safe haven, especially when compared to currencies like the Swiss franc, seems to be strengthening. The forward-implied yields on the yen are now above zero, making it more attractive to investors who are seeking a positive return.

Archyde: This newfound stability could offer the Bank of japan greater adaptability in managing monetary policy.How might this impact the trajectory of the Japanese economy?

Gareth Berry: Absolutely. A stronger yen provides the Bank of Japan with more leeway when deciding on future interest rate hikes. It could also help alleviate concerns about rising import prices, which were a challenge for the BOJ’s tightening policies in recent years.

Archyde: What are your thoughts on the yen’s long-term prospects, particularly against the backdrop of ongoing global uncertainty?

Gareth berry: While the dollar remains a dominant force, the yen’s recent performance demonstrates its resilience and enduring appeal. The combination of the BOJ’s tightening policies and a flight to safety could propel the yen further in the coming months. It will be critically importent to monitor developments in trade relations and global economic growth to assess the long-term trajectory, though.

Archyde: What do you see as the key factor that will ultimately determine the future direction of the yen?

Gareth Berry: That’s a great question. Ultimately, the yen’s direction will likely be driven by a confluence of factors, including the trajectory of global risk appetite, the Bank of Japan’s monetary policy stance, and shifts in US economic data.