2023-05-08 04:06:55

The yen carry trade, which had been expected to revitalize in response to the Bank of Japan’s new governor Kazuo Ueda’s policy of continuing monetary easing, was already facing headwinds. During the long holidays in Japan, the recurrence of financial instability in the United States caused the yen to appreciate. Some market participants say that the current environment is not suitable for medium- to long-term yen carry.

After the Bank of Japan decided to maintain its monetary easing policy at its policy meeting on April 28, yen selling became active in the foreign exchange market, focusing on the interest rate gap between Japan and overseas. On May 2, the dollar/yen exchange rate reached the high 137 yen level to the dollar, approaching the year-to-date high of March, while the euro/yen exchange rate climbed to the high 151 yen level to the euro for the first time since 2008. However, financial instability reignited, with U.S. regional bank stocks plummeting during the long holidays. There was also speculation that interest rate hikes in Europe and the United States would end, and those who had been selling the yen were forced to buy it back.

Bank of Japan

Photographer: Tomohiro Ohsumi/Bloomberg News

Yujiro Goto, chief currency strategist at Nomura Securities, said the conditions for a carry trade — high interest rate differentials and low volatility — were regarding to materialize, as there were no surprises at the BOJ meeting and U.S. financial concerns had eased.

However, in an environment where credit crunch and economic recession concerns are smoldering, especially in the United States, events that trigger sudden position adjustments are likely to occur, and when carrying out yen carry trades, it is necessary to be wary of the risk of a rapid appreciation of the yen. It was reconfirmed that it should not be done.”

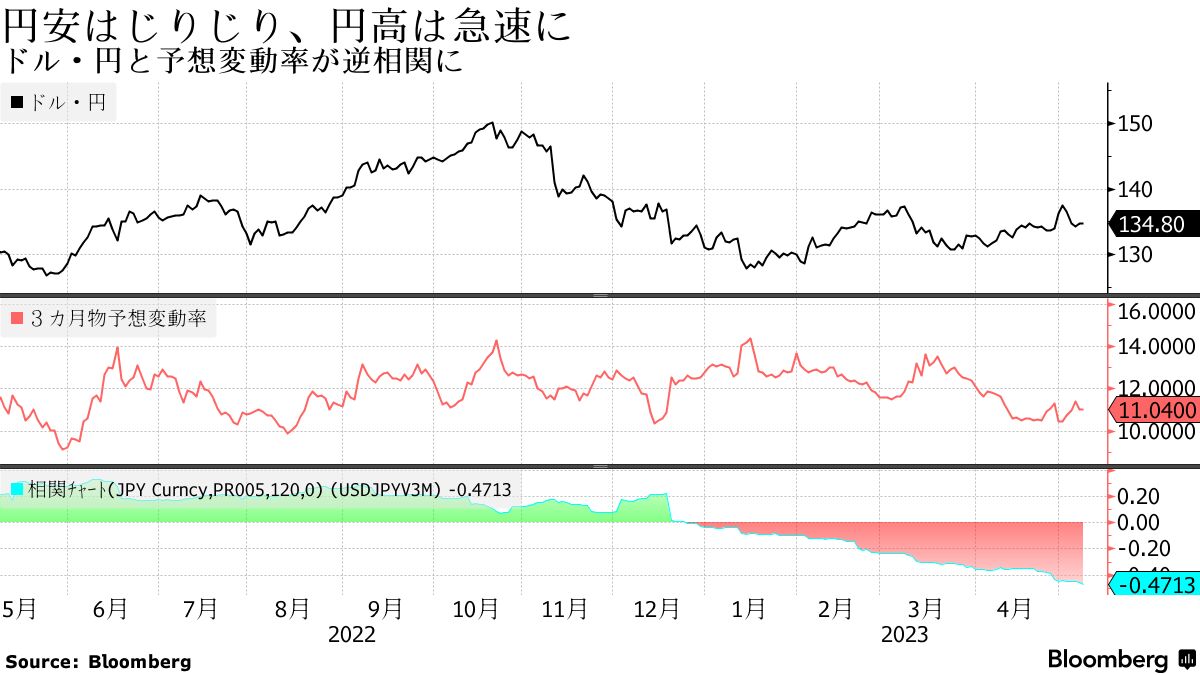

Looking at the relationship between the dollar/yen exchange rate and the 3-month expected volatility rate, last year there was a positive correlation in which the volatility rate rose when the dollar strengthened and the yen weakened. ing.

According to Mr. Goto, the negative correlation means that when the yen weakens, volatility declines and the yen gradually weakens, while when the yen strengthens, volatility increases and the yen tends to appreciate rapidly. explanation. With the U.S. debt ceiling problem and the U.S. interest rate hike, he said, “The stressful situation will not change, and bad news is likely to come out.” I’m watching

1683526190

#Yen #Carry #Trade #Darkens #Volatility #Environment #Wont #U.S #Bank #Anxiety #Bloomberg