XRP Price Eyes Rally, Fueled by Surge in Whale activity

Table of Contents

- 1. XRP Price Eyes Rally, Fueled by Surge in Whale activity

- 2. Whale Activity Spurs XRP’s Bullish Momentum

- 3. Price Movement: A Technical Overview

- 4. Market Drivers and Potential Retail Implications

- 5. Can Solana reach $225? Two Factors To Watch

- 6. Ecosystem Growth: A Foundation for Success

- 7. Technological Advancements: Fueling the Future

Table of Contents

- 1. XRP Price Eyes Rally, Fueled by Surge in Whale activity

- 2. Whale Activity Spurs XRP’s Bullish Momentum

- 3. Price Movement: A Technical Overview

- 4. Market Drivers and Potential Retail Implications

- 5. Can Solana reach $225? Two Factors To Watch

- 6. Ecosystem Growth: A Foundation for Success

- 7. Technological Advancements: Fueling the Future

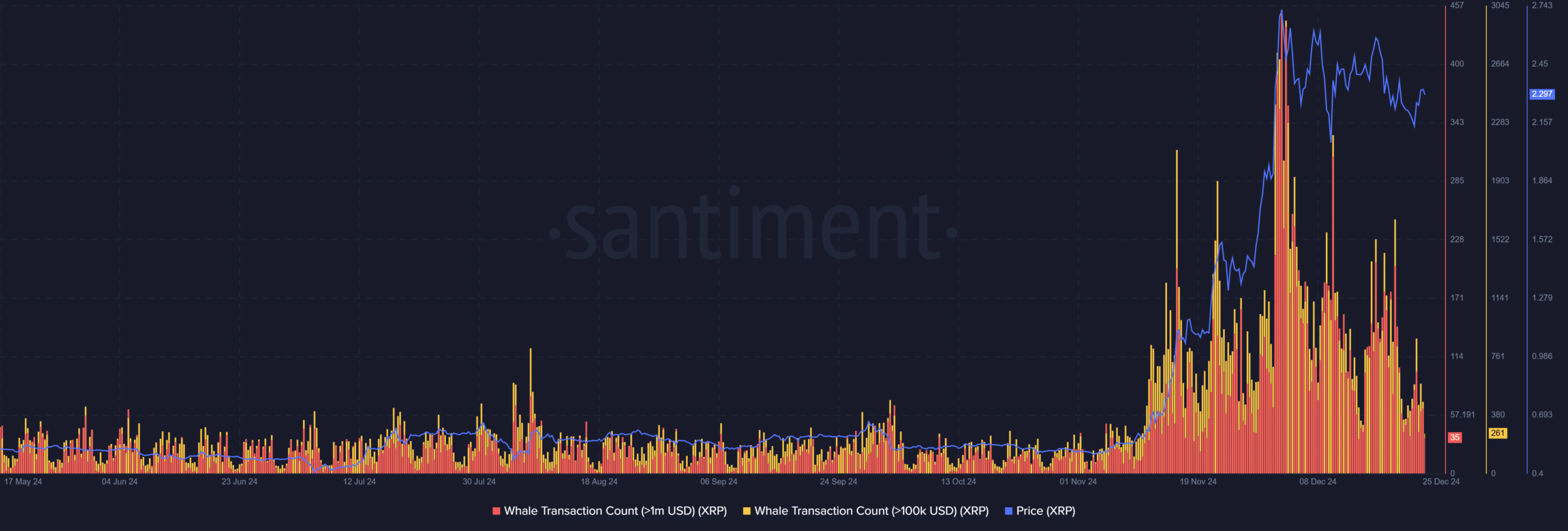

Recent market analysis reveals a meaningful uptick in large XRP transactions, suggesting a bullish outlook for the cryptocurrency. Whale activity, characterized by transactions exceeding $1 million, has surged in tandem with a steady rise in XRP’s price. This correlation points towards strategically timed accumulation by institutional and high-net-worth investors who may be anticipating a substantial price breakout in the near future.

As XRP consolidates around the $2.20 – $2.50 mark, analysts are speculating about the cryptocurrency’s next move. Will this period of consolidation lead to a sustained rally,or is XRP merely gathering momentum for the next phase of market activity?

Whale Activity Spurs XRP’s Bullish Momentum

Data indicates a noteworthy increase in XRP whale transactions,particularly those exceeding the $1 million threshold. The pattern of these large transactions directly correlates with XRP’s price increases, underscoring the significant influence of these large holders on the cryptocurrency’s market dynamics.

Interestingly, transactions exceeding $1 million are not solely driven by the largest whales. Smaller institutional players are also joining the fray. This synchronized activity across diverse investor tiers points to a robust accumulation phase, where whales are providing liquidity and stabilizing the market during price rallies.

“Large transactions like these demonstrate confidence among major holders and could lead to significant price shifts,” remarked one analyst. Whale transactions are often considered leading indicators of long-term price potential, as large holders rarely buy impulsively.

Price Movement: A Technical Overview

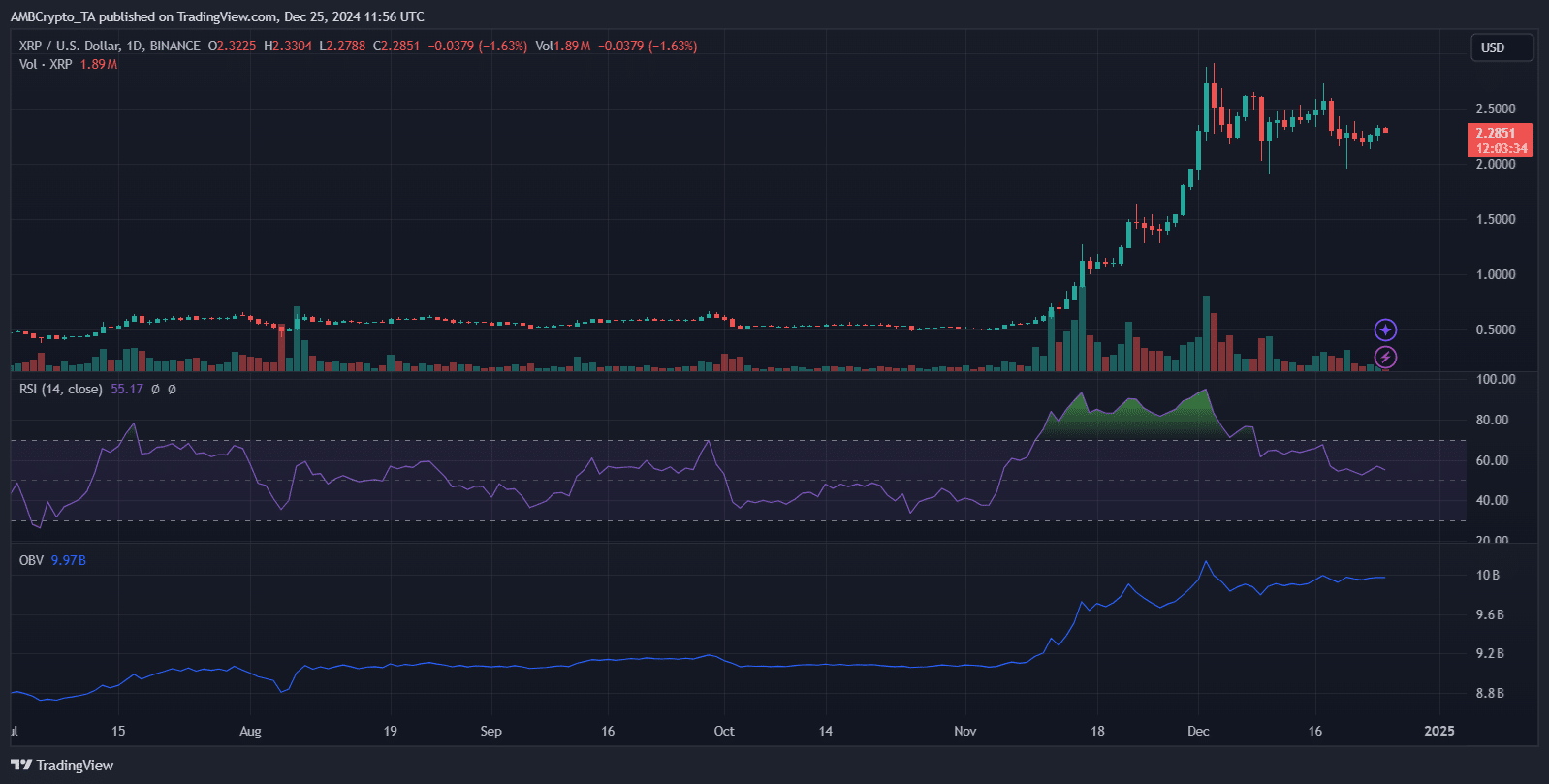

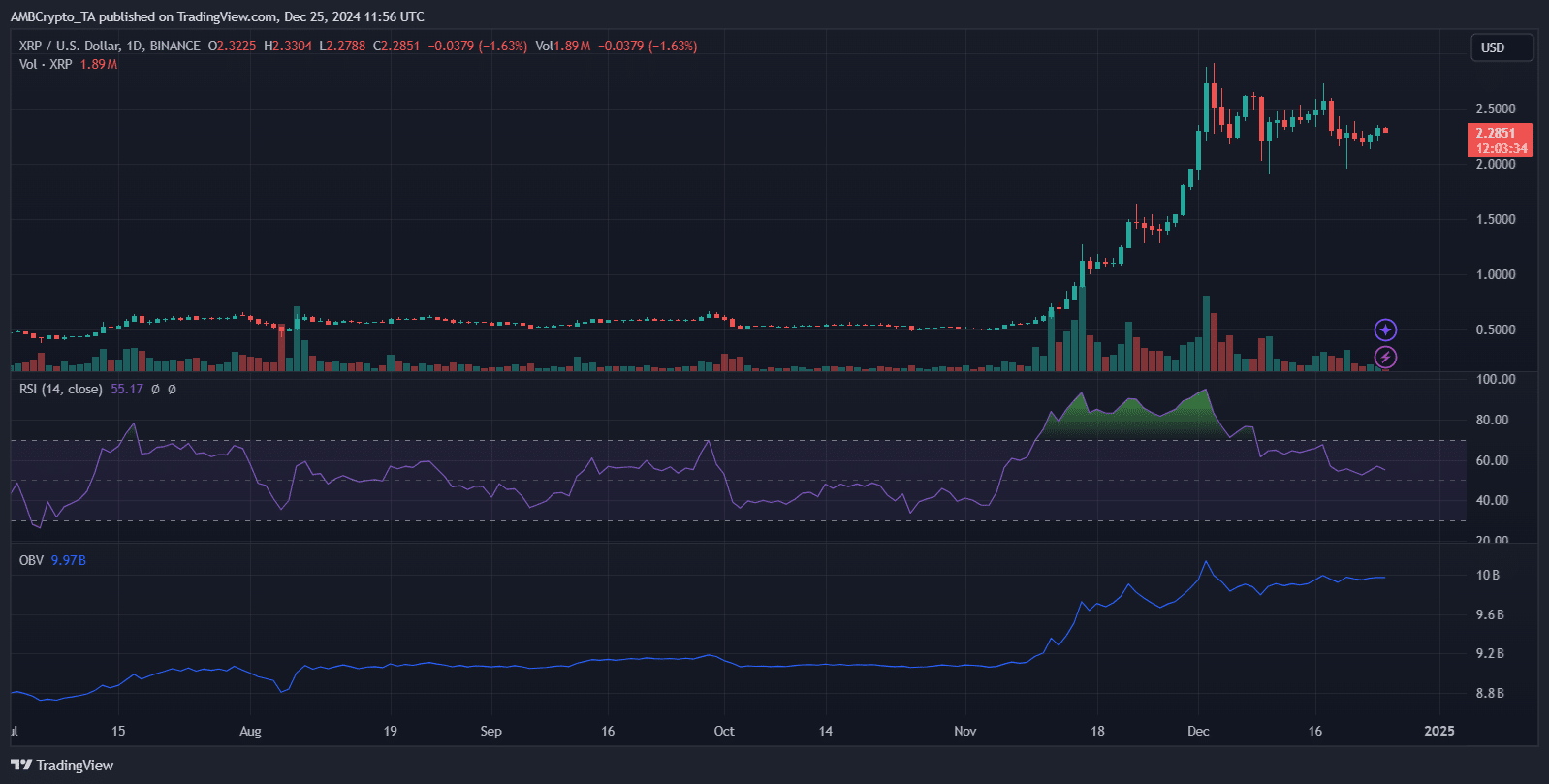

XRP is currently consolidating between the $2.20 and $2.50 price range.A breakout from this range could trigger significant price movement in either direction. Technical analysts are closely monitoring this consolidation period, looking for signals that could indicate the direction of XRP’s next move.

XRP is currently trading at $2.2851, marking a 1.48% decline for the day. The Relative Strength index (RSI) stands at 55.17, indicating neutral momentum and neither oversold nor overbought conditions.

Despite the price consolidation, the On-Balance Volume (OBV) at 9.97B suggests ongoing accumulation. However, a weakening buy-side momentum is evident in the tapering daily trading volumes.

The candlestick pattern suggests a possible continuation of consolidation below the $2.50 level,with support expected around $2.20. Resistance remains at $2.50, a level that has been repeatedly tested without a decisive break. While moving averages maintain a bullish alignment, indicating a long-term upward bias, the decreased volatility hints at whale activity stabilizing prices, possibly awaiting a catalyst for the next price move.

Market Drivers and Potential Retail Implications

XRP’s price action is considerably influenced by institutional activity and the recent legal clarity gained from its victory against the SEC.

High OBV levels, coupled with subdued price volatility, suggest controlled supply, driven by whale accumulation. Macroeconomic factors including overall market trends and regulatory updates might potentially be the catalyst for XRP’s next directional move.

For retail investors, the current price consolidation between $2.20 and $2.50 might signify cautious sentiment, potentially deterring short-term traders. The RSI neutrality points to limited immediate upside potential, while reduced volumes reflect lower retail participation.

A decisive breakout above $2.50 could reignite bullish momentum, while failure to hold support at $2.20 may trigger a sell-off. Retail investors are advised to closely monitor volume spikes and news events to anticipate potential volatility and adjust their strategies accordingly.

Can Solana reach $225? Two Factors To Watch

The cryptocurrency market is known for its volatility, and Solana (SOL) is no exception. While predicting price movements is always a challenge, certain factors can shed light on potential future trajectories. For SOL, two key elements warrant attention: the expansion of its ecosystem and the ongoing development of its technology.Ecosystem Growth: A Foundation for Success

A thriving ecosystem is essential for any blockchain platform’s long-term sustainability. Solana boasts a rapidly growing ecosystem, with numerous decentralized applications (dApps) being built on its network. This expansion attracts developers and users, fostering a vibrant community and driving demand for SOL.Technological Advancements: Fueling the Future

Solana’s commitment to continuous technological enhancement is another crucial factor. The platform is constantly being refined, with updates aimed at enhancing scalability, security, and efficiency.These advancements can attract institutional investors and developers seeking a robust and reliable blockchain platform. While reaching $225 would signify a significant price increase for SOL, the factors discussed above suggest that such a target is not implausible. The cryptocurrency market is inherently unpredictable, but Solana’s continued ecosystem growth and technological advancements position it favorably for potential future gains.## XRP’s Bullish Momentum: An Interview with Crypto Analyst Michael Jones

**Archyde: Michael,thanks for joining us today. XRP is seeing a notable surge in large transactions. What are your thoughts on this recent whale activity?**

**Michael Jones:** It’s certainly a positive sign for XRP. The surge in transactions exceeding $1 million is a clear indication of strong institutional confidence and strategic accumulation. What’s intriguing is that this large-scale buying isn’t just limited to the biggest whales; we’re seeing involvement from smaller institutional players as well. It suggests a broader belief in XRP’s long-term potential.

**Archyde: we’ve seen XRP consolidate around the $2.20 – $2.50 mark. Do you think this consolidation is a sign of a pause before a rally, or are we simply seeing a period of market stabilization?**

**Michael Jones:** It’s likely a combination of both. The consolidation period allows for a healthy correction after the recent price gains and gives whales an opportunity to accumulate more XRP at favorable prices. Though, the strong underlying fundamentals, combined with the ongoing accumulation trend, points towards a potential breakout from this range.

**Archyde: What are the key technical indicators that traders should be watching closely?**

**Michael Jones:** The On-Balance Volume (OBV) is a key indicator in my eyes. It’s currently trending upwards, indicating consistent buying pressure despite the price consolidation. This suggests that a considerable price move could be imminent.

Furthermore, the Relative Strength Index (RSI) currently sits at a neutral level, indicating neither overbought nor oversold conditions. This provides room for further price growth without entering overextended territory.

**Archyde: Beyond technical indicators, what broader market factors could influence XRP’s next move?**

**Michael Jones:** regulatory developments continue to be a significant driver for XRP. The recent legal victory against the SEC provided a much-needed boost in investor confidence. Further positive regulatory clarity could be a major catalyst for a significant price rally.

Additionally, the overall market sentiment towards cryptocurrencies plays a crucial role.

Should we see a broader resurgence in the crypto market, XRP is likely to benefit.

**Archyde: What advice would you have for retail investors who are considering investing in XRP at this stage?**

**Michael Jones:**

As always, it’s essential to conduct thorough research and understand the risks associated with any investment.

XRP shows promising potential driven by strong fundamentals and whale accumulation. Though, always remember to invest responsibly and diversify your portfolio.

Don’t chase fast profits; focus on a long-term investment strategy.

This text appears to be discussing teh current state and future potential of XRP (Ripple) and Solana (SOL) cryptocurrencies.

Here’s a breakdown of the key points:

**XRP Analysis:**

* **Consolidation:** XRP is currently trading between $2.20 and $2.50, indicating a period of consolidation. A breakout from this range could lead to significant price movement.

* **Indicators:** Technical indicators suggest neutral momentum (RSI) and potential for continued consolidation.

* **whale Activity:** High On-balance Volume (OBV) suggests accumulation by large holders (whales) while decreasing trading volume might reflect reduced retail participation.

* **Market Drivers:** Institutional interest and regulatory clarity following the SEC case victory are likely influencing XRP’s price.

* **Retail Implications:**

* Cautious sentiment due to consolidation might deter short-term traders.

* A decisive break above $2.50 could signal a bullish trend.

* Failure to hold $2.20 support could trigger a sell-off.

**solana (SOL) Potential:**

* **$225 target:** The text discusses the possibility of SOL reaching $225.

* **Key Factors:**

* **Ecosystem Growth:** Solana’s growing ecosystem of decentralized applications (dApps) is a strong driver of its value.

* **Technological Advancement:** Solana’s continual development and improvements in scalability, security, and efficiency make it attractive to developers and investors.

**Interview Teaser:**

* The text ends with a teaser for an interview with crypto analyst Michael Jones, focusing on large XRP transactions (which could indicate whale activity).

**Overall:**

The text provides a balanced analysis of XRP and Solana, highlighting both positive and cautious viewpoints. It emphasizes the volatility of the crypto market while pointing out factors that could potentially drive price movements in the future.