After the US released the latest employment report, the world gold price today plummeted from 2,056 USD to only 2,039 USD. Kitco News’s latest weekly gold survey shows that two-thirds of experts lose confidence in precious metals, thinking that gold prices will continue to decline next week.

Gold price today February 3: World gold plummeted, experts predict gold will continue to decline next week

Gold prices around the world fell sharply at the beginning of Friday’s trading session, immediately following a report on the US employment situation from the Department of Labor, data that supported hawks on US monetary policy. Ky. Gold price ended the week at 2,039 USD/ounce, down 0.75% on the day and slightly down 0.06% on the month.

Evolution of world gold prices. Source: Tradingeconomics

The monthly U.S. jobs report from the Labor Department showed nonfarm payrolls in January rose to 353,000, well above expectations for a rise of 175,000. The overall unemployment rate in January was 3.7% compared to the forecast of 3.8%. According to many market observers, due to good employment report data, interest rates may not be cut until March and possibly even May.

The US dollar index rallied on jobs news and strong intraday trading, while US Treasury yields edged higher. The yield on the benchmark 10-year US Treasury note is currently at 3.982%.

Kitco News’ latest weekly gold survey shows a clear divide between institutional and retail traders, with two-thirds of experts losing confidence in the precious metal, while most investors Retailers still expect gold prices to increase next week.

Frank McGhee, head of precious metals dealers at Alliance Financial, was among the participants who said gold still had some way to go. “The market is mispricing gold prices due to the strong US labor market and election news,” he said.

Naeem Aslam, Chief Investment Officer at Zaye Capital Markets, said this week’s data and statements are a wake-up call for the gold market and that the precious metal still has downside risks: “Important levels to watch now it will be $2,000 and a drop below that will create more panic.”

This week, 12 analysts participated in the Kitco News Gold Survey, and Wall Street sentiment appears to have shifted to clearly bearish bets on the precious metal’s near-term outlook. Only 2 experts, or 17%, predict gold prices will move higher next week, while 8 analysts, or 66%, predict gold prices will fall. Two other experts, accounting for 17%, predict gold prices will move sideways next week.

Meanwhile, 123 votes were cast in Kitco’s online polls, with the majority of Main Streeters maintaining an optimistic attitude. 66 retail investors, accounting for 54%, expect gold to increase next week. Another 27%, or 22%, predicted lower prices, while 30 respondents, or 24%, held a neutral view on the near-term outlook for precious metals.

Gold price today February 3: Domestic gold continues to increase

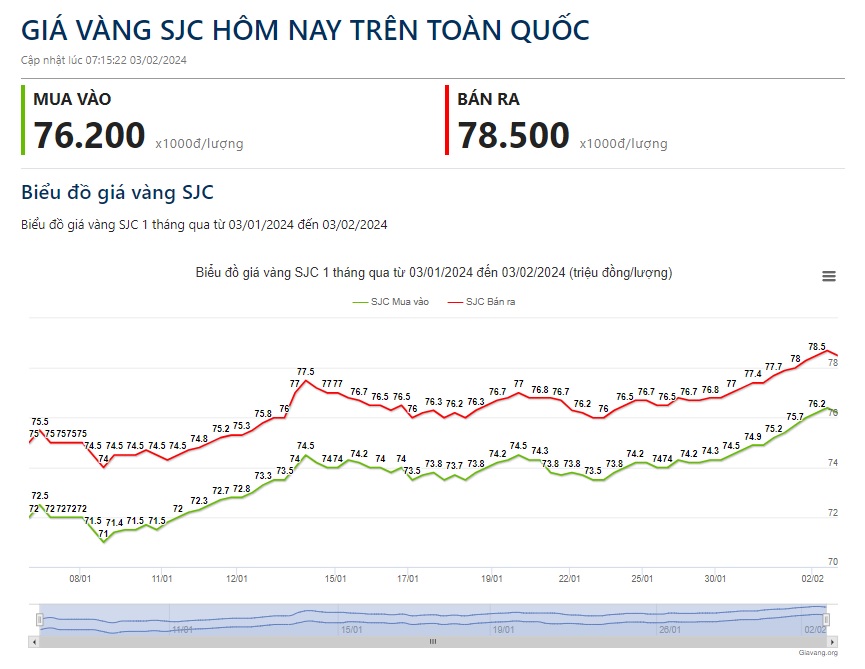

Today’s domestic gold price continues to increase to around 78.5 million VND/tael. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 76.2 million VND/tael purchased and 78.52 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang areas but selling is 20,000 VND lower. Thus, compared to yesterday morning, the price of SJC gold bars has been adjusted to increase by 200,000 VND in both directions.

In Phu Quy, SJC gold bar price is listed at 76.2 million VND/tael purchased and 78.4 million VND/tael sold, an increase of 100,000 VND on the buying side and 150,000 VND on the selling side.

Meanwhile, PNJ is buying at 76.4 million VND/tael and selling at 78.7 million VND/tael, an increase of 200,000 VND on the buying side and 300,000 VND on the selling side compared to yesterday morning.

The buying price and selling price of Bao Tin Minh Chau brand gold are respectively 76.25 million VND/tael and 78.35 million VND/tael, an increase of 100,000 VND on the buying side and 150,000 VND on the selling side.

The difference between domestic and world gold prices is regarding over 18 million VND.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael