One of the largest banks in the American financial market went bankrupt on Friday. Market participants began to worry regarding which companies might be in trouble due to the ripples caused by Silicon Valley Bank (SVB).

USDC, the second-largest stablecoin issued by Circle, has broken away from the dollar on a number of crypto exchanges. At the time of writing, it is trading around $0.89, according to data from CoinGecko.

However, it is important to note that Circle has reassured its customers that the company is still business as usual, despite 25% of their cash reserves being held by SVB. That’s regarding $3.3 billion in coverage.

Is Circle in trouble?

According to a report, as of late January, Circle’s cash reserves were held at regulated financial institutions in the United States, including Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank, Signature Bank, Silicon Valley Bank and Silvergate Bank.

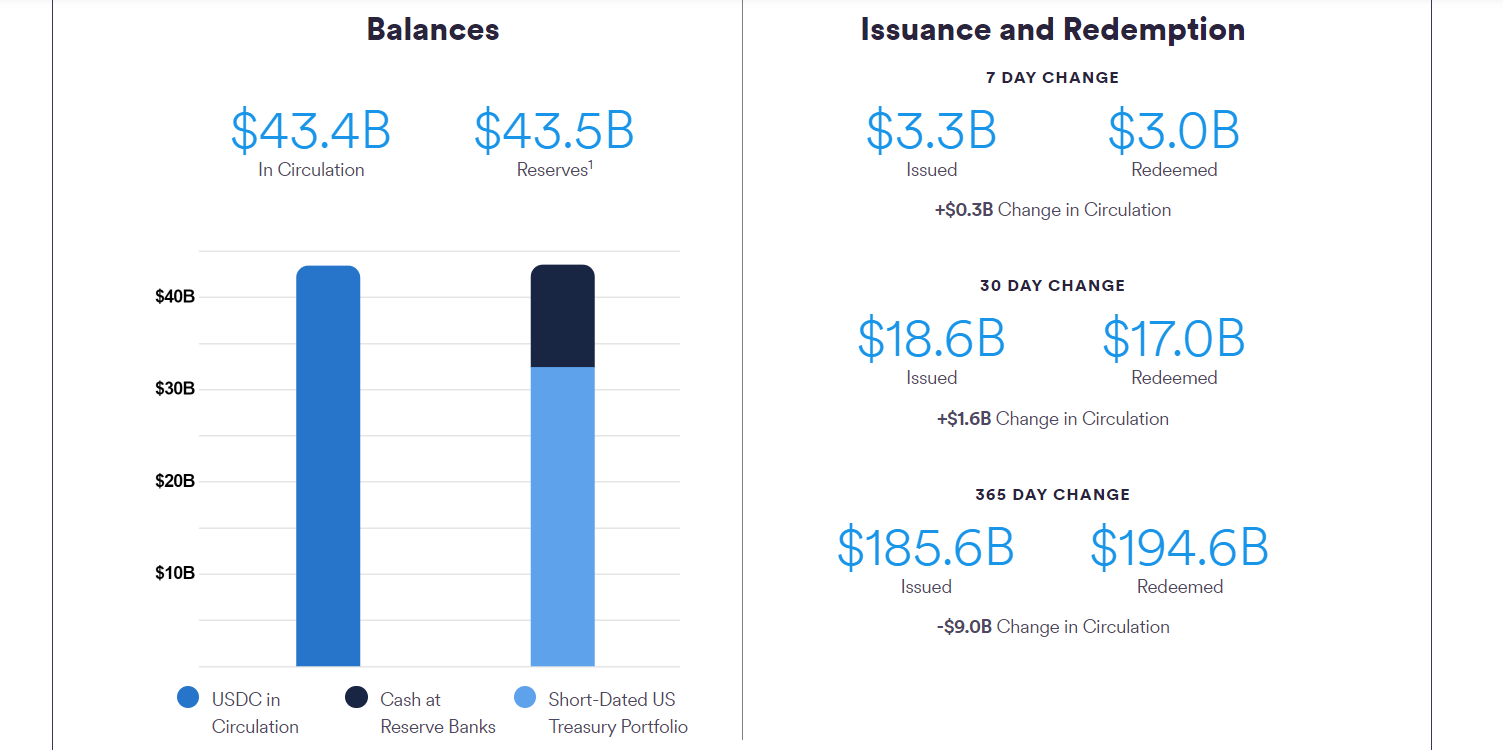

The report also disclosed that approximately $9.88 billion is held in all the institutions mentioned. Although the Circle on the transparency side according to updated data, this number has since increased to $11.4 billion. This is regarding 26.3% of Circle’s reserves, according to published data, the rest was held in US government securities.

Circle’s total reserves of $42.3 billion were only regarding 0.1% higher than its outstanding tokens, which stood at $42.2 billion. As of the followingnoon of March 11, USDC had a market capitalization of $36.6 billion. That’s $1.2 billion less than four hours earlier, according to CoinGecko.

At the time of writing, Circle has not yet released an official statement on exactly how much of its reserves it holds with each specific banking partner. BNY Melon was the primary custodian of USDC reserves, according to Circle’s announcement 12 months ago. However, Circle has already clarified that their reserves held at Silvergate – the cryptobank that was included in bankruptcy proceedings this week – have already been transferred to other banking partners.

Another banking partner of Circle, Signature Bank, appears to have been the number one alternative for crypto companies distancing themselves from Silvergate. However, the share price of this bank also fell by 22% on Friday amid banking concerns caused by SVB.

Tether and Binance

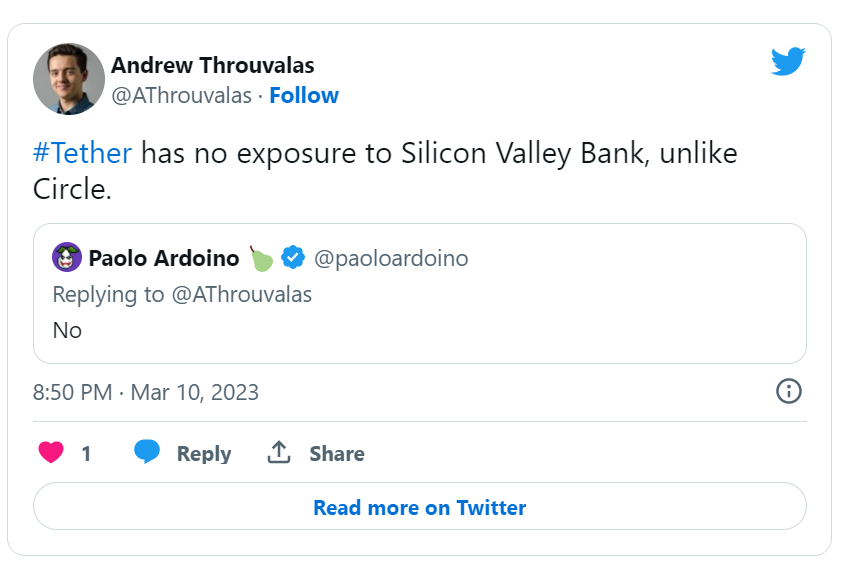

Tether — the world’s largest stablecoin issuer — doesn’t seem to be under similar pressure just yet. When asked via Twitter, Tether CTO Paolo Ardoino said the company has no exposure to SVB.

Following the collapse of SVB, market participants began to shed USDC and DAI stablecoins and appear to have bought Tether’s USDT in the Curve 3pool DeFi protocol.

Ardoinio called the activity inside the pool a “safe haven” via Twitter. Tether’s stablecoin dominance remains high with a market share of 53.3% according to DeFi Llama.

Binance CEO Changpeng Zhao also confirmed that his company, the world’s largest crypto exchange, has no exposure to Silicon Valley Bank.