The current and speedy fall within the worth of the US greenback within the Cuban casual market has generated a powerful dialogue on social networks. One of many predominant questions is whether or not this decline will translate into a discount within the costs of imported merchandise offered by Micro, Small and Medium Enterprises (MSMEs).

Within the final two weeks, the greenback has misplaced greater than 100 items of Cuban pesos (CUP), which has stunned each residents and retailers. Uncertainty is within the air: when will customers see a lower within the costs of fundamental merchandise that depend upon MSMEs and different personal companies?

At present, the Cuban authorities can’t absolutely fulfill home demand by way of its Freely Convertible Foreign money (MLC) shops or with native manufacturing. Subsequently, the inhabitants relies upon largely on MSMEs to entry important merchandise.

Debate on the networks

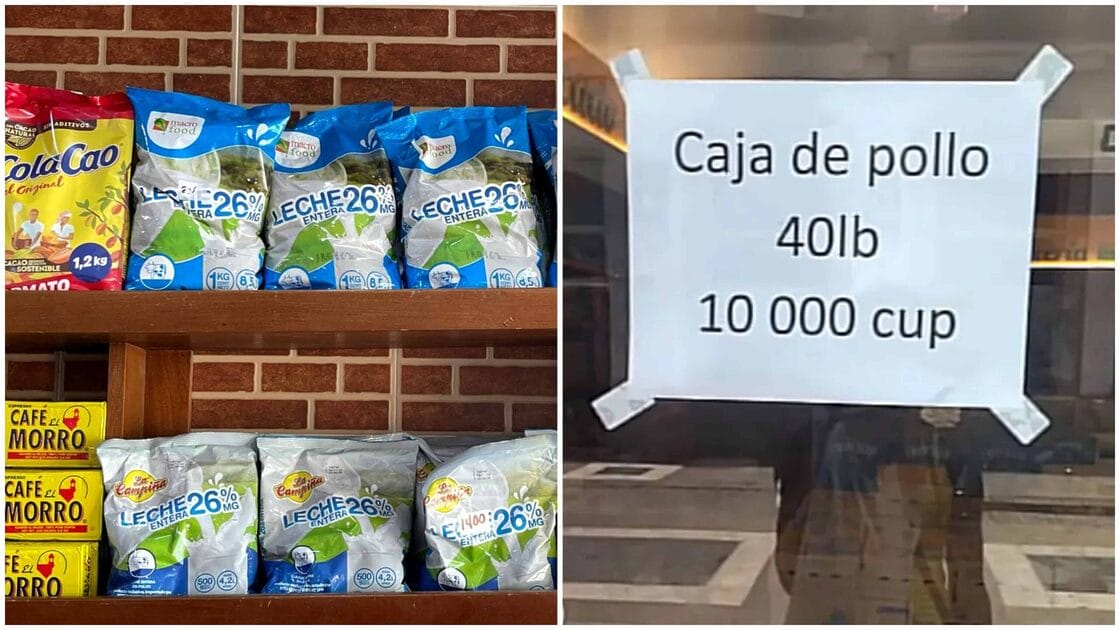

Journalist Fernando Ravsberg sparked a debate on Fb by questioning whether or not the autumn of the greenback is already impacting costs. He shared pictures of 10 kg bins of rooster at 7,100 CUP and cartons of eggs at 2,420 CUP in Havana. In international foreign money buying and selling teams, a digital “battle” between greenback and product sellers has intensified.

One consumer acknowledged that, regardless of the autumn of the greenback, the costs of merchandise resembling eggs, oil and bread won’t change. Then once more, one other Cuban argued that, based on the legal guidelines of the market, costs ought to fall if the greenback and the euro fall, citing for example some footwear whose worth fell from 10,000 to eight,500 pesos.

Nevertheless, an rising consensus is that the autumn within the worth of the greenback has been so speedy that MSME house owners haven’t had time to promote the acquired stock at a better price.

Based on opinions on social media, these companies must get better their revenue margins, which can take time and hold costs secure for now.

Within the quick time period, the expectation that the autumn of the greenback would routinely scale back costs has not been fulfilled. Some analysts even predict that the greenback may get better shortly and exceed 400 CUP for every USD. They’re based mostly on the absence of macroeconomic enhancements and the speculative nature of the casual market.

The reality is that though the drop within the greenback has been important, nobody can assure that it’s going to translate into an instantaneous discount in costs in MSMEs. The long-term results will depend upon a number of elements, together with the evolution of the financial system and the business methods of those small companies.

#MSME #costs #Cuba #fall #greenback