Of every four Colombians that the firm Kantar consulted regarding the country’s economic prospects, three responded that they are not favorable. The rise in the cost of living and more recently the rise in the dollar have taken their toll and, as if that were not enough, the economic recession in the United States would put more pressure.

Among the most severe analysts is the idea that this country has already entered a recession; the most demure think that this will happen next year; and the Bank of America – for example – observes this scenario for the end of 2022.

Less exports?

In any case, Colombia must be attentive because from an investor doubting whether or not to direct more dollars to the country, to a more expensive market in neighborhood stores might be the throes of said situation.

The recession would mean a fall in the United States economy for two consecutive quarters and in that order businessmen and investors there would tighten their belts, for which a first impact would be that Colombian exports would be affected.

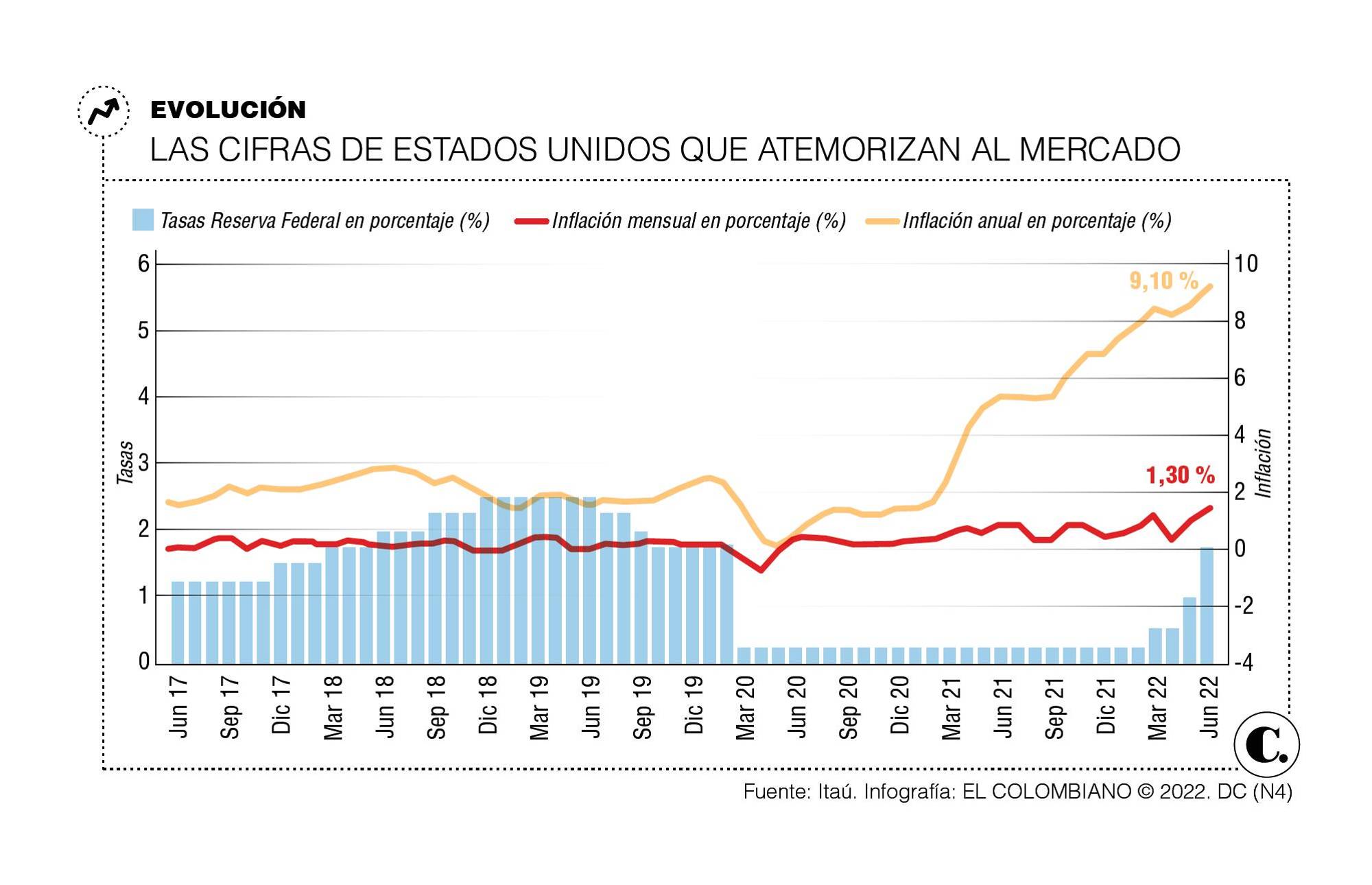

The “equation” that some make is simple: annual inflation reaches record levels in the United States –9.1% in June, the highest in 40 years–, then the Federal Reserve (FED) raises interest rates to reduce the consumption and tackle inflation, but lower consumption would imply that the economy contracts and falls into recession; in that downturn, the industry of that country would buy less abroad.

Hence, Colombia was hit, since the US is its main trading partner; It buys oil, fruit, and manufactured products, among others, and if that demand drops, the number of dollars that come in is also reduced, which would put more pressure on the current account deficit.

most expensive dollar

Of course, all scenarios have their “but”. In the case of the decrease in exports, it is in the fact that if the dollar continues at the same levels as in recent days, even if fewer products are sold, exporters might rely on the good prices of the currency to compensate.

Opinions are divided, some believe that the market is already taking the recession for granted and that is why when it is confirmed with official statistics there will be no further movement. Others, such as Juan David Ballén, director of Analysis and Strategy at the Casa de Bolsa, consider that it is uncertain how long the rise in the dollar will last.

In any case, you don’t have to go very far to see the havoc that an expensive dollar produces in Colombia. In recent weeks there is concern regarding what might happen to the prices of beans, lentils and oil brought from abroad, as well as variations in the cost of household appliances and tourist services and products, which are highly related to that currency.

While this continues to happen and in the scenario that everything worsens when the recession arrives, the professor at EAE Business School, Josep Beltrán, recommends reducing the use of credit cards for purchases in dollars abroad, buying fruits and vegetables produced in Colombia – which will become more expensive, but not as much as the imported product – and, if possible, save in dollars.

Remittances and market

In addition to all this, during a slowdown in the gringo economy and, why not, in other world powers, the jobs that are usually most affected are those of migrants. For this reason, the economic researcher at the Sergio Arboleda University, Luis Fernando Ramírez, sees that the flow of remittances might be reduced.

It is worth remembering that remittances are the money that Colombians abroad send to relatives in the country, and last year they totaled a record US$8,597 million, with the United States being the main origin. Clearly, this capital is an important driver of the economy, especially for the Coffee Region or the Valley.

Additionally, the entry of resources through the financial market would also be among the great victims to the extent that investors would be more modest and instead of putting money in emerging countries like Colombia, they would take refuge in the dollar while they wait for the storm to pass. .

Stocks and bonds are emerging as major affected and this week it was observed, because on Thursday the 10-year public debt securities (TES) closed at a rate of 13.47%, something that analysts saw with concern because they did not had not even given in the most alarming stage of the pandemic.

Will it take its toll on GDP?

In the end, the mix of high rates from the FED, recession, dollar and potentially lower exports and a falling financial market would take its toll on the Colombian economy, although it is one of the ones that has reactivated the most.

Although the Gross Domestic Product (GDP) would grow 6.5% this year, being one of the best in the world, by 2023 things would become different as the global slowdown and the aforementioned factors would take it to 2%, according to BBVA calculations. Research.

“The global slowdown will limit the growth of the sectors most related to exports (agribusiness), while the moderation of consumption and foreign trade will reduce the performance of trade and transportation. For the next year it will be navigated in a less favorable international environment”, projected experts from the firm