June 10, 2022

image source,Getty Images

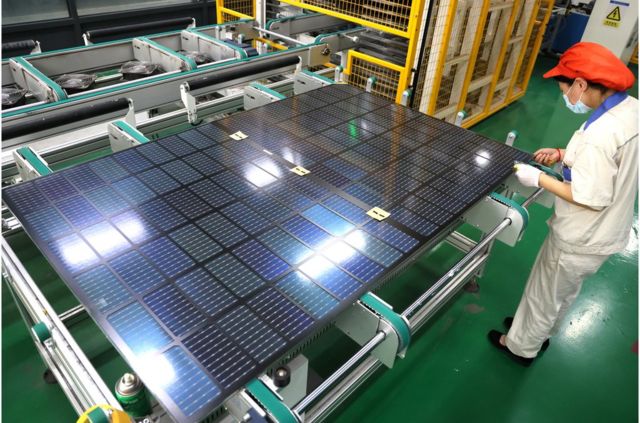

More than 60% of the world’s solar panels are made in China. On June 6, the White House of the United States issued a statement to provide a 24-month exemption period for import tariffs on photovoltaic cell modules in Thailand, Malaysia, Cambodia and Vietnam.

On June 6, the White House of the United States issued a statement to provide a 24-month exemption period for import tariffs on photovoltaic cell modules in Thailand, Malaysia, Cambodia and Vietnam.

At this time, the United States is facing a shortage of photovoltaic modules, and some projects may be delayed or suspended, thus affecting the country’s overall clean energy progress. In addition, U.S. inflation remains high, fueling discussions of removing tariffs.

Analysts believe that most of the photovoltaic module production in the above-mentioned four countries are Chinese companies. This move reflects the high dependence of American photovoltaics on China’s supply chain and is beneficial to China’s photovoltaic industry.

At the same time, there has been a heated discussion within the U.S. government over whether to retain tariffs on China. Supporters, including U.S. Treasury Secretary Yellen, believe that it is necessary to remove tariffs to reduce inflation; opponents, including Trade Representative Dai Qi, believe that The reasons for the formation of inflation are complicated, and the removal of tariffs will make the US lose the bargaining chip with China.

Why is it related to China?

About three-quarters of imported PV modules in 2020 will come from Southeast Asia, the White House statement said. There is a serious shortage of photovoltaic modules recently. Due to insufficient supply, half of the modules that were expected to be installed and used in the United States next year are in short supply, which also restricts the growth of downstream photovoltaic installations. Many photovoltaic projects in the United States are in the situation of being delayed or cancelled. This in turn affects and affects the adequacy of the power system.

Chinese companies are the main force of global PV modules. Last year, China’s PV module exports totaled 98.5GW, of which regarding 20% were exported to the Americas, or 18.7GW. Meanwhile, the US domestic PV capacity is only 7.5GW.

In February of this year, U.S. photovoltaic companies applied to the Commerce Department for an anti-circumvention investigation, targeting eight Chinese photovoltaic companies producing in Southeast Asia. After the U.S. Department of Commerce implemented an application for an anti-circumvention investigation in March, U.S. media said that the move caused a shock to the U.S. photovoltaic industry, with 318 photovoltaic projects cancelled or delayed, and “the entire industry was paralyzed.”

image source,Getty Images

An employee of a company in Lianyungang, China, produces solar panels for export in a workshop.

According to the analysis of the CITIC Securities Research Report, the current U.S. photovoltaic manufacturing capacity is stretched, and the exemption from tariffs reflects the high dependence of U.S. photovoltaics on the Chinese supply chain.

CITIC Securities also stated that the new measures of phased tariff exemption will enable a large number of such Chinese-funded companies to accelerate the recovery of photovoltaic module exports to the United States, and promote the recovery of photovoltaic installations in the United States. In the future, there may be some retaliatory panic buying and turmoil in the next two years. library requirements.

It is worth mentioning that the US Department of Commerce further stated that the existing US tariffs on photovoltaic cells and modules imported from China and Taiwan are still in effect. In addition, they will continue to investigate whether Chinese PV companies avoid U.S. tariffs through Southeast Asian companies. Any findings from the investigation will apply following the 2-year tax holiday has ended.

The industrial chain in the post-epidemic era

In the Trump era, China and the United States, the world’s two largest economies, started a trade war, and the two sides imposed tariffs on each other. Although Biden, the Democratic presidential candidate at the time, repeatedly criticized the tariffs, he did not remove the tariffs following he took office.

On the one hand, officials like U.S. Trade Representative Dai Qi prefer to keep these tariffs in place to develop a more strategic China trade strategy that protects U.S. jobs while reshaping China’s trade behavior in global markets. Such an approach might even include imposing new strategic tariffs.

Second, according to a poll released this week by Morning Consult, 73 percent of respondents said they support the U.S. government’s trade remedy measures once morest China to protect U.S. industries and American workers, while supporting Trump’s tariffs on China The number is also high, at 71%.

image source,Getty Images

The first phase of the trade deal signed by China and the United States in early 2020 expired. China then pledged to buy an additional $200 billion in U.S. goods and services in 2020 and 2021.

On the other hand, the United States is also plagued by inflation. U.S. Treasury Secretary Janet Yellen confirmed in a public speech that she was calling on Biden to lift some tariffs on China, some of which are “less strategic” and hurt U.S. consumers and businesses.

Tariffs have not been removed, and the epidemic era has triggered anxiety in the industrial chain of Western countries. The shortage of masks and other products caused by the epidemic, coupled with the long-term lack of political mutual trust, has caused anxiety in European and American countries. Some congressmen in the United States have proposed legislation to end the reliance on Chinese APIs and other products.

Wu Jing, an assistant professor at the Business School of the Chinese University of Hong Kong, previously told BBC Chinese that the globalization of the industrial chain has come to an end. The globalization of cross-border finance is still growing substantially today.

“Might as well open a brain hole – the industry chain may have a localization trend, but capital will begin to play a stronger role. For example, the masks during the anti-epidemic process may be produced in Vietnam, but the capital of the factory may From Hong Kong or mainland China. Another example is that the Sino-US trade war will continue to fight in the future, whether China’s production capacity can be transferred to Malaysia, but China will link these production capacity through capital.” Wu Jing said.

“All in all, the industrial chain in the future may become more and more localized and regionalized, but behind the scenes will be globalized and networked connections through capital and technology.”