The number of self-employed individuals unable to repay their debts and close their shops due to high interest rates and inflation is on the rise. On the 7th, tourists walk by a store in Myeongdong, Seoul, displaying a ‘For Rent’ sign. /Reporter Lim Dae-cheol”/>

The number of self-employed individuals struggling to repay their debts is rapidly increasing. This is largely due to ‘loan bills’ accumulated since the COVID-19 pandemic, coinciding with a challenging recovery phase for the domestic economy, exacerbated by high interest rates and inflation. Particularly alarming is the spike in delinquency rates, primarily affecting restaurants and lodging establishments that could not benefit from the summer vacation season due to the heatwave. Experts are calling for urgent measures to assist the self-employed, given the rising fears of a recession originating in the United States.

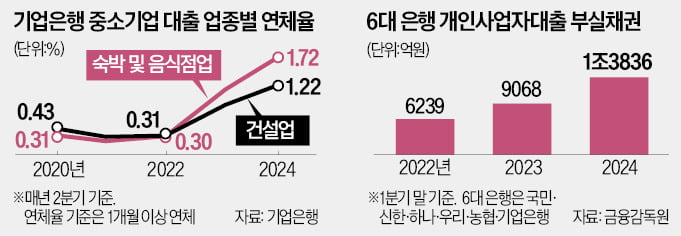

According to the financial sector on the 7th, among SME loans from the Industrial Bank of Korea, which specializes in serving small and medium-sized enterprises, the delinquency rate for the ‘accommodation and restaurant industry’ in the second quarter of this year registered at 1.72%. This marks the highest level since the compilation of related statistics began in 2015. This figure surpasses that of the construction industry (1.22%), which has been adversely affected by defaults in real estate project financing (PF). In the first quarter of last year, the construction industry (1.76%) outstripped the accommodation and restaurant sector (1.70%).

View image larger

The delinquency rate in the accommodation and food service sector is over double that of general manufacturing (0.73%). Analysis indicates that self-employed individuals are bearing a relatively severe burden due to the domestic economic downturn. Particularly, those in provincial areas are on the verge of collapse. Mr. A, who has operated a restaurant in Busan for four years, is contemplating closing after surviving on government subsidies. He reports a decrease in customer visits and a sharp increase in labor costs. He shared, “I have even cut back on staff, but thinking about the interest payments each month makes me feel dizzy.”

Due to the extreme heat, many small accommodation businesses nationwide are struggling to benefit from the summer vacation peak season. The trend of ‘late vacationers’ and ‘vacation abstainers,’ which sees people delay or forgo vacations to avoid the sweltering heat and high seasonal rates, has contributed to this.

The accumulation of delayed COVID-19 expenses is also exacerbating the delinquency rates among the self-employed. In 2020, the Industrial Bank of Korea provided operating funds at lower interest rates than commercial banks to around 270,000 self-employed businesses affected by COVID-19. The consequences of these loans have led to a rise in bad debts.

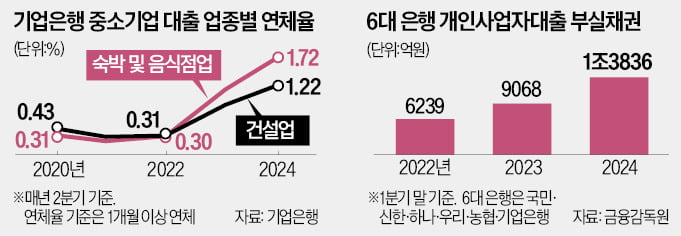

It’s not only KEB Hana Bank facing these issues. According to the Financial Supervisory Service, the amount of non-performing loans among the six major domestic banks (Kookmin, Shinhan, Hana, Woori, Nonghyup, and KEB Hana Bank) for individual business owners surpassed 1 trillion won in the first quarter. Non-performing loans are defined as those that are difficult to recover. In the first quarter, the total value of these non-performing loans was 1.3836 trillion won, significantly higher than the 2020 level (948.1 billion won).

The alarming issue is the speed at which bad debts are rising. Over the past year, they have increased by approximately 500 billion won, more than doubling compared to 2022. The number of self-employed individuals unable to withstand high interest rates and the looming recession is also sharply increasing. According to national tax statistics from the National Tax Service, 986,487 business owners closed their enterprises last year. This figure represents the highest number since statistics began being recorded in 2006, reflecting an increase of 119,195 closures compared to 2022 (867,292).

Reporter Park Jae-won [email protected]

The Rising Crisis of Self-Employed Individuals: Debt and Business Closures Amid Economic Struggles

The economic landscape for self-employed individuals in South Korea is becoming increasingly challenging. The ongoing effects of high interest rates and rising costs are leaving many unable to pay off debts, leading to a surge in store closures. This trend is particularly evident in heavily impacted sectors such as restaurants and lodging facilities, which have struggled to capitalize on peak summer vacation revenue due to extreme heat and shifting consumer behaviors.

Understanding the Increased Delinquency Rates

Recent reports from the financial sector reveal that the delinquency rate among small and medium-sized enterprise (SME) loans for the accommodation and restaurant industry has reached alarming levels. As of the second quarter of this year, the delinquency rate for this sector has soared to 1.72%, the highest since records began in 2015. This figure surpasses even that of the construction industry, which has also been hard-hit by financial troubles.

Comparative Delinquency Rates in Different Sectors

| Industry | Delinquency Rate (%) |

|---|---|

| Accommodation & Restaurant | 1.72 |

| Construction | 1.22 |

| General Manufacturing | 0.73 |

The significant increase in delinquencies indicates that self-employed individuals are bearing a disproportionately heavy burden due to the domestic economic downturn. The pressures are particularly severe in provincial areas, where many businesses are on the brink of collapse. For instance, Mr. A, a restaurant owner in Busan, reflects the struggles faced by many like him, stating, “With diminishing customer numbers and soaring labor costs, I contemplate closing down my business.”

Impact of COVID-19 Debt Accumulation

Another contributing factor to the rising delinquency rates is the accumulation of debts from the COVID-19 pandemic. In an effort to bolster struggling businesses, the Industrial Bank of Korea offered low-interest operating funds to approximately 270,000 self-employed businesses during the pandemic’s peak. However, these loans have since morphed into bad debts that burden many businesses today.

Non-Performing Loans: A Growing Concern

According to the Financial Supervisory Service, the non-performing loans (NPLs) among the six major domestic banks, encompassing Kookmin, Shinhan, Hana, Woori, Nonghyup, and KEB Hana Bank, have skyrocketed, exceeding 1 trillion won in the first quarter alone. The NPLs reached an alarming 1.3836 trillion won, significantly surpassing the 2020 figures of 948.1 billion won.

The Acceleration of Business Closures

This growing volume of bad debts is concerning as it filters down to the self-employed. The National Tax Service indicates that a record 986,487 business owners closed their doors in the past year, marking the highest rate since 2006. This represents an increase of 119,195 closures from the previous year, illustrating the escalating crisis for self-employed individuals in South Korea.

Anecdotal Evidence of Struggles

The current environment has also made it difficult for many small accommodation businesses to thrive. The scorching summer temperatures have led to a decrease in vacationers, with many opting to postpone or even forgo their trips altogether. The rise in ‘late vacationers’ and ‘vacation givers’ has compounded the woes of small businesses that usually depend on the summer season for their survival.

Expert Opinions and Recommendations

Economic experts emphasize that without special measures to aid self-employed individuals, the situation is likely to worsen. They recommend comprehensive support strategies aimed at rejuvenating the struggling SME sector, particularly through the provision of emergency financial assistance, loan restructuring, and targeted subsidies to relieve the burden posed by high interest rates.

Practical Tips for Self-Employed Individuals

- Explore Financial Assistance: Investigate local and national government programs aimed at supporting struggling businesses. Look for grants and low-interest loans designed for self-employed individuals.

- Cost Management: Review and adjust budget allocations to focus on essential expenditures. Limit non-essential spending during challenging periods.

- Flexibility in Operations: Consider increasing flexibility in service offerings to attract a wider customer base. Think about diversifying services or products that can be provided to meet evolving consumer needs.

- Networking: Engage with local business associations or groups for mentoring and potential collaborations. Sharing resources and support can help in overcoming common challenges.

- Financial Advisory: Consult with financial advisors to develop a clear plan for managing debts and improving financial health. Prioritize creating a sustainable revenue model.

The Path Forward for Self-Employed Individuals

The rising trend of self-employed individuals facing unmanageable debt is a pressing issue that demands immediate action. Without prompt and effective interventions, the longevity of countless businesses, particularly in vulnerable sectors, remains at risk. As the economic landscape continues to fluctuate, prioritizing the well-being of self-employed individuals will be essential in fostering a resilient economy.