People who request a loan from any bank in Colombia feel a great disappointment when the bank denies them that loan. How do I know if I am reported in datacrédito?

On many occasions the bank reserves why they denied you that credit or loan, however, there are some factors ‘confirmed’ that can significantly influence that negative decision.

Why am I denied a loan?

“Your credit application has been rejected”is the message that many customers in the banking sector have read, to know why they denied you that credit, you must understand how the system works.

Unprovable income: Independent people who are in the informal sector are the people who are most rejected by the financial system; their inability to prove where their income comes from is a bad omen for banks.

People who earn low wages, but who have other sources of income, cannot access high credits, precisely because they cannot prove it.

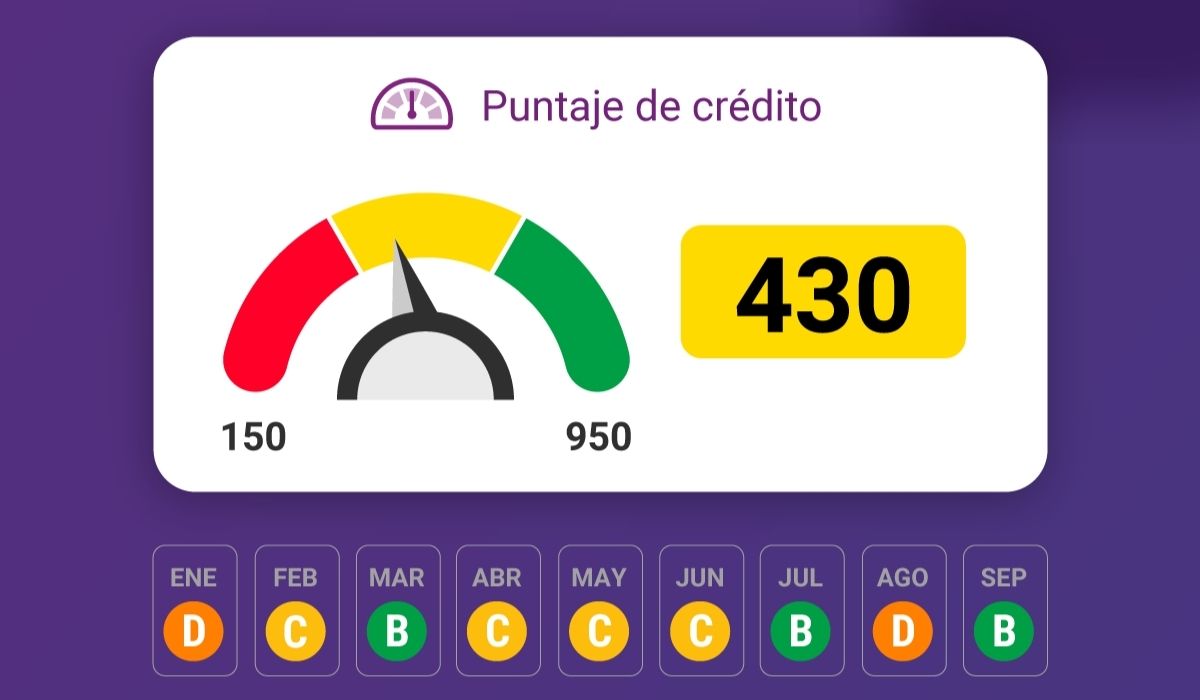

negative credit history: The risk centers send a report to the banks on the credit history of each citizen consulted. Carrying out several queries during the same quarter is a bad sign for banks.

Reported: If you defaulted on your previous credit payments, the financial system has practically denied you the possibility of accessing them.

???? The ABC of the Law clean slate that eliminates the negative score of DataCrédito

Banks are becoming increasingly sophisticated in their delinquent portfolio system and the credit application is their first barrier to reaching this point of ‘not lost’.

If you were denied a loan, it is recommended that you improve your credit history in the next 6 months and apply to another bank. Remember that age, proof of income and your assets are the best guarantee for banks.