2023-06-06 18:47:46

O Income tax used to keep Brazilians awake at night. At this time of year, it is necessary to report to the government on the income obtained and pay the taxes due. However, this process is not always as simple as it seems. The term known as “fine mesh” often causes apprehension in taxpayers across the country. But what is fine mesh and why bother? Oficina da Net responds in this article.

What is the income tax fine mesh?

The fine mesh of the Income Tax is nothing more than a more detailed analysis process of the income tax declaration that you submitted to the Federal Revenue Service. When a declaration is selected for the fine mesh, it means that there are inconsistencies or indications of fraud that require a more thorough review by the responsible body.

This review may occur due to errors in completing the declaration, omissions of relevant information, discrepancies between the data provided and the information available to the Federal Revenue, among other reasons. The fine mesh has as its main objective to ensure the correct calculation and collection of taxes owed by taxpayers, as well as to curb tax evasion practices.

How do I know if I fell into the fine mesh of Income Tax?

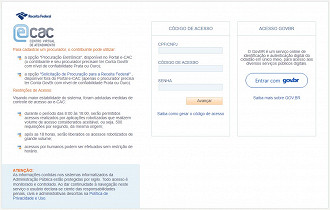

To find out if you have fallen into the fine mesh, it is essential to pay attention to the notices issued by the Federal Revenue. If your statement has been withheld for analysis, you will receive a notification, usually by letter or message, informing you of the situation and requesting correction or supplementation of the information provided. In addition, it is possible to monitor the processing of the declaration through the system e-CAC (Virtual Taxpayer Service Center).

Below, see the tutorial on how you can do this query.

Necessary time: 3 minutes

-

Enter the website of e-CAC;

-

Machete login with your data. You can use your CPF and Access Code or log in using your gov.br account.

-

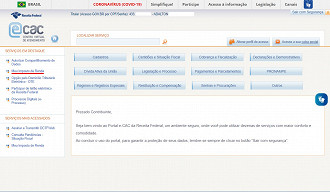

After logging in with your account, in the side menu, look for My Income Tax;

-

On the next screen, under the menu IRPF servicesenter in Mesh Pending Issues;

-

If your Statement has any pending items, this information will be displayed on this tab.

I fell into the fine mesh, now what?

If you’ve fallen into the IRS fine mesh, it’s important to act promptly to resolve the situation. A fine mesh indicates that there is an error in your income tax return. If the error is related to incorrect filling or omission of information, you can correct it through an IR rectifying statement, using the same program used to make the original statement.

Candle remember that in some cases, it is possible to fall into the fine mesh for no apparent reason. In these cases, it is necessary to wait for the official notification from the Federal Revenue and, then, present the documents that prove the correctness of your declaration.

However, if the taxpayer does not take any action following falling into the fine mesh and being notified, he might face more severe consequences. In this case, a fine of 75% will be applied on the amount of tax due, in addition to having the name included in the Cadin, the register of people with debts with federal agencies.

How long does it take to get out of thin mesh?

The time required to break out of the fine mesh may vary depending on the specific situation and circumstances involved. Normally, when you fall into the fine mesh, the Federal Revenue will notify you by means of a letter or message informing you of the discrepancy found and requesting clarification or additional documentation to resolve the situation.

After providing the requested information, the time required to exit the fine mesh may vary. In some cases, the IRS can process the information quickly and resolve the situation within a few weeks. However, in more complex cases or if there is a need for additional investigations, the process can take months.

Thus, it is important to note that each situation is unique, and the exact time to resolve the fine mesh may vary.

1686077570

#Income #Tax #fine #mesh #fell