2023-12-22 05:00:00

Perhaps you are in the same situation as Olivier, who contacted us via the orange “Alert us” button. In order to better understand the upcoming political debates as the elections approach, he would like to know how the State earns money and, above all, how it spends it? We therefore collected all the figures to summarize this as simply as possible, and we interviewed a specialist to get his opinion on the budgetary outlook for the coming years. Come on, let’s hang on, you’ll see, it’s not that complicated.

“In view of the elections, would it be possible to have a detailed explanation of the state’s income and expenditure? How the state earns money and what are the main resources (VAT, property taxes, fines, corporate dividends public, etc.)? And how are state expenditures broken down?” We sometimes ask ourselves these crucial questions from Olivier. But we rarely have all the (right) answers. We are trying to see things more clearly.

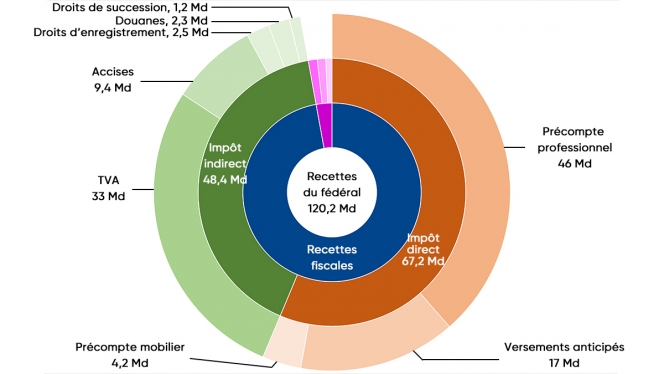

For this exercise, we will take the figures from 2021, the year for which all the necessary data is available. First, let’s look at state revenue. At the federal level, it is above all necessary to distinguish tax revenue from non-tax revenue. This first category is the most lucrative since it brings in nearly 116 billion to the federal government. Within tax revenue, we then distinguish between direct taxation and indirect taxation (see graph below).

Direct taxation

Direct taxation is mainly made up of professional withholding tax, i.e. the withholding tax on salaries, at the source of the tax, which alone represents 46 billion euros. Then come the advance payments (17 billion), which companies and self-employed people pay during the financial year so as not to have to pay all their taxes at the end of the year, and the withholding tax (4.2 billion), a tax relating to income generated by savings accounts, bonds or the receipt of dividends.

Note also that when sending tax extract warnings (document which provides information on the tax calculation and which provides an amount to be paid or reimbursed), self-employed people and individuals recovered nearly 5 billion euros in end of the year, while companies had to pay 3.2 billion to the State.

Indirect taxation

Unsurprisingly, it is VAT (value added tax) which occupies a majority share of this category, with 33 billion in revenue in the coffers of the federal state. Another subject that often comes to the surface during budgetary conclaves: excise duties. This tax, which affects fuel, tobacco, alcoholic beverages, but also electricity and gas, brings in more than 9 billion euros to the state. Registration, customs and inheritance duties together bring in the sum of 6 billion.

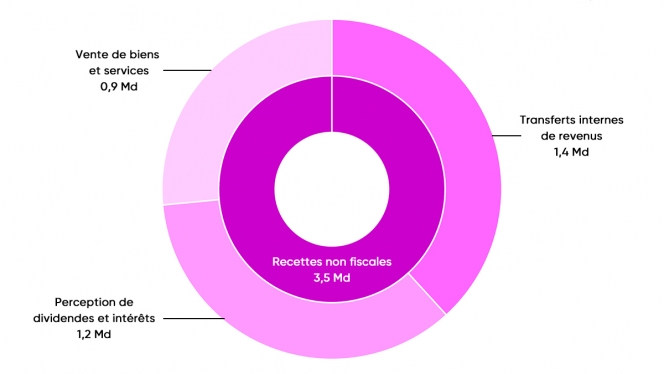

Non-tax revenue

These are State revenues which come from participation in companies or capital gains on the sale of assets held, for example. In total, they bring in 3 and a half billion euros.

Please note that all of these revenues are not used directly by the federal government. Redistribution takes place towards regions, communities, social security or even the European Union. Excise duties on tobacco are, for example, partially redirected to social security while the European Union receives part of the VAT and the Walloon region receives inheritance tax.

Finally, other taxes are directly levied by the regions, such as the property tax for example, or by the municipalities, which can sometimes decide on the rate of additional taxes on the personal income tax, the property tax and the registration tax. The communities have no way of collecting taxes and therefore depend on subsidies paid by the federal government. But you have understood, there are more than 120 billion euros per year which fill the public coffers.

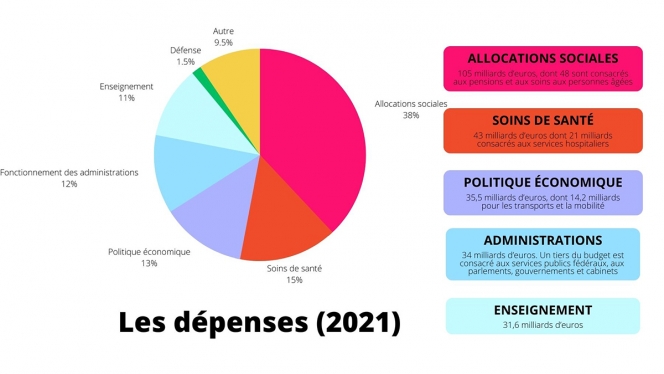

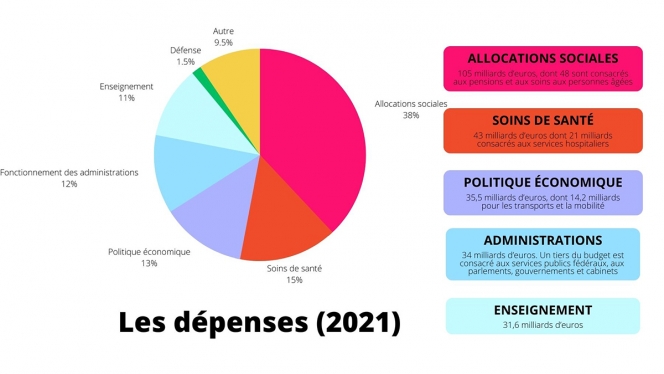

What are the expenses?

To deal with Belgian spending, we will take into account all the money spent by all levels of power, and not just the federal level. Thus, these are in total 279 billion which are divided into different main categories. The largest being social benefits which weigh 105 billion. This generic term includes: pensions and care for the elderly (48.3 billion), unemployment benefits (10.3 billion), expenses for the long-term sick and disabled (18.5 billion). ) as well as family allowances and various family aids (11.3 billion).

Health care, for its part, costs Belgium more than 40 billion and is mainly made up of hospital care (20.9 billion) and ambulatory care, i.e. care provided outside hospitals (15.2 billion). These two categories constitute what we call social security, which therefore costs our country nearly 150 billion.

Our administrations are expensive

In addition to social security, three categories weigh approximately the same in the national budget: administrations, economic policy and education. The first category cited is dedicated to the functioning of public authorities. Nearly a third of the 35 billion devoted to it are used to finance the famous SPF, federal public services, the various parliaments, governments and cabinets as well as the royal family, specify our colleagues at the Echo.

Economic policy is divided into two main families. Subsidies for the economy, trade, the labor market and subsidies dedicated to transport and mobility. Finally, education also occupies an important place in the list of expenses with 31.6 billion euros devoted to it, which places Belgium above the European average.

Belgium on the right track?

During the last budgetary year, Belgium recorded a new deficit of 17.4 billion euros. A figure which adds to the already heavy debt, which should reach 508 billion by the end of 2024 according to forecasts.

According to economist Bruno Colmant, member of the Royal Academy of Belgium, the aging of the population will inevitably further increase public spending. “The big increase will be in health care. The situation is not good in Belgium, so we risk increasing taxes and increasing the public debt even further. Those who say they are going to reduce taxes, I call them liars“.

1703229315

#states #revenues #expenditures #explain #simply