How to stop being overdrawn with a salary above the French median? Can we learn to clean up our finances? Here are some of the questions we tackle every Thursday in the Settlement section.

Talking regarding money, in France, is still taboo. However, it is a fascinating subject… and feminist in certain aspects! In our section Settling scores, of the people of all kinds come to peel their budgettell us regarding their relation to money and their financial organization as a couple or alone. Today, Bravo has agreed to open its accounts for us.

- Profession: economist in a public group

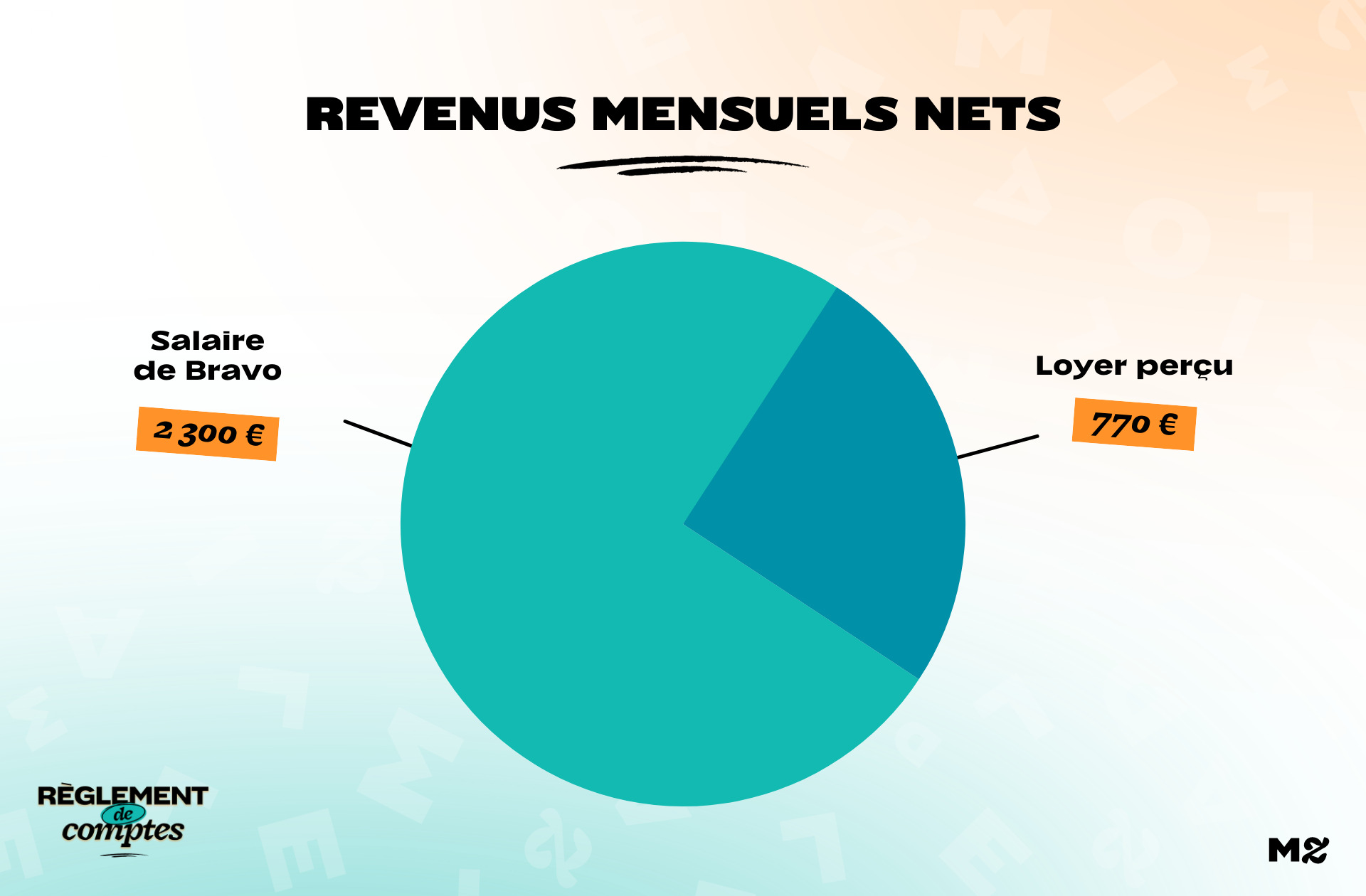

- Net salary following deduction at source: €2,300

- Place of living: An apartment owned by her spouse in Paris

Bravo’s income

Bravo works as an economist on a permanent contract in a public company. Because of her employer’s special social security system, she is still considered as a trainee but will obtain the official status of permanent employee at the end of the year. In this position, she wins €2,300 per month. A salary that she admits to be comfortable, but that she has trouble managing:

“Even if my salary is slightly below what I would receive, at my level of studies (bac +8) and for the same job in a private company, I am well paid. Frankly well paid, right? According to the median and even the French average, I am financially comfortable. But in view of my way of life, it passes ric-rac, I would say. »

Indeed, the thirty-year-old announces it from the introduction, she considers herself obsessed with money… In a way she considers very negative:

« I am very (very) spendthrift, regularly overdrawn and unable to really cope with large planned expenses let alone unforeseen ones.

So, here it is, it’s a bit my MEA culpa privileged girl. And I’m willing to stretch the stick of the article to get beaten in the forum comments which I find are always full of good advice! »

For her, money is a source of terrible anxiety:

“I’m impulsive, so I don’t watch what I spend, and when I manage to watch out for 10 days in a row, I reward myself by spending. »

She also owns an apartment that she rents out 770 € monthly. In all, she manages a budget of €3,070 per month.

The organization of Bravo and its partner

Bravo lives with her spouse and to manage their common expenses, they have a common account which is used for their daily life.

« The joint account is used for shopping, paying for outings for two and fitting out purchases for the apartment.. »

Bravo’s expenses

Bravo and her spouse each own an apartment.

“We are both owners. He, from the apartment where we live, me, from an apartment that I bought in 2020 with a terrace, in a suburb of Paris. I planned to buy it to live in, but I didn’t understand the signals my boyfriend was giving me at the time (it might have been more explicit, the signal is expensive). Finally, I moved in with him a year later. »

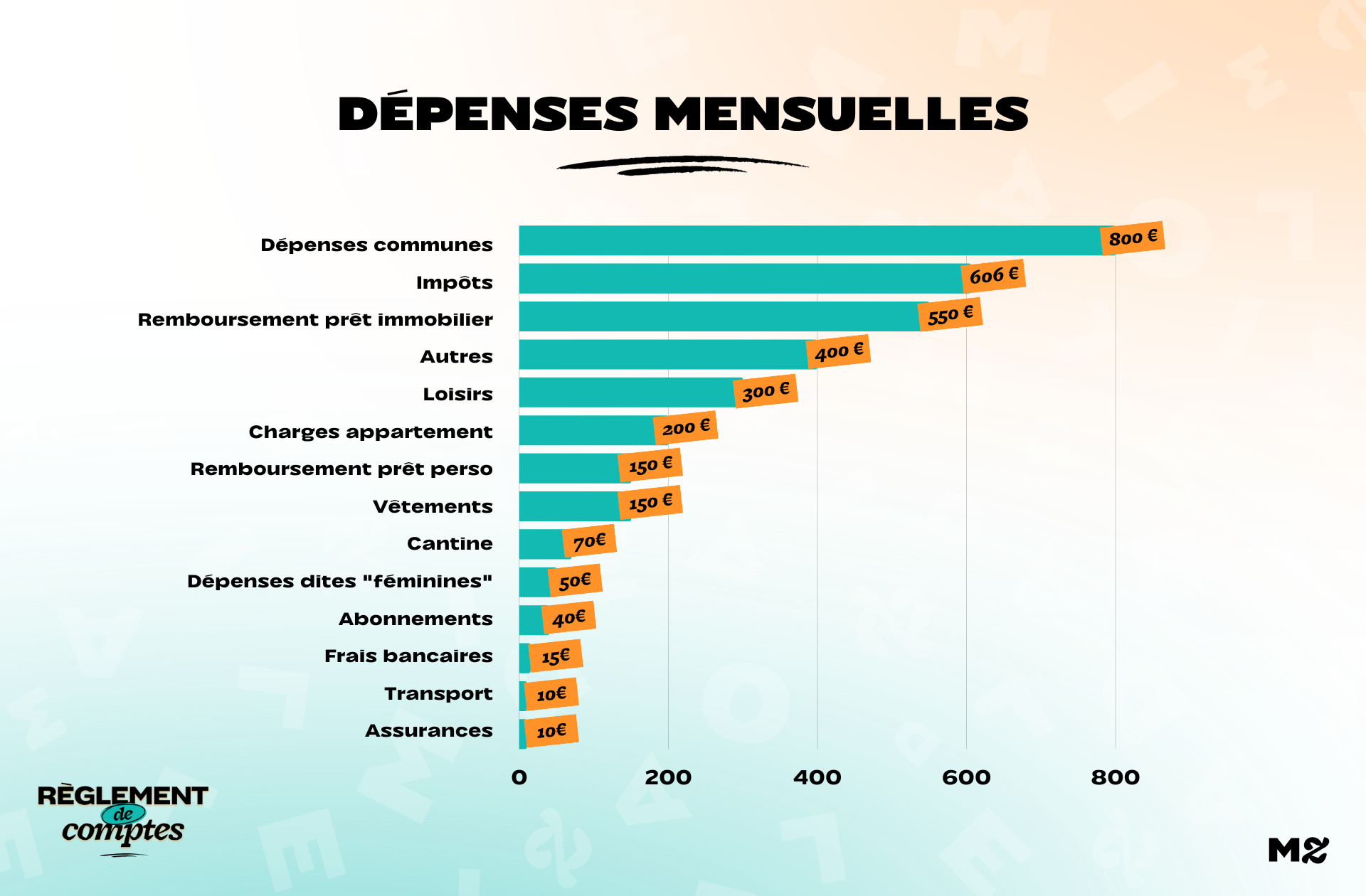

For this apartment that she bought for €160,000, she is repaying a loan of €550 per month to which are added various types of charges and taxation:

“I rent this apartment and collect a rent of 770 € monthly.

I reimburse my credit of 550 €, the property tax is 63 € per month, and I include in the rent my tenant’s internet box and electricity (which cost me around 50 € per month). I also pay tax on my property income of 110 € per month smoothed over the year. Finally, the condominium fees amount to 150 € per month, and I pay monthly insurance to 10 €. »

Once the rent for this property has been collected, the apartment she owns costs her approximately €165 per month. At the same time, she now lives with her companion in a Parisian apartment:

“We have a nice apartment that we had redone on the top floor of a somewhat old building, with a view of the Eiffel Tower and no vis-à-vis. This is the ideal apartment if you consider that 7 floors without a lift is not a problem. »

If she does not pay rent to her companion, she places each month €800 on their joint account: one half for his share of the shared expenses, and the other, as rent and participation in the expenses for his companion. This sum finances their shopping and their common expenses.

“This money is used for food shopping, paying for our common outings, sometimes helping to pay for expenses on vacation, and each month helps us pay for a purchase of a hundred euros for the house (sometimes the necessary to DIY, sometimes a decorative object or plants for example). We are also deducted from this account by 36 € per month for a UGC duo card that was taken out when we were full of good resolutions (and we used it twice this year, a huge waste). »

In addition to their UGC subscription, this amount therefore includes each month 80 € for fruit and vegetable baskets, a hundred euros purchases for the house, their joint outings and their shopping which they do most of the time at Monoprix.

“For the races, I prefer practicality because I get knots in my brain when it comes to getting around (I’m on my bike or on foot and even if I take 10,000 steps a day, I’m lazy). »

She pays for internet access in their shared accommodation up to 40 € per monthwhich include their box and various streaming services (Netflix, Amazon Prime…), and its bank charges amount to 15 €.

“I don’t understand taxes”

Recently, Bravo has been devoting €600 per month, excluding withholding tax, to its taxes. To the 173 € detailed above which concern his apartment and his rental income are added 100 € monthly until December 2022: his taxes having only been calculated from the second half of this year, it pays in six months what it will pay over twelve months each year from 2023.

To this are added 33 € per month of monthly housing tax (” It’s a catch-up, because they forgot me last year she explains) and 300 € monthly income tax catch-up payments for four months. A confused calculation, which she does not really master:

« In truth, I suck nothing. »

The subscription to a self-service electric bicycle service that allows him to travel costs him 10 € monthly.

To eat at her workplace, the 30-year-old has to eat lunch regularly: her office canteen does not offer very appetizing vegetarian options, so she spends 70 € per month in restaurants or sandwiches.

Also, well done reimburses each month 150 € to her companion to whom she owes €2,200 for expenses that she has not managed to absorb.

“Each time, it’s an absolute SHAME to ask for help, and at the same time, not being able to build up an emergency mattress, I don’t see how else to do it…

Every month she counts 50 € to go to the beautician to have hair removed, to which is added a subscription of 16 € at the Body Minute institute that she « can’t cancel as the process is boring.«

Bravo’s hobbies

On average, Bravo counts 150 € per month expenses for her clothes, which she mainly buys second-hand: “Sometimes it’s more when I buy myself a good pair of pumps, sometimes less because I’m just buying €40 from a thrift store.. «

For her leisure, she estimates spending 300 € monthly which include several subscriptions:

« I have 25 € Gymlib subscription which allows me to access a lot of activities and which I might hardly do without, 15 € pour Apple Music, 6 € for Diplo World, and 2 € for Wikipedia per month… But that’s just to clear my conscience!

She also counts 50 € of booksvery often goes out for drinks, and buys gifts for loved ones.

Bravo’s relationship to money

At the beginning of each month, Bravo sets aside €400 to cover major expenses: condominium fees, plane tickets for holidays or work. But in fact, she always ends up dipping into this amount to fill her overdraft before the end of the month:

“In total, I have €440 to indulge myself, but in reality, I am regularly overdrawn and I have to use what I have set aside to make up for it.

I’ve been trying for years to make and stick to a budget but I’m clearly living beyond my means.. In fact, I know that I am SUPER privileged, yet I am drowning in expenses and I want my rhythm of life: lots of leisure, good meals etc.

I’m also just very bad manager, very spendthrift, very impulsive and I have been uncovered every month of my life.

She would like to reduce her lunch budget, but also the cost of her apartment:

“Every two days, by dint of receiving calls for funds, I tell myself that I will sell it. There, I’m being asked for €10,000 for work and it completely worries me, I can’t cope with it… But to sell would be to lose my contribution because the price per m² hasn’t changed much in two years.

In general, money is a source of anxiety for Bravo, but also of discomfort:

“This poor management prevents me from considering my two life projects in a serene way: we are trying to have a baby, and I worry at the idea of not being able to assume it financially. In addition, I am considering a professional retraining which would put me out of work for a while, and towards a job whose median salary is €1,500 net per month.

For the poor manager that I am, these projects taken separately are a source of anxiety… Anxiety that reinforces my financial impulsiveness. Taken together, it becomes discouraging and infuriating at all.to have such an enviable situation and not manage to blossom.

She hopes that sharing her budget in Settlement can help her achieve a more peaceful relationship with money:

“I hope this will help readers who might recognize themselves in my situation, and that others will be able to share their experience as a good manager to help me put my situation in front of me once and for all: I know that I might live much better, and I don’t do it on a whim. It’s very paradoxical, especially since it’s still a source of anxiety and a bad image of myself.

Thanks to Bravo for answering our questions!

Photo credit: Karolina Gabrowska / Pexels