AI & Human Exploration: Algorithm Marketplace

Dorsey Floats “Algorithm Marketplace” Idea too Combat Bias SAN FRANCISCO — Jack Dorsey, the co-founder of Twitter and Square (now Block), has proposed a novel

Dorsey Floats “Algorithm Marketplace” Idea too Combat Bias SAN FRANCISCO — Jack Dorsey, the co-founder of Twitter and Square (now Block), has proposed a novel

Pope Francis’ Final Hours: “Thank You” and a Final Appearance VATICAN CITY (Archyde.com) — the Vatican has released poignant details surrounding the final hours of

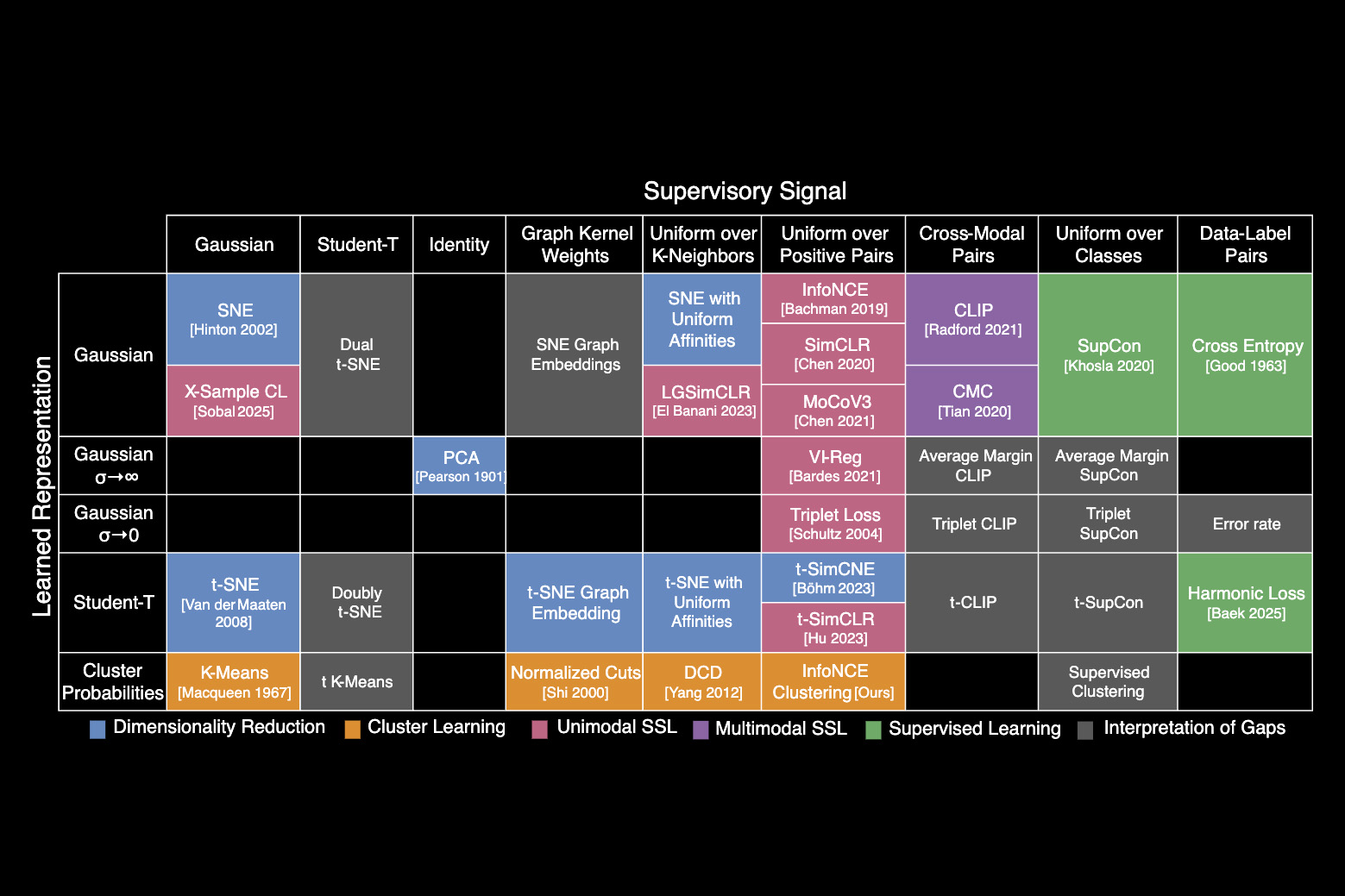

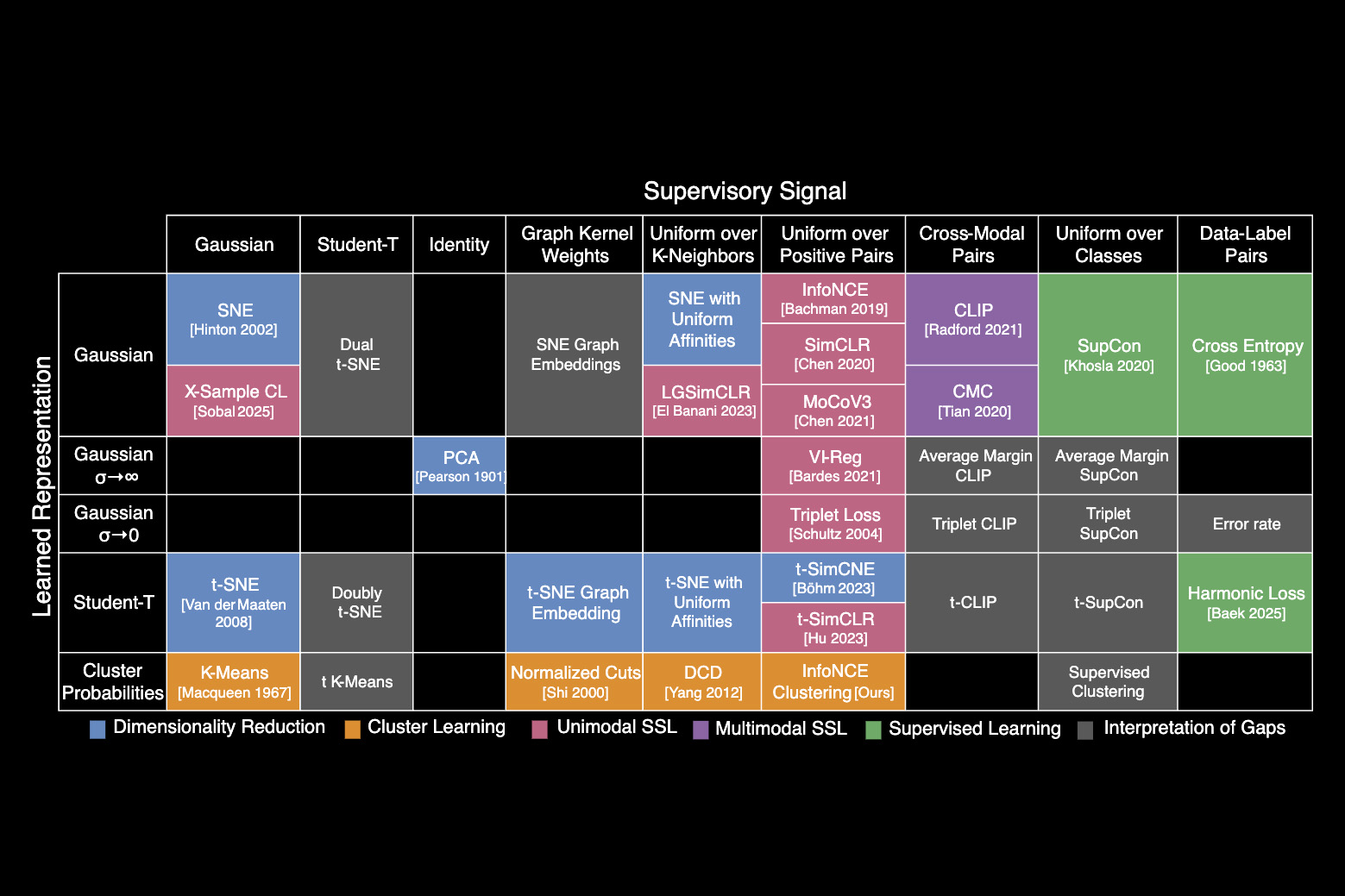

MIT Researchers Unveil ‘Periodic Table’ of Machine Learning, Promising AI Discovery CAMBRIDGE, Mass. — In a breakthrough that could streamline the growth of artificial intelligence,

YouTube CEO Lobbied for Exemption From Australian Social Media Ban, Raising Eyebrows Among Competitors CANBERRA, Australia – Newly released documents reveal that YouTube’s global chief

Dorsey Floats “Algorithm Marketplace” Idea too Combat Bias SAN FRANCISCO — Jack Dorsey, the co-founder of Twitter and Square (now Block), has proposed a novel

Pope Francis’ Final Hours: “Thank You” and a Final Appearance VATICAN CITY (Archyde.com) — the Vatican has released poignant details surrounding the final hours of

MIT Researchers Unveil ‘Periodic Table’ of Machine Learning, Promising AI Discovery CAMBRIDGE, Mass. — In a breakthrough that could streamline the growth of artificial intelligence,

YouTube CEO Lobbied for Exemption From Australian Social Media Ban, Raising Eyebrows Among Competitors CANBERRA, Australia – Newly released documents reveal that YouTube’s global chief

© 2025 All rights reserved