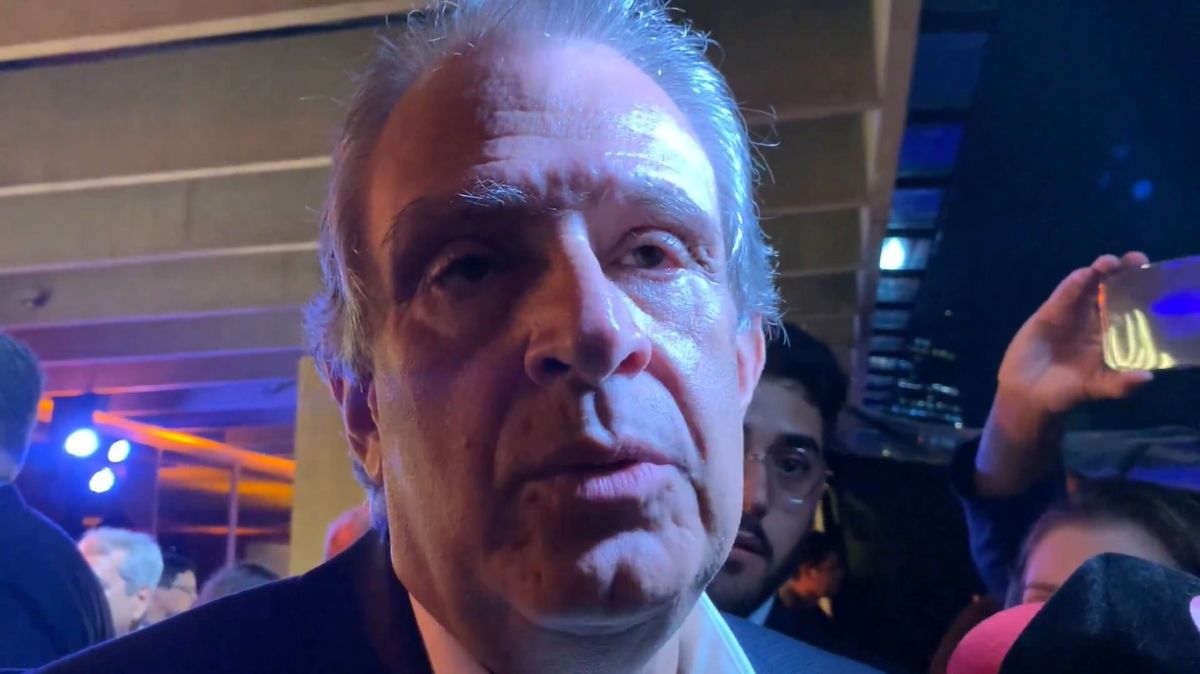

“The ADNOC deal is one of my favorite deals because we are the only industrial partner in a consortium of major investors,” said Snam CEO Marco Alvira.

He added in an interview with “Al Arabiya” today, Thursday, that the value of the investment that was injected is $250 million and bears a good, stable and predictable return. He continued, “We hope to use this deal not only to enter the region as an industrial partner, but also to sell and market our technology and to work with ADNOC to prepare the infrastructure for the future.

He explained that will have a “hump” A parallel system for gas and hydrogen for decades to come, but since the infrastructure of gas and hydrogen is similar, work can be done to shift in the field of energy until the abandonment of fossil fuels and the complete transition to renewable energies.

Marco Alvira said that the return from the ADNOC deal is slightly more than 10%, which is a good, healthy and stable return. The return should always be considered in comparison with the risks, and here the risks are very limited because we work with ADNOC, one of the major companies with high reliability, and it pays the rent on the asset owned by it, if not Company risks.

Sanam was awarded this deal in a consortium that included Global Infrastructure Partners and Brookfield Asset Management to acquire 49% of the gas pipelines for $10 billion.

The CEO stated that “Snam” company is actively working in the Saudi market through a deal to sell “electrolyzers” in NEOM and has an office in Riyadh and a team there, and “SANAM” continues to pay attention to the Saudi and Gulf market.

He added that the world will need conventional oils, but it also needs renewable energies, and Saudi Arabia and the UAE are the two best places to create an energy transition, or as I call it the hydrogen revolution.

He continued, “We have the technology, the skills and the people and we do not need to reinvent anything. We can also invest in gas infrastructure because it is immune to future developments.”