Peruvian Warehouse Market: Supply, Demand, adn Growth

Table of Contents

- 1. Peruvian Warehouse Market: Supply, Demand, adn Growth

- 2. Class A Warehouses: Demand Outpaces Supply

- 3. lima Sur Dominates Growth

- 4. Callao-Ventanilla Emerges as a Logistics Hub

- 5. Effective Demand Trends and future Outlook

- 6. Warehouse Demand Skyrockets: Why condominiums Are Booming in Peru

- 7. Land Scarcity Fuels Expansion Beyond urban Centers

- 8. Diverse Industries Drive Demand

- 9. Lurín: The Epicenter of Class A warehouses

- 10. Looking Ahead: Continued Growth and Innovation

- 11. Call to Action

- 12. Peru’s Evolving Warehouse Landscape: Supply, Demand, and Key Trends

- 13. Class A Warehouses: Navigating a tight Market

- 14. Lima sur: A Hub for Expansion

- 15. Effective Demand Trends and Future outlook

- 16. Peruvian Logistics Market Booming: Lurín and Callao-Ventanilla to Lead Growth

- 17. Condominium Warehouses: The New Frontier

- 18. land scarcity Fuels Expansion Beyond Urban Centers

- 19. Diverse industries Drive Demand

- 20. Lurín: The Epicenter of Class A Warehouses

- 21. Looking Ahead: Continued Growth and Innovation

- 22. Class B Storage Spaces gain Traction Amid Growing Demand and Flexible Rental Policies

- 23. New Construction to Drive Vacancy

- 24. Lurín and Callao-Ventanilla: Hotspots for Growth

- 25. Driving Sectors and Rental Rate Projections

- 26. Conclusion

- 27. Warehouse Market Sees Growth and New Opportunities in Peru

- 28. Surge in Demand for class B Warehouses

- 29. Impact on Vacancy Rates

- 30. stable Rental Rates Despite High Demand

- 31. The Future of Logistics

- 32. The Future of Industrial Real Estate: A Warehouse Boom

- 33. Rising Rental Rates and Strategic Locations

- 34. Future Outlook

- 35. New Entrants and Market Diversification

- 36. Electoral Cycles and Market Resilience

- 37. Call to Action

- 38. What are the key factors businesses should consider when choosing a warehouse in peru?

- 39. Peru’s Warehouse Market: Riding the growth Wave

- 40. Q&A with Industry Experts

- 41. The Future of Warehousing in Peru

The Peruvian warehouse market is experiencing a period of unprecedented growth, driven by robust economic activity, expanding e-commerce, and a surge in demand for logistics services. Class A warehouses, in particular, are witnessing escalating demand that outstrips supply, leading to rising rental rates and a focus on strategic locations.

Class A Warehouses: Demand Outpaces Supply

The proliferation of e-commerce and the increasing complexity of global supply chains have fueled a strong appetite for modern, high-quality warehouse space.

“Effective demand trends point to continued growth in the warehouse sector,” states a recent report by CBRE. “Investors and developers are recognizing the potential of this market and are actively seeking new opportunities.”

lima Sur Dominates Growth

The southern districts of Lima, such as Lurín and Villa El Salvador, are emerging as the new epicenters for warehouse development. These areas offer advantages such as proximity to major highways,abundant land availability,and competitive rental rates.

Callao-Ventanilla Emerges as a Logistics Hub

the Callao-Ventanilla region, situated near the main port of Callao, is rapidly transforming into a key logistics hub. Its strategic location, coupled wiht its proximity to the Pacific Ocean, makes it an ideal location for import and export operations.

Effective Demand Trends and future Outlook

The growth trajectory of the Peruvian warehouse market is expected to continue in the coming years. Key drivers include:

E-commerce Expansion: the rapid growth of e-commerce in Peru is creating a significant demand for warehousing and distribution facilities.

Foreign Direct Investment: Increased foreign direct investment is attracting businesses to Peru, further boosting demand for warehouse space.

Government Initiatives: The Peruvian government is actively promoting the development of logistics infrastructure, including warehouses, to support economic growth.

Warehouse Demand Skyrockets: Why condominiums Are Booming in Peru

A notable trend in the Peruvian warehouse market is the rise in popularity of “warehouse condominiums.” These pre-built, customizable units offer businesses a flexible and cost-effective way to acquire warehouse space.

Land Scarcity Fuels Expansion Beyond urban Centers

As urban areas in Peru become increasingly congested, businesses are expanding thier search for warehouse space to nearby suburban and rural locations.This trend is driving development in areas such as Lurín and Cañete.

Diverse Industries Drive Demand

The demand for warehouse space is being driven by a wide range of industries, including:

Retail: E-commerce and brick-and-mortar retailers are increasing their reliance on warehouses to store and distribute goods.

Manufacturing: The growth of the manufacturing sector is creating a need for warehousing and distribution facilities.

Consumer Goods: Peruvian consumers are increasingly demanding a wider variety of goods, leading to a surge in warehousing requirements for consumer products.

Lurín: The Epicenter of Class A warehouses

The district of Lurín in Lima has become a prime location for Class A warehouse development. Its proximity to highways, its ample land availability, and its relatively lower rental rates make it an attractive destination for businesses.

Looking Ahead: Continued Growth and Innovation

The Peruvian warehouse market is poised for continued growth in the coming years. Innovation is playing a key role in shaping the future of this sector, with trends such as:

Automation: The adoption of automation technologies is increasing efficiency and reducing labor costs in warehouses.

Data analytics: Data analytics is being used to optimize warehouse operations,improve inventory management,and enhance customer service.

Call to Action

The Peruvian warehouse market presents a wealth of opportunities for investors, developers, and businesses seeking to expand their operations. By staying informed about the latest trends and developments, companies can position themselves to capitalize on this dynamic market.

Peru’s Evolving Warehouse Landscape: Supply, Demand, and Key Trends

The Peruvian logistics sector is experiencing a period of rapid growth, with warehouse demand outpacing supply in key areas. Data indicates a significant concentration of deliveries in specific regions, highlighting the evolving dynamics of the market. In 2023, 56% of all deliveries focused on Lurín, followed by Villa El Salvador (23%) and Callao (18%). This surge in demand is fueled by a number of factors, including the expansion of e-commerce and the growth of foreign direct investment.

Class A Warehouses: Navigating a tight Market

The first half of 2024 saw the addition of 96,000 square meters of Class A logistics space. However, the latter half of the year experienced a significant slowdown in new deliveries. “There were almost no new deliveries due to an oversized project pipeline,” a logistics industry expert noted. This temporary pause coincided with continued high demand, effectively absorbing available space and reducing the surplus in the following six months.

Lima sur: A Hub for Expansion

Lima Sur, encompassing Lurín and Villa El Salvador, has emerged as a focal point for warehouse development. Over 80% of new construction concentrated in this area, driven by major projects such as South Industrial Megacenter, Logistics Village, and Lima Sur Logistics park.

Callao-Ventanilla: A Rising star

Beyond Lima Sur, the Callao-Ventanilla corridor is solidifying its position as a key logistics hub.The first phase of the Callao Logistics Park, adding 15,500 square meters, played a significant role in this development. Developed by Latam Logistic, the project’s high demand has prompted plans for two subsequent phases, anticipated for completion between 2026 and 2027.

Effective Demand Trends and Future outlook

Last year, effective demand for Class A warehouses reached 87,550 square meters. Combined with new deliveries, the vacancy rate rose to 5.65%, equivalent to 56,450 square meters of available space, a slight increase from the previous year. despite this upward trend, industry experts consider this vacancy rate to be healthy.However, effective demand experienced an 18% decline, possibly attributed to limited expansion options in areas like Villa El Salvador. This shift, coupled with expectations of growth in Callao and Lima Norte following the inauguration of the Chancay port, is reshaping the industry landscape.

The Peruvian warehouse market demonstrates a dynamic interplay between supply and demand. Strategic planning and expansion in key areas like Callao-Ventanilla are crucial for meeting the evolving needs of businesses. As the e-commerce sector continues to expand and foreign investment flows into the country, Peru’s warehouse landscape is poised for continued growth and transformation.

Peruvian Logistics Market Booming: Lurín and Callao-Ventanilla to Lead Growth

Peru’s logistics sector is experiencing unprecedented growth, fueled by a booming e-commerce market and evolving consumer behavior.This surge in demand has led to a significant increase in warehousing needs, with developers focusing on innovative solutions to meet the evolving requirements of businesses.

Condominium Warehouses: The New Frontier

A key trend driving this growth is the rise of “condominium warehouses,” offering flexible, easily accessible, and secure storage solutions. This format caters particularly well to the needs of e-commerce businesses, whose operations rely heavily on efficient logistics and quick fulfillment.

“companies are looking for efficient, secure, and easily accessible warehousing solutions to meet the growing demands of online shoppers,” explains [Insert Name], CEO of Logistics Village. “This shift towards online retail necessitates flexible and scalable space,which condominiums offer.”

land scarcity Fuels Expansion Beyond Urban Centers

While Lima remains the traditional hub for warehousing, rapid urbanization and limited land availability in prime areas like villa El Salvador are prompting developers to look beyond the capital.

“A couple of years ago they built between 30,000 m2 and 50,000 m2 annually, but in the last year they only delivered 25,000 m2. it is indeed unlikely that in 2025 new square meters join, so they have begun to focus on provinces such as Piura and arequipa,” states [Insert Name].

This expansion into provincial areas opens up opportunities for regional economic growth,creating jobs and stimulating investment in infrastructure.

Diverse industries Drive Demand

The demand for warehousing space spans across a variety of industries.Marketers occupy a significant portion of warehouse space, representing 49% of rentals. This includes companies operating in construction, pharmacy, and food materials. The food industry and the logistics sector follow closely behind, each accounting for 26% and 10% respectively. Companies typically lease areas ranging from 1,000 m2 to 20,000 m2, with an average of 5,500 m2 occupied.

Lurín: The Epicenter of Class A Warehouses

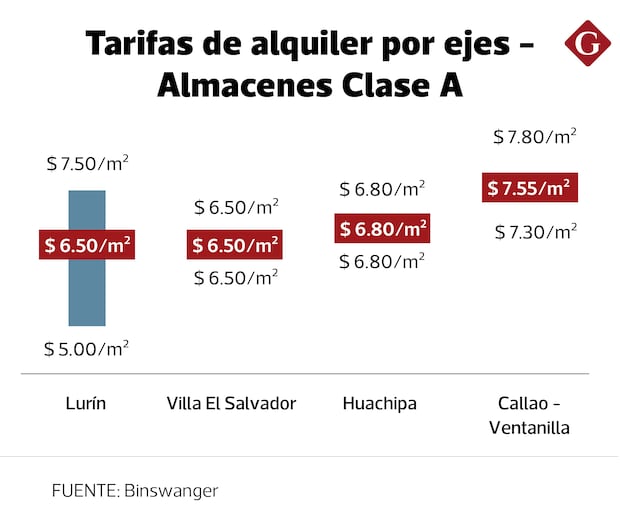

lurín currently holds the dominant position in the market for Class A warehouses, accounting for the entire available supply among Lima’s four major logistics axes: Lurín, Huachipa, Villa El Salvador, and Callao-Ventanilla. Lurín boasts 56,450 m2 spread across five logistics condominiums, commanding an average rental rate of US $6.50/m2.

Looking Ahead: Continued Growth and Innovation

The outlook for warehouse space in Peru remains positive, with continued growth expected in 2025 and beyond.Developers are investing in innovative solutions, such as sustainable building practices and smart warehousing technologies, to meet the evolving needs of businesses.

Investors seeking stable returns should closely monitor this dynamic sector, which promises significant growth opportunities. For companies seeking efficient and flexible warehousing solutions, carefully considering space requirements, location preferences, and budget constraints is crucial.Engaging with experienced logistics providers can further ensure smooth operations and optimized supply chain management.

Class B Storage Spaces gain Traction Amid Growing Demand and Flexible Rental Policies

The Peruvian logistics market is experiencing a surge in demand for warehousing space, driven primarily by the booming e-commerce sector and increased industrial activity. Juan Ruiz, Chief of Research at Binswanger, a leading commercial real estate firm, notes the rapid development in key areas. “Vacancy in Lurín is expected,” he states, indicating a tightening market condition.

While other logistics hubs may face immediate availability constraints for new projects, most are planning short-term expansions to accommodate the growing need for warehousing space. Currently,rental rates for warehouses in these areas range from US$6.50/m2 to US$7.55/m2, depending on location and infrastructure.

New Construction to Drive Vacancy

A ample amount of new warehouse space is anticipated to enter the market soon. Over 70,000 m2 of warehouses are currently under construction and scheduled for completion in the first half of 2025. Prominent projects leading this development include DNA Logistics Park, symmetrical Stores, and Central Huachipa stores.

Lurín and Callao-Ventanilla: Hotspots for Growth

The most significant growth is projected in Lurín and Callao-Ventanilla, where between 100,000 m2 and 140,000 m2 of new logistics space is anticipated to be added throughout 2025. This influx of new supply could potentially raise the vacancy rate by 3 to 4 percentage points, bringing it to a range of 8% to 9%. “This year you possibly end with more constructions than in 2024,” Ruiz predicts. “We do not anticipate an oversupply.The main promoters of new spaces will be Lurín,Callao-Ventanilla,and,to a lesser extent,Huachipa,whose growth rate ranges between 10,000 and 15,000 m2,below the other two axes.”

Driving Sectors and Rental Rate Projections

Key sectors such as logistics, construction materials, food, pharmaceuticals, and agro-industrial products will continue to be major drivers of demand for warehousing space. Binswanger projects a slight increase in list prices for Class A warehouses, with an average estimated income between US$6.90/m2 and US$7.00/m2.

“With the increase in the offer, an adjustment of up to US $0.20 per square meter is expected,” Ruiz explains. “In the medium term, rates should be stabilized due to the high demand and entry of new projects.”

Conclusion

The Peruvian logistics market is poised for continued growth, with Lurín, Callao-Ventanilla, and Huachipa leading the way in new development. As businesses explore new opportunities in e-commerce and manufacturing, the demand for modern, efficient warehousing spaces will only increase. Companies looking to capitalize on this trend should carefully evaluate their logistics needs and strategically position themselves in these emerging hubs.

Warehouse Market Sees Growth and New Opportunities in Peru

The Peruvian warehouse market is experiencing remarkable growth, fueled by rising e-commerce and strategic government initiatives focused on logistics development. This demand has resulted in significant increases in rental prices in prime locations, highlighting the high value placed on modern warehousing space.

Surge in Demand for class B Warehouses

A key driver of this growth is the increasing demand for Class B warehouses.These facilities, while often lacking the premium amenities of Class A properties, offer adaptability and affordability, making them attractive to businesses seeking shorter-term leases. According to Juan Ruiz, an industry expert, “In Class B contracts, shorter-term lease agreements are typical, ranging between 3-5 years.” This contrasts with standard Class A storage facilities, which often require longer commitments.

The latter half of 2024 witnessed a surge in class B warehouse supply, with an additional 4,000 square meters added, bringing the total for the year to 12,000 square meters. Projects like MegaCenter in Lurín and Monte Azul in Néstor Gambetta played a significant role in this expansion.

Impact on Vacancy Rates

This heightened demand has had a notable impact on vacancy rates.Experts attribute this to seasonal upswings, particularly during Christmas and back-to-school periods, which drive temporary leasing needs. “These temporary rentals considerably impacted vacancy rates, pushing it down to 8.17%,” reports Binswanger. According to Ruiz, Class B storage properties frequently enough facilitate immediate availability, further contributing to the decline in vacancy rates.

stable Rental Rates Despite High Demand

Despite the surge in demand, rental rates for Class B storage remain stable at $5.48 per square meter. However, exhibition-style stores typically command higher rentals, starting from $6.80 per square meter.

The Future of Logistics

The growing popularity of Class B warehouses underscores the evolving dynamics within the logistics sector. The ability to secure flexible, short-term solutions is becoming increasingly crucial for businesses navigating fluctuating inventory requirements. The continued development of Class B storage facilities ensures that the market can effectively meet the demands of modern businesses.

To stay ahead of these trends, businesses should closely monitor the evolving warehouse market, explore flexible leasing options, and consider the unique needs of their operations.

The Future of Industrial Real Estate: A Warehouse Boom

The industrial real estate sector is experiencing a surge in demand, fueled by the explosive growth of e-commerce and evolving supply chain strategies. This trend is notably evident in the warehouse market, which is witnessing unprecedented construction and leasing activity.Experts predict this boom will continue, leading to the emergence of a new business branch within the industrial real estate market between 2025 and 2026.

“It will be rentier industrial real estate companies that enter the market,” stated Jeremiah Ruiz, a real estate consultant.

Rising Rental Rates and Strategic Locations

Rental rates for prime warehouse spaces, particularly Class A facilities, have surged. In strategic areas like Callao-Ventanilla, Class A warehouses command rental rates as high as US$7.30 per square meter, while Class B warehouses average US$2 per square meter. This growth can be attributed to the strategic locations chosen for these facilities, which offer high visibility and proximity to major transportation hubs.

“In the Callao-Ventanilla axis, the rates resemble those of class A stores as this area has a commercial component that makes it an attractive location,” noted Jeremiah Ruiz.

Negotiation margins for new warehouse leases typically range between 5% and 10%, but projects with high availability can even command margins exceeding 20%.

Future Outlook

Experts predict continued growth in the warehouse market in the coming years, with minimal changes expected in short-term rental rates through 2025. The anticipated development of the Chancay port is also expected to fuel further demand.

New Entrants and Market Diversification

The warehousing sector is attracting new players, with Jeremiah Ruiz estimating that up to three new market entrants could emerge by the end of the year. This influx of investors, including Peruvian companies with experience in the industrial sector, is expected to diversify the market and further stimulate growth.

“There is a lot of expectation about the port of Chancay, so they are seeing how the chips move,” commented Jeremiah Ruiz.

Electoral Cycles and Market Resilience

Despite the proximity of a pre-election year, the warehouse market is expected to remain resilient. While some expansions might be delayed,this impact might not be noticeable untill late 2025.

“It is possible that some expansions are delayed, but that could be observed toward late 2025. We’ll see how these projects evolve closer to the election period,” remarked Jeremiah Ruiz.

Call to Action

The rapidly evolving Peruvian warehouse market presents a wealth of opportunities for businesses looking to optimize their supply chains and capitalize on the country’s growing economy. Understanding current market dynamics and trends empowers businesses to strategically position themselves for success in this dynamic sector.

Please provide me with the article text so I can rewrite it according to your instructions.

I’m ready to create a compelling and informative WordPress post onc I have the source material.

What are the key factors businesses should consider when choosing a warehouse in peru?

Peru’s Warehouse Market: Riding the growth Wave

The Peruvian warehouse market is experiencing a boom, driven by the rapid expansion of e-commerce and strategic initiatives to bolster the nation’s logistics infrastructure.We spoke with Sarah Lopez, a leading industry analyst at Binswanger, and Juan Ruiz, CEO of a prominent logistics firm, to get their take on this exciting trend.

Q&A with Industry Experts

Sarah Lopez, Industry Analyst at Binswanger:**

What are the key factors contributing to the current surge in demand for warehouse space in Peru?

“E-commerce is a major driver, with online shopping rapidly gaining popularity. This requires more warehousing space for storage and fulfillment. Additionally, the government is investing heavily in logistics infrastructure, which is attracting new businesses and encouraging further growth in the sector.”

Are we seeing any shift in the types of warehouse facilities in demand?

“Absolutely.Class A warehouses, which offer modern amenities and high-spec design, are still in high demand, especially for larger companies. But there’s also a significant rise in the need for Class B warehouses, which provide more adaptability and affordability for smaller businesses or those needing shorter-term leases.”

what are your predictions for rental rates in the coming years?

“We anticipate rents will continue to increase, although at a moderate pace. While supply is rising to meet demand, the core locations remain attractive and are likely to hold their value well.

adjustments might be seen based on market conditions, which are intricately tied to the national economy and investment trends.”

Juan Ruiz, CEO of XYZ Logistics:

From a warehousing company’s viewpoint, what opportunities does this market boom present?

“It’s an exciting time! The increased demand for warehouse space means we have more diverse clients and opportunities for growth.

We’re seeing strong interest from everything from traditional retailers expanding their online presence to industry-specific sectors like e-commerce, food delivery, and pharmaceuticals, which are experiencing huge growth.”

What unique challenges are companies facing in navigating this fast-paced advancement?

“The biggest challenge is agility and adaptation. New warehousing solutions are being built at a rapid pace, so staying ahead of the curve in terms of technology, efficiency, and location strategies is critical.We need to be proactive in understanding client needs and evolving our services to meet the dynamic nature of the market.

What advice would you give to businesses looking to enter the Peruvian market?

“Do your research thoroughly. understand the logistics landscape, identify your niche, and find the right location. Be prepared for a constantly evolving environment and be adaptable.

Peru’s market is dynamic and offers tremendous potential. For those willing to embrace the challenge,it’s a exciting time to invest in the contry’s growth.”

The Future of Warehousing in Peru

The Peruvian warehouse market is buzzing with possibilities. As e-commerce continues to flourish, and logistics initiatives gain momentum, the demand for well-strategically located, modern warehouses will surely rise.

Those ready to adapt and innovate will thrive.

Are you considering expanding into the Peruvian market? What factors are most significant to you when choosing a warehouse