Ahead of the U.S. Federal Reserve’s final policy-making meeting of the year next week, economists polled by Bloomberg expect the central bank to raise its benchmark interest rate to 5 percent at rest and then hold it there for a full year. This is tantamount to extinguishing the market’s expectations for a possible rate cut in the second half of the year, and also deepening the possibility that the US economy will enter a recession.

Bloomberg surveyed 44 economists from December 2 to 7, and the results showed that economists expect the Federal Open Market Committee (FOMC) to raise interest rates by 2 yards (50 basis points) next week, in line with market views. Then, the two consecutive meetings in January and March next year will raise interest rates by 1 yard (25 basis points) respectively. The Fed will announce its December resolution next Thursday at 3 am in Taiwan.

The FOMC will release its latest Summary of Economic Projections (SEP) this time, and the interest rate dot plot may show a peak of 4.9% next year (representing the target range for the federal funds rate of 4.75-5.00%), up from the 4.6% forecast in September.

This may come as a hawkish surprise to investors. Although most people also predict that the terminal interest rate will fall at regarding 4.9% next year, they believe that the interest rate will be cut by 2 yards sometime in the second half of next year.

Economists polled by Bloomberg expect the benchmark interest rate to be cut to 4% by June 2024 and then to 3.5% by the end of 2024.

Fed Chairman Jerome Powell has said he is willing to let the economy take some pain and let inflation, which is near a 40-year high, come down. That view may be glimpsed in the latest economic forecasts.

GDP, Unemployment and Inflation Forecasts

Economists predict that the latest SEP will show weaker U.S. gross domestic product (GDP) growth, which might fall to 0.8% in 2023 from 1.2% forecast in September, while the unemployment rate rises to 4.6%, just above 9%. monthly forecast. The US unemployment rate was 3.7% in November.

Bloomberg economists Anna Wong and Eliza Winger say the Fed has signaled it might reach a terminal interest rate of regarding 5% in the first half of 2023, during which time the Fed might raise rates by 2 yards this month, followed by two hikes each time. 1 yard of interest rate hikes, and then keep it at 5% for the whole year.

“Resilience in U.S. consumer spending and the labor market has put upward pressure on inflation and led us to raise our end-point rate forecast,” said Kathy Bostjancic, chief economist at Nationwide Life Insurance.

Just under half of economists surveyed by Bloomberg see a rate cut in 2023. Those predicting a rate cut also expect the unemployment rate to rise to 5 percent from the current 3.7 percent, and that rising unemployment combined with a recession will prompt the Fed to cut interest rates.

Hugh Johnson, chairman of Hugh Johnson Economics, said that while the Fed clearly wants to keep interest rates at the peak for a full year, the final decision still depends on the data. If the economy shrinks and inflation starts to cool in the first half of the year, it may challenge this approach.

The SEP due next week is likely to show higher inflation than estimated in September. Policymakers in September forecast inflation at 5.6 percent this year and 2.9 percent next year.

The Fed’s preferred inflation indicator, the core personal consumption expenditures (PCE) price index, rose below market forecasts in October (0.2% month-on-month, 5% year-on-year), but has almost been above market expectations this year .

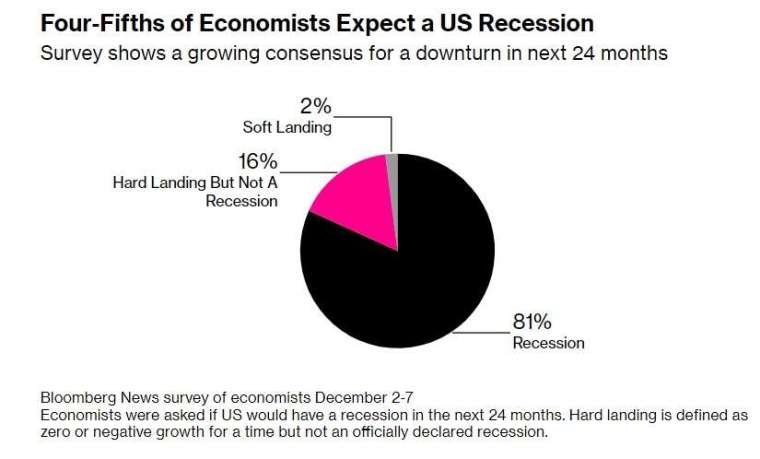

80% think U.S. economy will be in recession

The number of economists predicting a U.S. recession has increased, despite Fed officials arguing that the U.S. still has a chance of heading for a “soft landing.”

Eighty-one percent of respondents predicted the U.S. economy would enter a recession, and 16 percent predicted a “hard landing,” meaning a period of zero economic growth or economic contraction, but not enough to be officially declared a recession.

In addition, 76% of economists predicted a global recession.

Thomas Costerg, senior U.S. economist at Pictet Wealth Management, said the risk of the U.S. making monetary policy mistakes is high and a so-called soft landing is increasingly unlikely.

Economists also predict that the FOMC’s decision-making statement will retain the November interest rate guidance, that is, it will continue to raise interest rates to a “sufficiently restrictive” level to bring inflation back to the target value. The Fed revised that wording in November to take into account the incremental effect of rate hikes and the time lag in the real economy when the impact is felt.

About 25% of the economists surveyed believe that Fed policymakers may have different voices at this meeting. If it comes true, it will be the third time this year that all members have not obtained unanimous consent. The first two occurred in March (St. Louis Federal Reserve Bank President Bullard advocated a larger rate hike) and June (Kansas City Federal Reserve Bank President George advocated a smaller rate hike).

(This article is not open to partners to reprint)