There is a confusing gap in risk sensitivity between asset classes.

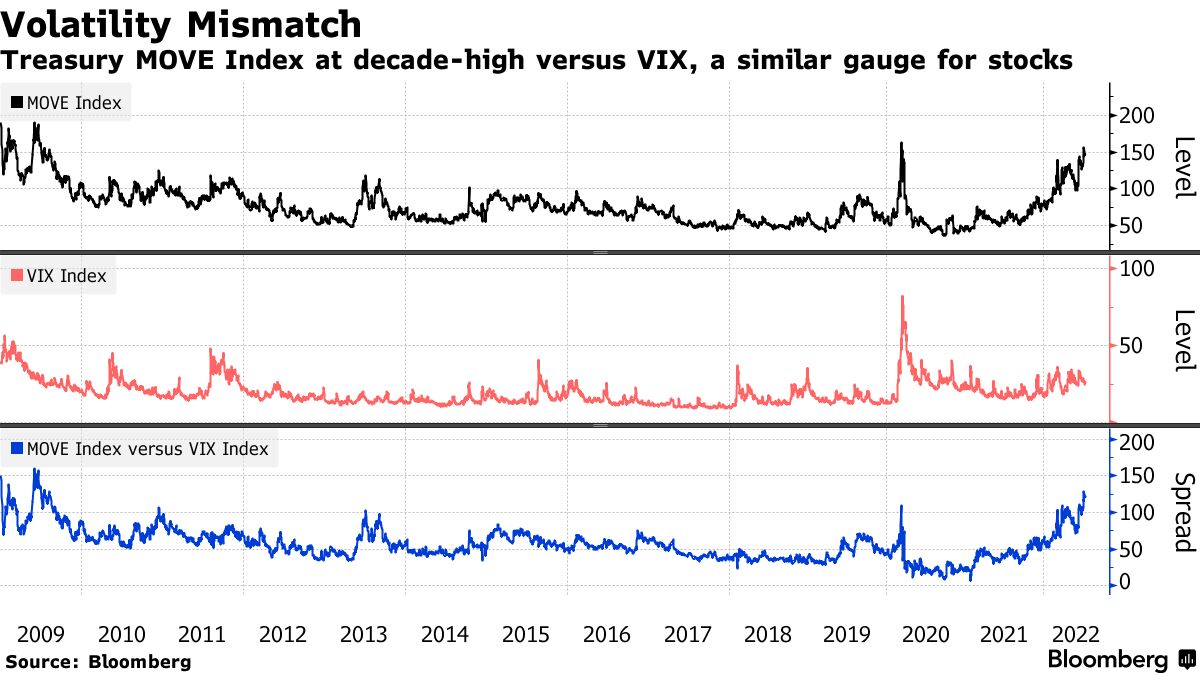

Volatility is shrinking in equities, but soaring in bonds. The ICE / BofA / MOVE index, which is a cost indicator for US Treasury options, has risen in four of the last five weeks. Meanwhile, the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), a similar indicator of equities, has fallen for the third straight week. The VIX premium for the MOVE index expanded this month to its highest level since 2009.

Wall street road sign

Photographer: Michael Nagle/Bloomberg

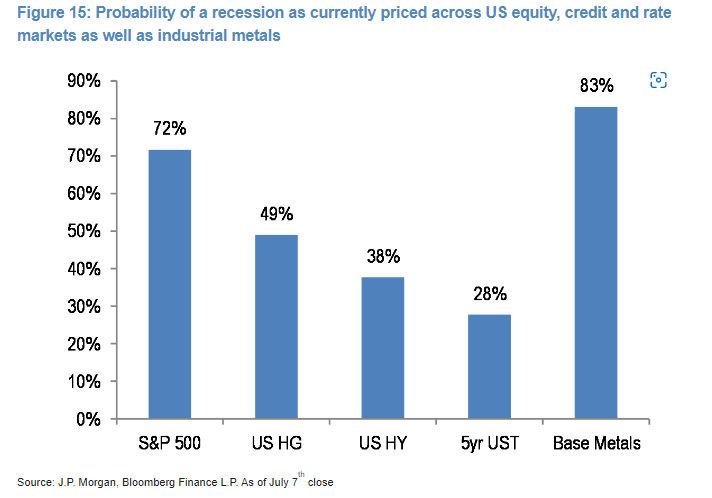

If you take this straightforwardly, it’s a bad idea for equity investors. In other words, the imbalance will be resolved by further damaging the stock market. On the other hand, there is a view that the stock index is distorted because professional traders are shy away from the options that are the basis of VIX. Those who think that the stock market was woven with more bad news than other assets when the market capitalization of 15 trillion dollars (regarding 2060 trillion yen) was blown off in the first half of January to June, causing a time lag. There is also.

According to Bank of America (BofA) strategists such as Gonzalo Assis, this gap suggests a “under-incorporation” of stock market recession risk. According to the bank’s model, the volatility gap between interest rates and equities is the largest since at least 2000.

“From our point of view, this inequality is unsustainable and is likely to close through rising equity volatility,” strategists said in a report. “Recession is a headwind for stocks and is difficult to consider in advance, suggesting that there is room for further downturns,” he said.

Source: JPMorgan

Original title:

news-rsf-original-reference paywall">Rates Volatility Lapping the VIX Is Latest Cross-Asset Conundrum(excerpt)

:quality(50)/cdn-kiosk-api.telegraaf.nl/3a7181b4-c85a-11ef-8faf-56e8a92e9b4d.jpg)