2024-03-29 12:40:00

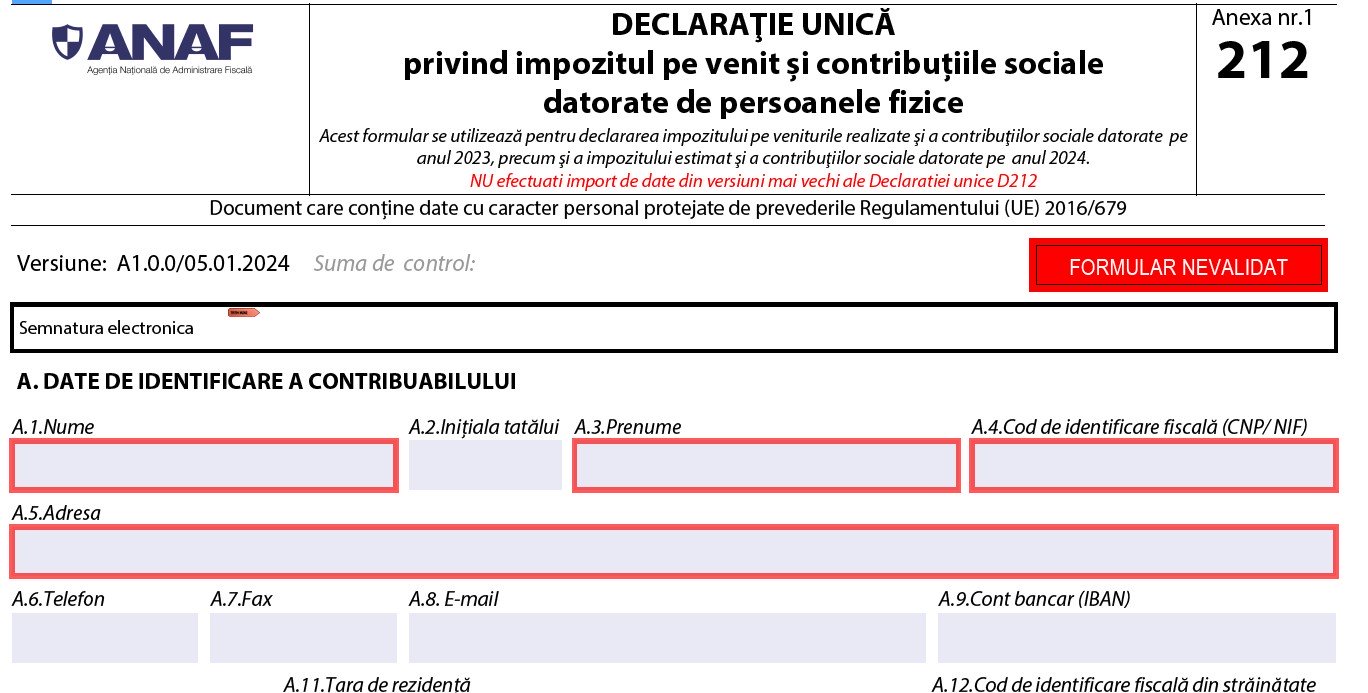

How do I complete the Single Declaration 2024? That’s a question many people ask themselves who have income from self-employment, rent, investments and more. The May 27 deadline is approaching, and by then the taxes declared on that 212 form must be paid.

ANAF headquartersPhoto: Agerpres

Tax consultant Cornel Grama helped us make a VIDEO TUTORIAL for this year, especially since there have been a lot of changes in the filling and declaration method.

The first part of the VIDEO clip contains the general aspects, but also some additional instructions to better understand what needs to be ticked and why: both in the part of revenues achieved in 2023 and in the part of estimating those in 2024. In the part of two you have calculation models for various situations.

What completion examples you find in the Tutorial

The VIDEO tutorial is divided into chapters on how to complete in various situations along with related explanations:

- 1. What you complete in Chapter I for income from independent activities in the real system 4:20

- 2. What do you fill in if you have income from copyright 7:24

- 3. How do you complete if you have rental income 10:04

- 4. How to top up for income from stock market gain 13:10

- 5. How to top up if you have cryptocurrency income

- 6. How to fill in for the tourist rental of the rooms in the personal home 15:52

- 7. How to fill in the statement of income from abroad 18:07

- 8. How to fill in for CAS and CASS on self-employment income in 2023 19:42

- 9. PFA that has income above the CAS and CASS cap in 2023 and rents above the 24 salary cap. How does 47:45 complete

- 10. Rent in foreign currency – 2023, exchange rate adjustment – with income above the CASS ceiling, and the average BNR exchange rate is 4.9465 lei/euro, the income being above the CASS ceiling. How to complete the Single Declaration 2024 53:39

- 11. Income from investments and the stock market, dividends, interests from Romania above the CASS ceiling. How to complete 57:00

- 12. Income from foreign stock market investments above the CASS ceiling. Complement pattern 58:35

- 13. A natural person has independent activities in the real system, but in addition to that he also has dividends from abroad. Last year it estimated below the ceiling. How do they complete? 1:00.12

- 14. Rent in lei, with an individual tenant, with income above the CASS ceiling 1:03:00

- 15. Income norm for 9 months from 2024, being above the CAS ceiling – CASS 1:04:40

- 16. Cryptocurrency revenue over the cap in 2023 1:06:24

- 17. Lawyer who is an associate in a law firm. In 2023 he has income above the CASS ceiling / In 2023 he has below the ceiling of 60 salaries 1:08:00

- 18. Income from the rental for tourist purposes of rooms in houses between 1 and 5 rooms 1:13:00

- 19. A natural person has no income, but opts for CASS to be insured for health. How does it complete 1:14:28

- 20. How to complete for income from agricultural activities in 2024 at income rate 1:16:00

- 21. A person estimated less than 6 salaries (18,000 lei), but achieved more than 12 salaries (36,000). What he has to do 1:19:09

- 22. An authorized natural person (PFA) estimated below 6 wages, but achieved between 6 and 12 minimum wages. How does it complete 1:20:00

- 23. A PFA estimates 6 salaries but has realized between 12 and 24 salaries. How does it complete 1:22:40

- 24: PFA estimated 6 salaries but achieved over 24 salaries. Fill-in model 1:24:10

- 25. PFA estimated 6 salaries, realized below 6 salaries and was not salaried in 2023. What is happening? 1:25:00

- 26. A person estimates less than 6 salaries in 2024. What happens and how to complete the Single Declaration 1:26:00

- 27. A person estimates for 2024 an income between 6 and 12 salaries. How does it complete 1:28:17

- 28. Do you estimate an income between 12 and 24 salaries? What are you filling in 1:29:04

- 29. A person estimates income over 24 salaries. Fill-in model 1:30:16

- 30. Someone starts the activity in 2024 (he has a real system) and has an estimated annual income of 80,000 lei. How does the Single Statement 1:31:20 complete

- 31. How to complete for 2024 at the income rate if the activity starts on March 1, 2024, at an annual rate of 84,000 lei 1:32:26

What minimum salary is taken into account for the payment of contributions

The minimum salary taken into account in 2024 for the income related to 2023 is 3,000 lei (even if during the year the minimum salary was increased to 3,300 lei, something even confirmed by ANAF). So, as you will also see in the Single Statement, for the payment of health and pension contributions there will be ceilings below.

For CASS payment:

• 18.000 lei

• 36.000 lei

• 72.000 lei

For CAS payment:

• 36.000 lei

• 72.000 lei

In conclusion:

If you have income between 18,000 – 36,000 lei/year, then CAS is zero (it’s optional), but you have to pay CASS of 1,800 lei

If you have income between 36,000 – 72,000 lei/year, then the CAS is 9,000 lei, and the CASS of 3,600 lei

If you have income higher than 72,000 lei/year, then CAS is 18,000 lei, and CASS 7,200 lei

(Obviously, for what is below 6 minimum wages, only income tax is paid).

Income tax remains the same: 10%

What minimum salary is taken into account for the income related to 2024

The minimum salary that is taken into account for the income from 2024 is 3,300 lei. A number of things have come into play regarding the caps, payments you will make in 2025 until May 25.

Income tax remained the same: 10%.

With regard to CASS, 10% of the earned income or the income norm will be paid and it will be capped at 60 minimum wages.

Thus, the CASS will be calculated on a basis of calculation that cannot be higher than 60 salaries to the net income, respectively the annual rate of income, respectively the adjusted annual rate of income.

So, the ceiling is between 6-60 salaries, i.e. between 19,800-198,000 lei.

If the base achieved is less than 6 minimum wages, then PFA will owe a difference in CASS contribution up to a base of 6 minimum wages.

Exempted from this CASS difference are those PFAs that have income from:

• salaries and salary equivalents at a level at least equal to 6 minimum gross salaries per country, in force during the period in which the incomes were made;

• rents, dividends, interest, stock exchange, crypto, other sources for which they owe the social health insurance contribution at a level at least equal to 6 gross minimum salaries per country.

Another novelty is related to the separate division of income

As the tax consultant Cornel Grama also drew attention to, if a PFA has income from independent activities of more than 60 salaries (210,000 lei) and from (dividends or rents or the stock market, crypto, etc.) more than 24 minimum salaries, he will end up paying CASS at 84 minimum wages (so at incomes of 294,000 lei).

“There is no provision that says that if you pay as PFA at 24 salaries to the other incomes (dividends, rents, stock exchange, interests) you are exempt because you have already “contributed” to 24 salaries. What’s more, you paid for… 60 salaries! Income from self-employment is no longer cumulated with the other income categories for the 6/12/24 salary ceilings as before. They are treated separately”, says Grama.

Another change, introduced recently, concerns income from rents, dividends or bank interest that natural persons receive. Basically, if someone has income below 6 minimum wages, then they will pay CASS of 10% on that ceiling, if they are not employed or have income from self-employment.

You will pay CASS if you estimate in the Single Statement income of more than 6 minimum wages and you have made less.

The CAS (pension) ceilings remain as before.

IMPORTANT: Those who were on the income norm must know that the ceiling has been changed. It is no longer 100,000 euros, but 25,000 euros. So, if you exceeded 25,000 euros this year, from 2024 you will switch to the real system.

1711728093

#VIDEO #TUTORIAL #complete #Single #Declaration