2023-05-23 06:02:49

[이데일리 유재희 기자] The share price of Draft Kings (DKNG), an online casino and sports betting platform operator in the United States, has soared 120% this year, and is expected to rise further. This is because the growth potential is great depending on the penetration of new markets.

|

|

According to American economic media outlets CNBC and Barron’s on the 22nd (local time), Robin Farley, an analyst at UBS, raised his investment opinion on Draft Kings from ‘Neutral’ to ‘Buy’ and raised his target price to $30 from $19 previously. raised by 58%. On this day, Draft Kings stock price closed at $25.22, up 4.6% from the previous day, once more breaking a 52-week high. According to Robin Farley’s analysis, it means that it can rise by 20% in the future.

Draft Kings broke through the $70 mark in March 2021 with the benefit of the Corona 19 pandemic, but it also fell below $10 in May last year with Endemic. However, this year, it is showing an increase of 120% due to the overperception of the decline and expectations for growth. In particular, on the 5th, Draft Kings announced its first quarter results and raised its annual guidance, showing confidence in growth. This is because the trend of improvement is becoming clear, with monthly active users and sales per player increasing by mid to high 30%, respectively.

|

Draft Kings is an online sports betting and online casino platform operator founded in 2011. In particular, it ranks first with a 30% share of the US sports betting market. Draft Kings is showing steep sales growth. After growing 110% in 2021, it showed a growth rate of 73% last year, and sales growth of 40% this year is expected. In 2018, the US federal government’s sports betting ban was ruled ‘unconstitutional’. As a result of this ruling, sports betting is now allowed in 33 of the 50 states in the United States. Six states have allowed online casinos. The allowed area is increasing every year.

Robin Farley noted that new state expansion is accelerating. “DraftKings currently operates a sports betting or online casino service in 23 states, and the market is expanding faster,” he said. Achieving sales is also a factor that raises expectations for growth.”

Robin Farley raised his earnings estimates to reflect this growth momentum and Draft Kings’ earnings guidance. This is the basis for raising the target price significantly.

He raised Draft Kings’ revenue forecast for this year from $2.91 billion to $3.19 billion. Robin Farley predicts that the company will grow compound sales at a CAGR of 20% through 2026. “Gross margin is expected to rise by 0.5 percentage points from the previous year to 39.3% this year and break through 40% next year,” he said.

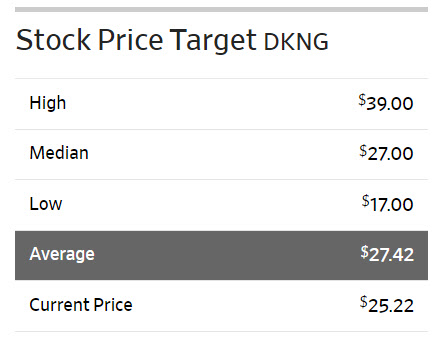

Meanwhile, Wall Street opinions on Draft Kings are somewhat mixed. Only 19 out of 34 analysts (56%) maintain a buy opinion (including overweight and outperform the market).

The upper target price is $39 and the lower price target is $17. The average target price is $27.42, which is 9% higher than the closing price on the day.

|

1684823193

#Video #Draft #Kings #surged #year..