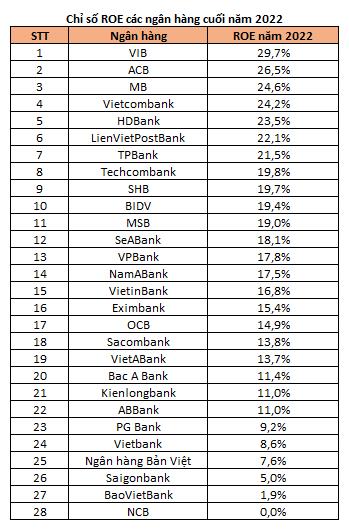

According to statistics from the 2022 consolidated financial statements of 28 banks, the return on equity (ROE) index of most banks last year recorded an increase compared to the previous year.

Specifically, the overall ROE ratio of banks is at 19.8% in 2022, an increase of 1.6 percentage points compared to the previous year. In which, the top 10 banks with the highest ROE include VIB, ACB, MB, Vietcombank, HDBank, TPBank, LienVietPostBank, SHB, Techcombank and BIDV.

Source: Compiled from financial statements of banks

VIB topped the table with ROE of 29.7%. In 2022, the bank’s profit following tax increased by 32% compared to the previous year, reaching VND 8,468 billion while equity increased by 34% from VND 24,290 billion to VND 32,651 billion.

Explaining the profit growth and ROE during the period, VIB said that the bank achieved a net profit margin (NIM) of 4.5% thanks to its retail-focused strategy and stable medium and long-term deposits. Total banking revenue grew 21%, higher than the 17% growth rate in operating expenses.

In the next two positions are ACB and MB with ROE of 26.5% and 24.6% respectively. Profits of both banks have grown strongly in the past year with an increase of 43% (ACB) and 38% (MB) respectively compared to 2021.

In the group of state-owned banks, Vietcombank and BIDV are the two banks in the top 10 with ROE of 24.2% and 19.4%, respectively. Vietcombank is the most profitable bank in the system, while BIDV recorded a strong growth in profit following tax of 70% compared to 2021, reaching more than VND 18,000 billion.

Source: Compiled from financial statements of banks

The other bank is VietinBank with ROE of 16.8%, modestly ranked 15th.

The banks with the lowest ROE on the list include Viet Capital Bank (1.7%); Saigonbank (5%), BaoVietBank (1.9%) and NCB.

Eximbank is the bank with the highest ROE increase compared to the previous year among the listed banks. Thanks to the pre-tax profit nearly tripled compared to 2021, from more than 1,000 billion VND to nearly 3,000 billion VND, Eximbank’s ROE has increased from 5.9% to 15.4% in 2022.

ROE (Return on Equity) or return on equity is a measure of how much profit a shareholder spends and accumulates. The higher the ROE ratio, the more efficient the company uses the shareholder’s capital, which means that the company balances the shareholders’ capital harmoniously with the borrowed capital.