Against the backdrop of a decrease in the rate of return on deposits, over 2.2 billion UST were withdrawn from the Anchor protocol in less than two days. Due to the incident, the algorithmic stablecoin of the Terra ecosystem briefly lost its peg to the US dollar.

At the moment on May 8, the asset was trading near $0.98, according to CoinGecko.

In March the Anchor community voted for the offer, according to which the rate on deposits can change by a maximum of 1.5%, depending on the volume of the yield reserve (yield reserve).

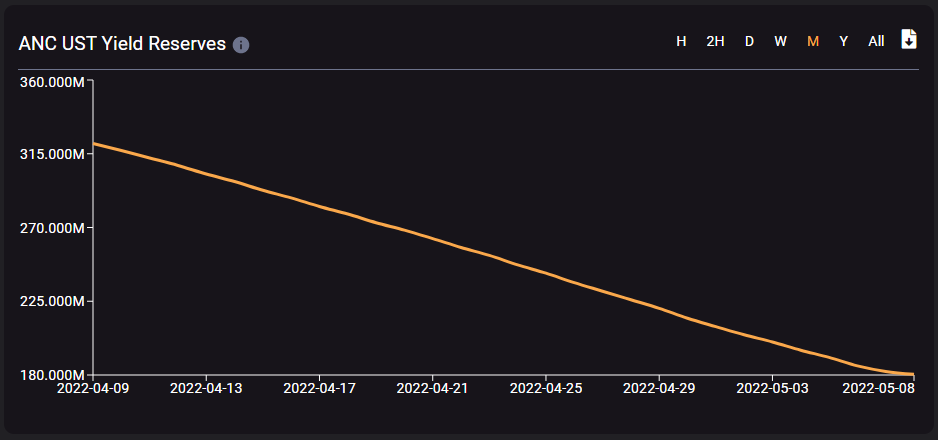

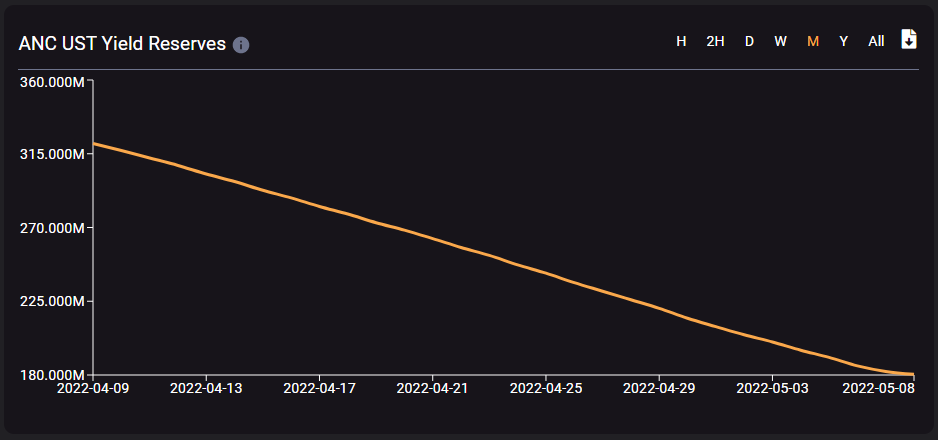

According to SmartStakeover the past month, the volume of project reserves decreased by almost 44%, to 180.45 UST.

Similar incidents have already happened to Anchor in the past – in February 2022, the protocol reserve was almost completely depleted. To prevent collapse, the non-profit organization Luna Foundation Guard (LFG) transferred to the project 450 million UST.

However, this time there was no capital injection. In early May, the interest rate on deposits at Anchor for the first time has been reduced before 18%. Now its value is even lower – 17.87%.

Because of this, users began to massively withdraw assets from the protocol. On May 7, Anchor’s deposits exceeded 14 billion UST – at the time of writing, the figure is 11.77 billion UST (-16%).

The team at decentralized exchange Curve Finance also confirmed that “someone started selling en masse” on UST on May 7, causing the stablecoin to briefly lose its peg to the US dollar. The developers noted that these actions “faced a lot of resistance” in the form of counter sales of ETH and stETH.

News of Curve Wars ????⚔️

Yesterday, someone started selling UST en masse, so it started to depeg. However, that was met with a great resistance, so the peg was restored. To get enough USD for that, a lot of ETH and stETH were sold also.

Aftermath? High Curve trading vol (>uni3) pic.twitter.com/ZChdZiVzcK

— Curve Finance (@CurveFinance) May 8, 2022

For example, the acquisition of UST was announced by Tron founder Justin Sun, who called the move his “secret plan.” According to Etherscanhe purchased regarding 1 million UST using USD Coin (USDC) to buy.

I am buying #UST. ????

— H.E. Justin Sun ???????????????? (@justinsuntron) May 8, 2022

Previously on the Tron network launched algorithmic stablecoin USDD, whose collateral model is similar to that used in the Terra ecosystem.

The mechanism for ensuring the sustainability of UST relies heavily on arbitrageurs, so the decline in Anchor’s yield negatively affected the motivation of the latter to maintain the parity of the stablecoin with the US dollar.

In March 2022 LFG established a reserve bitcoin fund, which should promptly provide the liquidity in BTC necessary to maintain a stable price of UST. In May, the volume of assets under his management has reached 80 394 BTC.

Some felt that the loss of UST’s peg to the US dollar might lead to the liquidation of some of the fund’s assets. For example, this was announced by the head of the trading company Thanefield Capital under the nickname resonancethis.

If Jump doesn’t defend this soon then there’s going to be an incoming $3.5B market sell for BTC

FWIW I think the buy execution on that $3.5B was poor — insiders frontrunning/public knowledge etc

The reverse flow might therefore have a disproportionate impact

— Resonance (@resonancethis) May 7, 2022

In the comments, users noted that the LFG fund does not automatically sell assets, so you should not expect an avalanche of Bitcoin market sales.

point is there is no automatic «market sell» trigger — UST needs to be sold to redeem the BTC — the BTC is then sold to buy UST to maintain the peg but this doesn’t just happen instantaneously all at once.

— | Coach | (@coachpoppavic) May 7, 2022

Polygon project security manager Mudit Gupta noted that the UST incident was accompanied by a number of suspicious transactions.

According to him, on May 7, Terraform Labs deleted 150 million UST liquidity with Curve, followed by an unknown newly created address translated over 84 million UST to the Ethereum network. A few minutes later, ETH was dumped, which caused the sell-off, Gupta noted.

Shortly therefollowing, the company brought out additional 100 million UST with Curve.

When the stablecoin began to decline, an unknown market participant started selling ETH and buying UST. The latter traded below the anchor level, allowing for a profit.

— Terraform Labs removed another $100m of UST liquidity from Curve soon following

— As UST started to depeg, an unknown actor started dumping ETH and buying UST ($100m+)

— As UST was trading below peg, they made a profit all while avoiding bad optics around dumping Ether— Mudit Gupta (@Mudit__Gupta) May 8, 2022

Terraform Labs founder Do Kwon explained that the company has withdrawn 150 million UST from Curve in preparation for the launch of the 4pool pool, which is scheduled for next week. After that, she withdrew another 100 million UST in order to “reduce the imbalance.”

Kwon emphasized that Terraform Labs was not involved in the 84 million UST operation. He also added that the company has no incentive to unlink the stablecoin from the US dollar.

And not sure what possible profit would have been gained even if we tried — 50bp spread on UST while luna giganuked?

— Do Kwon ???? (@stablekwon) May 8, 2022

For more on how Anchor’s problems might impact Terra’s economy, ForkLog wrote in a recent exclusive:

Recall that Tether CTO Paolo Ardoino warned that Algorithmic high-cap stablecoins are dangerous for the market.

Subscribe to ForkLog news in Telegram: ForkLog Feed – the entire news feed, ForkLog — the most important news, infographics and opinions.

Found a mistake in the text? Select it and press CTRL+ENTER