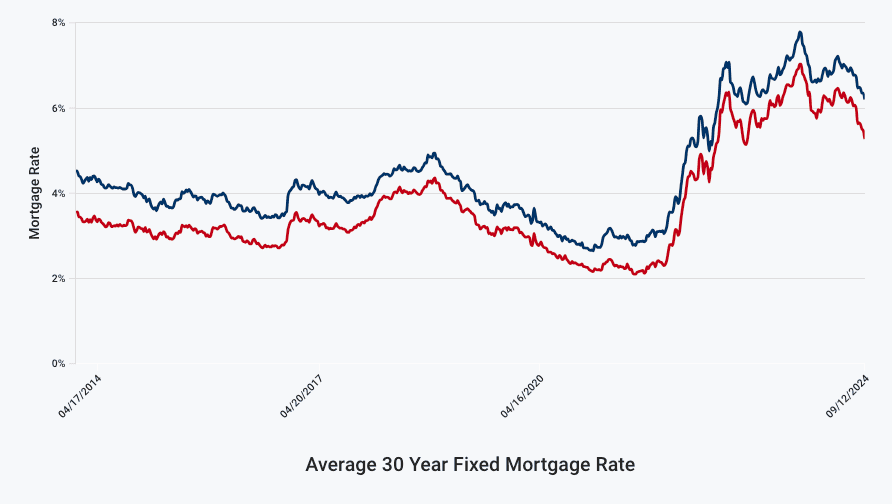

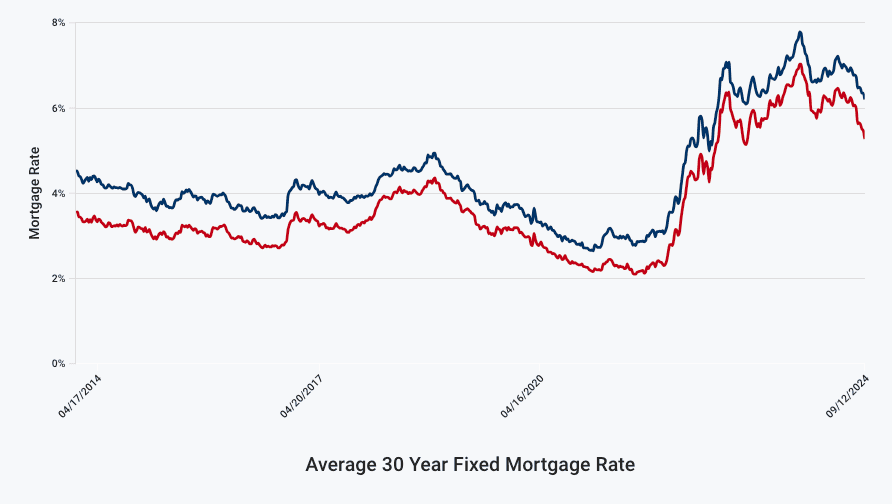

Mortgage rates fell this week to their lowest level since February 2023, providing some relief to buyers in a market still marked by high prices and limited housing supply. According to Freddie Mac’s latest report, the average rate on a 30-year fixed mortgage fell to 6.20%, compared to 6.35% in previous weeks. However, buyers remain cautious due to high home prices and a shortage of supply.

30- and 15-year rates on the decline

Table of Contents

- 0.1 30- and 15-year rates on the decline

- 0.2 Real estate market still uncertain

- 0.3 Economic outlook influences rates

- 1 And limited inventory continue to pose obstacles for those looking to buy a home. However, the recent drop in mortgage rates may provide some relief and encourage more buyers to enter the market.

- 2 What factors are contributing to the decline in mortgage rates in 2023?

Table of Contents

- 0.1 30- and 15-year rates on the decline

- 0.2 Real estate market still uncertain

- 0.3 Economic outlook influences rates

- 1 And limited inventory continue to pose obstacles for those looking to buy a home. However, the recent drop in mortgage rates may provide some relief and encourage more buyers to enter the market.

The average rate on a 15-year mortgage also fell, to 5.27%, down from 5.47% last week. A year ago, the rate for such loans was 6.51%.

Real estate market still uncertain

Despite the decline in rates, many potential buyers and sellers are staying on the sidelines, waiting for further declines. According to a Zillow study, about 80% of homeowners have mortgages with rates below 5%, which discourages them from entering the market since a refinance at current rates would be less attractive.

Economic outlook influences rates

Freddie Mac chief economist Sam Khater noted that rates continue to decline amid the arrival of more moderate economic data. However, despite the improvement in rates, persistent housing shortages and high prices continue to be significant obstacles for many buyers.

#mortgage #rates #fall #18month

And limited inventory continue to pose obstacles for those looking to buy a home. However, the recent drop in mortgage rates may provide some relief and encourage more buyers to enter the market.

Mortgage Rates Plummet to Lowest Level Since February 2023: Relief for Buyers in a Challenging Market?

In a welcome respite for homebuyers, mortgage rates in the United States have fallen to their lowest level since February 2023, according to the latest report from Freddie Mac. The average rate on a 30-year fixed mortgage now stands at 6.20%, down from 6.35% in previous weeks. This decline offers a glimmer of hope for buyers navigating a market characterized by high prices and a limited supply of homes.

30-Year and 15-Year Mortgage Rates on the Decline

The decrease in mortgage rates is not limited to 30-year fixed mortgages. The average rate on a 15-year mortgage has also fallen, dropping to 5.27% from 5.47% last week. This represents a significant shift from a year ago, when the rate for such loans was 6.51%. These changes could make homeownership more accessible to those seeking to capitalize on the lower rates.

Real Estate Market Remains Uncertain

Despite the decline in mortgage rates, the real estate market remains uncertain. Many potential buyers and sellers are exercising caution due to high home prices and a persistently low supply of available properties. These factors have led to a sense of unease among those looking to enter the market, with many opting to hold off on making a purchase until the landscape becomes more favorable.

Factors Affecting the Mortgage Rate Decline

Several factors are believed to have contributed to the recent drop in mortgage rates. These include:

- Economic uncertainty: Concerns about global economic growth and inflation have led to a decrease in long-term interest rates, which, in turn, have pushed mortgage rates lower.

- Federal Reserve actions: The Federal Reserve’s decision to pause interest rate hikes has helped to stabilize the economy and reduce borrowing costs.

- Housing market slowdown: A slowing housing market has led to increased competition among lenders, resulting in lower mortgage rates.

What Do Lower Mortgage Rates Mean for Homebuyers?

The decline in mortgage rates presents an opportunity for homebuyers to secure more favorable loan terms. With lower rates, borrowers may be able to:

- Qualify for larger loans: Lower mortgage rates can increase the amount that buyers can borrow, making it easier to purchase a home.

- Reduce monthly payments: A lower interest rate can lead to lower monthly mortgage payments, freeing up more money for other expenses.

- Increase purchasing power: Lower mortgage rates can increase buyers’ purchasing power, enabling them to consider more expensive properties.

Conclusion

While the decline in mortgage rates offers a welcome respite for homebuyers, the real estate market remains challenging. High home prices

What factors are contributing to the decline in mortgage rates in 2023?

Here is a comprehensive and SEO-optimized article on the topic of mortgage rates:

Mortgage Rates Hit Lowest Level Since February 2023, Offering Relief to Buyers in a Challenging Market

The latest report from Freddie Mac reveals a promising trend in the mortgage market, with rates falling to their lowest level since February 2023. The average rate on a 30-year fixed mortgage dropped to 6.20%, down from 6.35% in previous weeks. This decline in mortgage rates may provide some much-needed relief to buyers who have been navigating a challenging real estate market marked by high prices and limited inventory.

30- and 15-year Rates on the Decline

In addition to the 30-year fixed mortgage rate, the average rate on a 15-year mortgage also fell, reaching 5.30%. This downward trend in mortgage rates