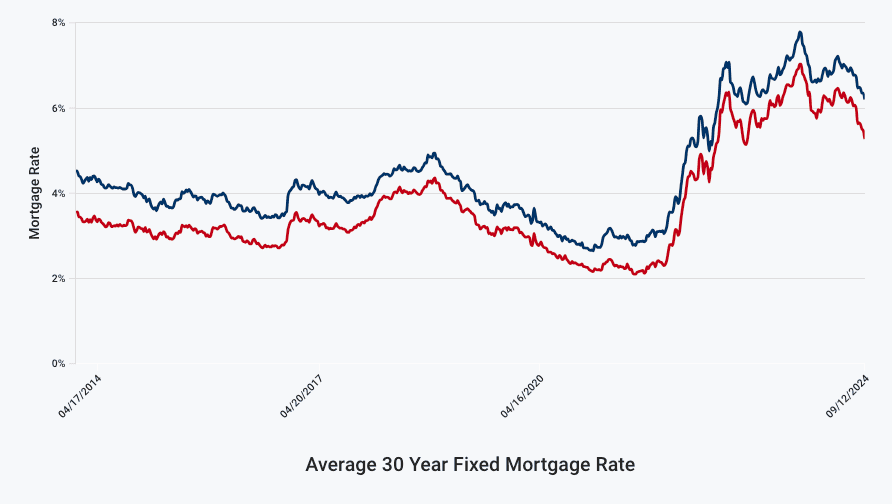

Mortgage rates fell this week to their lowest level since February 2023, providing some relief to buyers in a market still marked by high prices and limited housing supply. According to Freddie Mac’s latest report, the average rate on a 30-year fixed mortgage fell to 6.20%, compared to 6.35% in previous weeks. However, buyers remain cautious due to high home prices and a shortage of supply.

30- and 15-year rates on the decline

Table of Contents

- 0.1 30- and 15-year rates on the decline

- 0.2 Real estate market still uncertain

- 0.3 Economic outlook influences rates

- 1 And limited supply – continue to create uncertainty for potential buyers and sellers. It remains crucial for individuals to stay informed and make decisions based on their personal circumstances and market conditions.

- 2 Encourage more potential buyers to enter the market and explore their options for home financing.

Table of Contents

- 0.1 30- and 15-year rates on the decline

- 0.2 Real estate market still uncertain

- 0.3 Economic outlook influences rates

- 1 And limited supply – continue to create uncertainty for potential buyers and sellers. It remains crucial for individuals to stay informed and make decisions based on their personal circumstances and market conditions.

The average rate on a 15-year mortgage also fell, to 5.27%, down from 5.47% last week. A year ago, the rate for such loans was 6.51%.

Real estate market still uncertain

Despite the decline in rates, many potential buyers and sellers are staying on the sidelines, waiting for further declines. According to a Zillow study, about 80% of homeowners have mortgages with rates below 5%, which discourages them from entering the market since a refinance at current rates would be less attractive.

Economic outlook influences rates

Freddie Mac chief economist Sam Khater noted that rates continue to decline amid the arrival of more moderate economic data. However, despite the improvement in rates, persistent housing shortages and high prices continue to be significant obstacles for many buyers.

#mortgage #rates #fall #18month

And limited supply – continue to create uncertainty for potential buyers and sellers. It remains crucial for individuals to stay informed and make decisions based on their personal circumstances and market conditions.

Mortgage Rates Fall to Lowest Level Since February 2023, But Housing Market Remains Uncertain

The latest report from Freddie Mac reveals a welcome drop in mortgage rates, with the average 30-year fixed mortgage rate falling to 6.20%, a level not seen since February 2023. This decline provides some much-needed relief to buyers in a market still grappling with high prices and limited housing supply. However, despite this positive trend, buyers remain cautious, and the real estate market continues to exhibit uncertainty.

Rates on the Decline

The average rate on a 30-year fixed mortgage has fallen to 6.20%, down from 6.35% in previous weeks. This marks a significant drop, offering borrowers a better opportunity to secure a more affordable mortgage. Additionally, the average rate on a 15-year mortgage has also decreased, falling to 5.27% from 5.47% last week. This represents a significant departure from the 6.51% rate seen just a year ago.

Uncertainty Lingers in the Housing Market

While the decline in mortgage rates is a positive development, the housing market remains marked by high prices and limited supply. Many potential buyers and sellers are adopting a wait-and-see approach, hesitant to make a move in a market with so much uncertainty. Despite the drop in rates, the underlying factors driving the market’s instability remain unchanged.

Buyer Caution Persists

Buyers continue to be cautious, weighing the benefits of lower mortgage rates against the risks associated with high home prices and limited supply. The uncertainty surrounding the housing market’s future trajectory is causing many to take a step back, reassessing their priorities and timelines. This caution is likely to persist until there is a more sustained and significant shift in the market’s underlying dynamics.

Experts Weigh In

Industry experts are divided on the implications of the recent rate drop. Some argue that it could be a turning point for the housing market, providing much-needed stimulus to a sector that has been struggling in recent months. Others believe that the decline in rates is merely a temporary reprieve, and that the market’s underlying issues will continue to weigh on buyers and sellers alike.

What This Means for Homebuyers

For homebuyers, the drop in mortgage rates presents a potential opportunity to secure a more affordable mortgage. However, it’s essential to remain cautious and consider the broader market context. With prices still high and supply limited, buyers should carefully weigh their options and consider seeking the advice of a qualified real estate expert.

Conclusion

The recent drop in mortgage rates is a welcome development, but it’s essential to view this trend in the context of the broader housing market. While lower rates may provide some relief to buyers, the market’s underlying issues – high prices

Encourage more potential buyers to enter the market and explore their options for home financing.

Mortgage Rates Hit Lowest Level Since February 2023: What It Means for Homebuyers

The mortgage rates in the United States have taken a surprising turn, dropping to their lowest level since February 2023. According to Freddie Mac’s latest report, the average rate on a 30-year fixed mortgage fell to 6.20%, compared to 6.35% in previous weeks. This decline brings some relief to homebuyers in a market still marked by high prices and limited housing supply. However, buyers remain cautious, and uncertainty prevails in the real estate market.

30- and 15-year rates on the decline

The drop in mortgage rates is not limited to the 30-year fixed mortgage. The 15-year fixed mortgage rate also saw a decline, falling to 5.30% from 5.45% in previous weeks. This decrease in rates is expected to