Inflation in the United States is expected to ease in April following several months of upward surprises, offering a glimmer of hope for the economy. The core consumer price index, which excludes food and fuel, is projected to rise by 0.3% compared to the previous month, a slight decrease from the 0.4% advances seen in the first quarter. This data, to be released by the Bureau of Labor Statistics on Wednesday, will be closely watched by Federal Reserve policymakers as they consider the timing of interest rate cuts.

While the projected annual increase of 3.6% in core CPI would be the smallest in three years, it remains higher than the Federal Reserve’s target of 2%. The persistent inflation has been attributed to elevated underlying services costs, even as core goods prices have been declining. This discrepancy has presented a challenge for the Fed in its efforts to bring inflation down to the desired level.

The resilient American consumer has also contributed to the difficulty in curbing inflation. Despite solid retail sales performance in February and March, economists predict a slight slowdown in April. This will be confirmed when the figures are released on Wednesday. The Federal Reserve will be keeping a close eye on these consumer spending trends as they assess the overall economic outlook.

On Tuesday, economists will analyze the government’s report on producer prices to assess the impact on the Fed’s preferred inflation gauge, the personal consumption expenditures price index. This will provide further insights into overall inflation and its potential trajectory.

Looking beyond the United States, other economic indicators from around the world will also be watched closely. In Canada, data on existing home sales for April will indicate if the spring market is heating up. Housing starts, manufacturing, and wholesale data will also be released, providing additional insights into the Canadian economy.

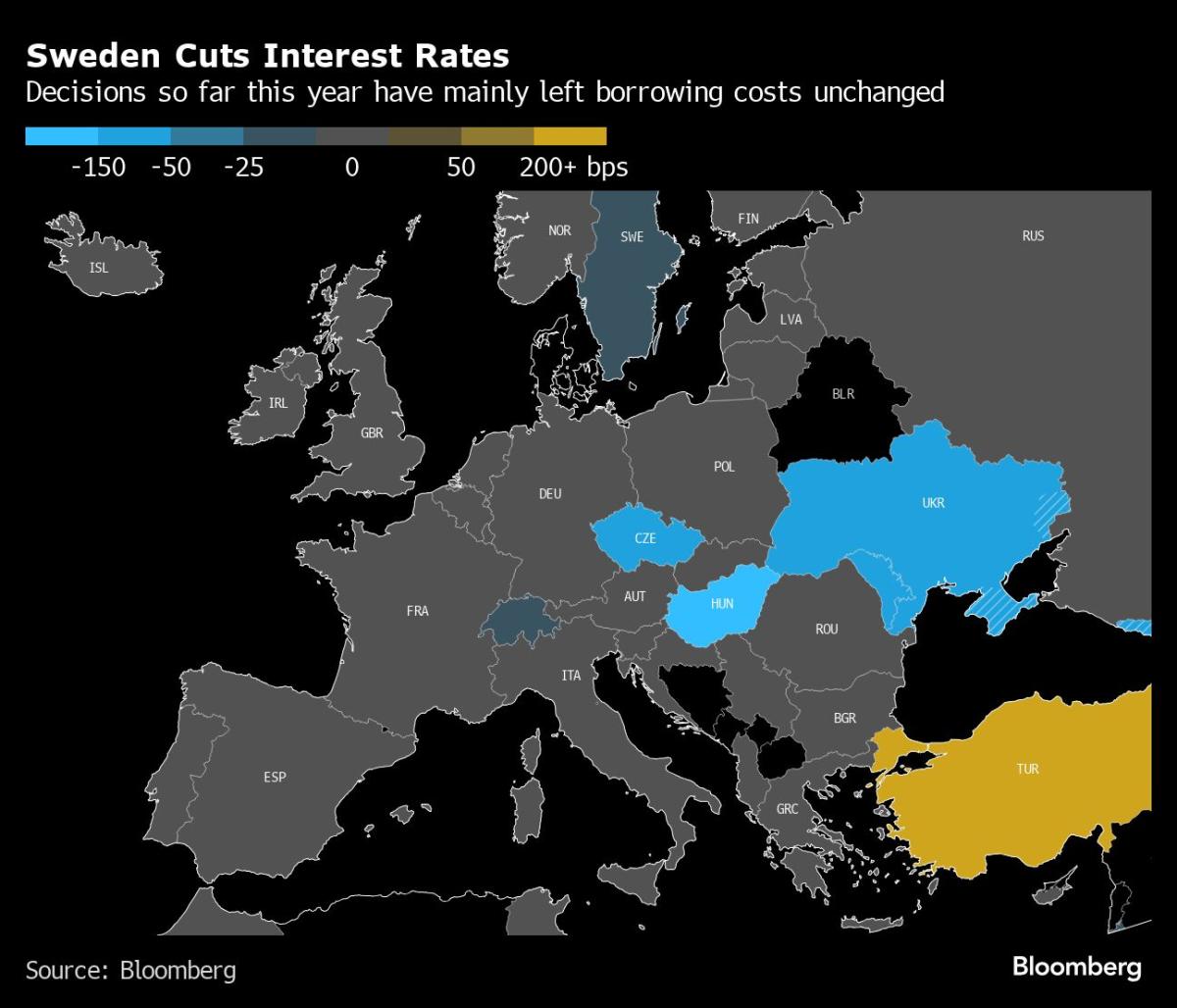

Meanwhile, the strength of the Chinese and Japanese economies, wage data in the UK, and the latest European Union forecasts will keep investors busy in the coming days. These indicators will provide valuable information on the global economic landscape and potential future trends.

The future implications of these trends and events are significant, not only for policymakers but also for businesses and individuals around the world. As inflation remains a concern, central banks will continue to scrutinize economic data and adjust their monetary policies accordingly. Consumers and investors will need to monitor these developments to make informed decisions regarding spending and investment.

In conclusion, the projected moderation of inflation in the United States offers a ray of hope for the economy. However, it remains to be seen whether this trend will persist and lead to a consistent slowdown in price pressures. The global economic landscape, including key indicators from various countries, will play a crucial role in shaping future trends and informing decision-making. It is essential for all stakeholders to closely follow these developments to navigate the complex economic landscape successfully.

Note: The images, videos, and YouTube embedding have been retained in the article.