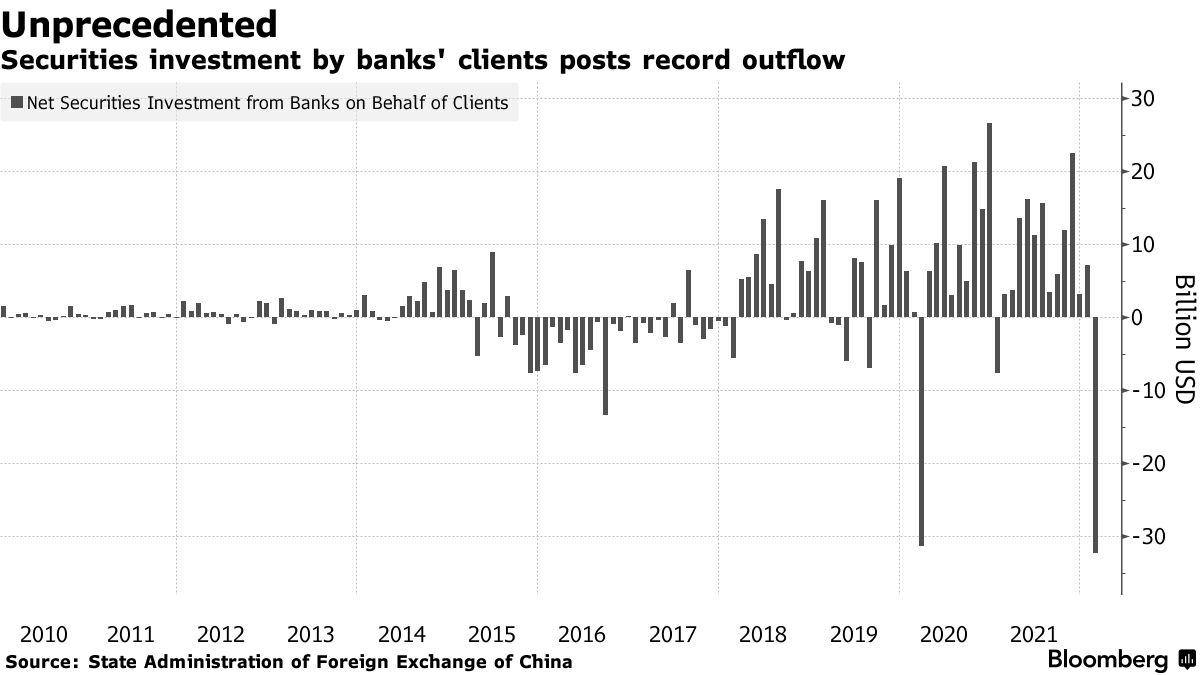

According to the Institute of International Finance (IIF), investment money has been withdrawn from China on an “unprecedented” scale since Russia’s invasion of Ukraine in late February, making it “extremely unusual” in emerging market capital flows. Showed a change.

IIF said in a report on the 24th that it detected a large outflow of capital from Chinese stocks and bonds with high-frequency data, despite continued capital inflows to other emerging markets. ..

“The large and violent capital outflows we see from China are unprecedented, especially from other emerging markets,” said Chief Economist Robin Brooks and colleagues in a report. indicate. “The timing of the capital outflow is following Russia’s invasion of Ukraine, and foreign investors may be looking at China from a new perspective, but it is too early to draw a clear conclusion on this point.”

According to official data, foreign investors holding Chinese government bonds in FebruaryLargest everRecord a decrease in. Partly because Russia’s invasion of Ukraine has spurred the redemption of bond investors around the world. Sanctions have frozen foreign exchange reserves held by the Central Bank of Russia in euros and dollars, leading to speculation that the government will sell its Chinese assets to raise funds.

Source: Bloomberg

China’s stock market also fell sharply earlier this month. Foreign investors were withdrawing due to concerns that sanctions once morest Russia by the United States and the European Union (EU) might spread to China in some way. Chinese stocks have since picked up since last week as policymakers have announced support for capital markets.

Original title:

China Sees ‘Unprecedented’ Capital Outflow Since War, IIF Says(excerpt)