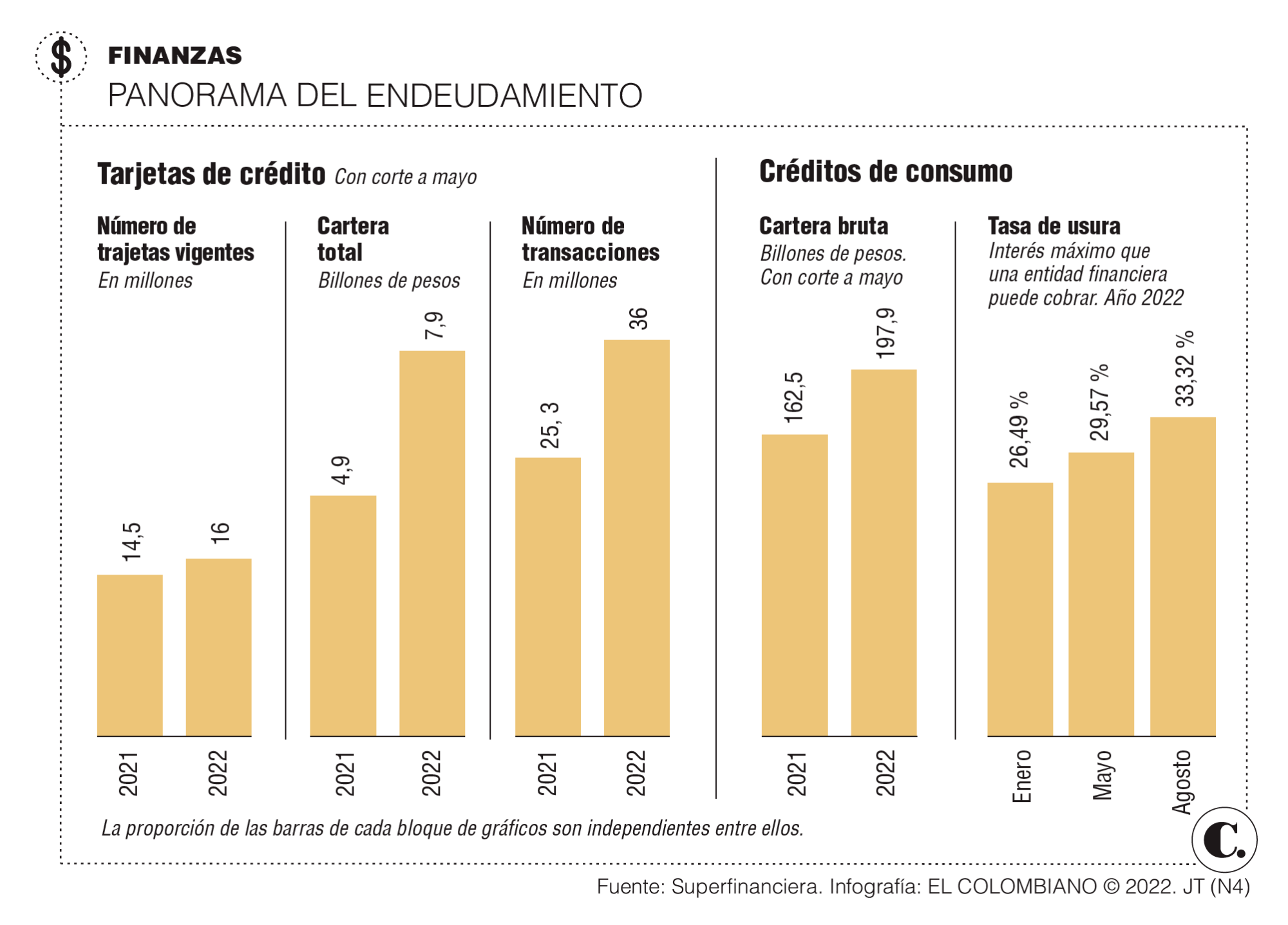

Credit card purchases are growing at a dizzying pace in Colombia. And according to data from the Financial Superintendence, as of May, the total debt with them amounted to $7.9 billion, 45% higher when compared to the same month last year.

In this context, Jorge Castaño, financial superintendent, expressed his concern and pointed out that the portfolio of credit institutions is growing, “but it is growing in ways that are not the most reasonable at this juncture.”

The official noted that while a few years ago some users fell into arrears 11 or 12 months following taking the debt, now they do so in periods of 90 days.

“toxic” debt

Jaime Jaramillo, advisor and co-founder of Finanzas Emocionales, stressed that the superintendent’s concern is that the debt with the bank grows in credit segments such as consumption, in which resources are allocated to trips or goods that are not durable.

He recalled that as a result of the pandemic, the Banco de la República lowered interest rates to historical lows with the aim of stimulating private consumption. However, the situation has changed a lot since 2020 and now Colombians face a high cost of living. And to control this situation, the interest paid on loans is increasing.

According to Jaramillo, curbing the high prices that consumers are paying requires curbing spending and that leads to an economic slowdown. From his perspective, under this scenario the risk of non-payment to financial entities would increase.

Experts have argued that if the banks do not recover the money from the loans, a “domino effect” crisis can be generated, like the 2008 mortgage crisis in the United States.

“A credit card and consumer crisis would be more serious than the one in 2008 in the US, because there the banks had the properties as collateral. Instead here: What might seize? In addition, when banks are under threat of bankruptcy, they are often rescued by governments with taxpayers’ money, ”said the Emotional Finance advisor.

Call to Prudence

In the opinion of Alfredo Barragán, a banking expert, “if we are on the verge of an economic contraction, we have to be more cautious”. And it is that from the perspective of several experts consulted, there has been a lack of caution considering that the quota of current cards in the country went from $62 billion to $100 billion between 2019 and so far in 2022.

Wilson Triana, financial consultant, emphasized that “credit cards are an easily accessible product with attractive quotas that in certain cases may be above the possibilities that many households have of dealing with high debt”

“Its use —he added— must be moderate, much more so if one takes into account that, with all the banking tactics, at any moment people are exposed to filling their pockets with more than one”.

No risk yet?

Hernando José Gómez, president of Asobancaria, maintained that “households are not over-indebted and at this time the figures are between 30% and 32% in the debt burden. Normally, we are only considered to enter a danger zone when we are at 40%.”

However, he agreed with the financial superintendent and recognized that the pace of granting loans must be slowed down “so that we are in no way going to cross that threshold of 40%, which is the maximum reasonable.”

“It is time to start moderating the growth of the portfolio, especially the consumer portfolio, that is the message that the Banco de la República has sent us, which has increased its rates from 1.75% to 9%; that is a message from the bank saying: moderate credit”, commented the union chief.

Gómez indicated that with the adjustment in disbursements, most likely these consumer loans “will converge towards the general growth rate, which will be around 12% this year.”

Who can, save

Jaime Jaramillo explained that the economic slowdown is an ever closer reality due to the high interest rates that curb spending and reduce the generation of wealth.

“When there is a recession everything becomes cheaper, so who wins in a recession? The one who has money saved and on hand to buy. In the mortgage crisis of 2008, those who had saved money won when the houses worth a million dollars were negotiated at US$300,000, the recommendation at this time is to try to save,” he pointed out.

45%

annual increase in May total debt with credit cards in Colombia.