2023-04-30 16:37:44

Inflation has been one of the main concerns of the global economy in recent quarters. It was particularly pronounced at the level of advanced economies.

This led to the sharpest round of monetary policy tightening in decades. But headline inflation rates have come down from their peaks last year, and inflationary fears have eased. While the European Central Bank (ECB) and the US Federal Reserve (Fed) are still likely to raise their key rates, investors and analysts are now trying to understand when the monetary authorities will switch, i.e. interrupt the cycle of raising rates and maybe even starting to ease them.

There is no doubt that high inflation rates should continue to decline over the coming months. However, we believe it will be difficult for the ECB and the Fed to bring inflation back below the 2% target without sustaining higher interest rates for longer. The two main factors supporting our view relate to inflationary energy price pressures and tight labor market conditions in the US and Eurozone (EA).

Breakdown of inflation in the euro area and the United States

(%,From one year to another)

Source: US Bureau of Labor Statistics, Eurostat, QNB analysis.

First, lower energy prices have been an important factor in lowering headline inflation since peaking in mid-to-late 2022, but this downward trend might s exhaust. The price of Brent oil peaked at around USD 124 per barrel (p/b) in June last year, and averaged USD 73.4 in March 2023. Lower energy prices had a significant impact on headline inflation. During the 2022 inflation peaks, energy costs explained 3 and 4.3 percentage points (pp) of the overall measure for the United States and the eurozone, respectively. More recently, contributions from energy had a negative impact of -0.5 percentage point in the United States and -0.2 percentage point for headline inflation in the Eurozone, thus explaining a large part the decline in inflation rates from their peak levels.

However, oil prices have recently risen following the surprise announcement by OPEC+ members of an oil production cut of 1.15 million barrels per day (mb/d). In addition, although the market believes that the recovery of economic activity in China is not as strong as expected and has already ended, we believe that China’s overall post-COVID recovery is still possible. . From our perspective, this will strengthen demand and further support higher energy prices over the medium term. Therefore, we expect inflationary pressures in the energy sector going forward.

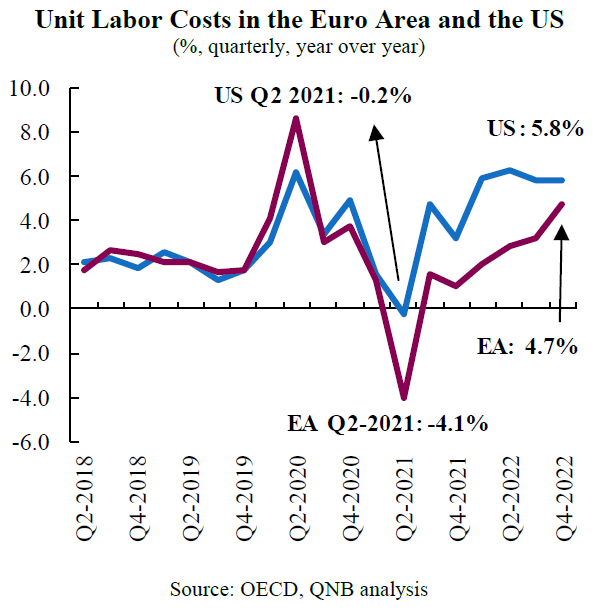

Unit labor costs in the euro area and the United States

(%, quarterly, annual)

Source: OECD, QNB analysis

Second, measures of core inflation that exclude volatile items, such as food and energy, show significant persistence, suggesting underlying price pressures remain firm despite record measures. tightening of monetary policy implemented by the ECB and the Fed. One of the main drivers of non-energy inflation is the difficult situation in labor markets, which continues to put pressure on labor costs. This is an indirect but important factor that influences all price components excluding energy.

In the United States, the unemployment rate has averaged 3.5% this year so far, which is close to its historical low, while the labor force participation rate has still not not returned to pre-pandemic levels. In Europe, the unemployment rate of 6.8% is also close to its historical low. These tensions on the labor market are reflected in an increase in wages, and therefore in costs for companies. The most recent releases of unit labor costs, for the last quarter of 2022, showed increases of 4.7% for the Eurozone and 5.8% for the United States with a downward trend. increase in the case of the European economy.

This cost increase will continue to put pressure on inflation, especially in the labor-intensive services sector, as companies raise prices to minimize the squeeze on their profit margins. In the United States, non-energy inflation fell to 5.5% in March, down only 0.6 percentage points since June, still far from the 2% target. Even more strikingly, in the euro zone, non-energy inflation is on the rise and reached 7.1% in March.

Monetary policy has little influence

The behavior of core inflation is particularly important because monetary policy has little influence on commodity prices. In addition, central banks would like to see clearer signals that interest rate hikes are having a concrete effect on inflation fundamentals to guide their future decisions.

Overall, despite the significant moderation in headline inflation, it is too early to declare victory once morest high inflation and to expect the ECB and the Fed change course. The positive development of headline inflation has been heavily dependent on the volatility of energy prices, and core inflation remains too high in an environment of still tight labor markets and producing strong wage growth .

According to press release

1682882008

#fight #inflation #United #States #Europe