2023-05-07 23:08:23

-Participation of zinzins increased by holding the account of third parties.

– A volume of issues of 180 billion FCFA programmed this week.

The public securities market of the West African Monetary Union (UMOA) closed the first week of May with 4 issues in an international context marked in particular by the increase in the key rates of the European Central Bank (ECB) and the American FED hinting at a probable alignment of the Central Bank of West African States (BCEAO) at its next meeting in June. In the meantime, Côte d’Ivoire with 33 billion FCFA mobilized, Mali with 30.34 billion FCFA, Benin for 38.5 billion FCFA and Togo for 33 billion FCFA have all tested their rating on the regional government securities market. The cumulative supply of 125 billion FCFA generated a total mobilization of 124 billion FCFA, representing a coverage rate of 157.10% once morest 132% the previous week.

In the opinion of market analysts, “this dynamic of the level of evolution of hedges for a few weeks expresses the interest of investors for public securities, despite the context characterized by the normalization of the monetary policy of the BCEAO”. As noted here last week, investors generally position themselves on short maturities, in particular 91-day, 182-day and 364-day paper to the detriment of medium-term maturities of 3 years and 5 years…

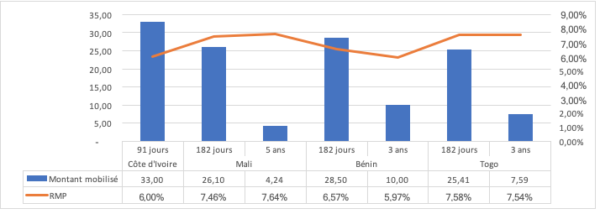

This short-term trend is highlighted by analyzing emissions country by country. Côte d’Ivoire, for reasons of cash constraints, intervened on the MTP on May 02, 2023 with a BAT at 91 days. This solicitation saw the participation of 8 investors for a coverage rate of 193%. More than 80% of this financing mobilized comes from Abidjan. As for Mali, it positioned itself on May 3, 2023 on three maturities, namely 182 days, 3 years and 5 years. The presence of the State of Mali on the MTP attracted the interest of 12 investors spread over 5 of the 8 places of the Union for a level of coverage of 101.31%. Benin, which entered the market on May 4, 2023, mobilized 35 billion over 182 days; 364 days and 3 years. This investor appetite made it possible to have a coverage rate of the announced amount of 144% subscribed to more than 80% by non-residents. Togo closes issues for an amount of 30 billion over three maturities: 182 days; 364 days and 3 years. 22 investors spread over 6 of the 8 places of the Union have expressed their interest for a level of appetite estimated at around 190%.

In general, the rise in yields continues on the public securities market, whetting the appetite of institutional investors (insurance company, pension fund, deposit and consignment fund, UCITS management company, Management and Intermediation Company). The participation of these famous zinzins increased with the outstanding amount held on behalf of third parties, which rose from 935 billion (end of December 2022) to 1,063 billion (end of April 2023), i.e. an increase of 14%. This pace should accelerate if, according to one analyst, the authorized intermediaries at the level of the MTP strengthen the mobilization at the level of the institutional clientele in order to help them better optimize their cash flow and take advantage of the returns offered on the government securities of the States of the ‘Union.

For the week of May 08, 2023, the offer promises to be even greater. Thus four issues for a total amount of 180 billion FCFA are scheduled for Côte d’Ivoire (70 billion), Burkina-Faso (30 billion), Niger (30 billion) and Senegal (probably 50 billion). The issue of Côte d’Ivoire will be through a targeted auction reserved for Specialists in Treasury Securities (SVT) of the issuing state.

As a reminder, the Specialists in Treasury Securities (SVT) are made up of certain market intermediaries, i.e. banks and Management and Intermediation Companies (SGI), which have received approval from the Public Treasury of the state in which they are located.

Public securities issued on the market by auction with the assistance of UMOA-Titres are more remunerative assets with yields of at least 6% on short-maturity securities (duration less than or equal to 1 year) commonly called Bonds Treasury Assimilables (BAT). As for securities with medium maturities (duration between 3 and 5 years), yields reach almost 8%. This is an opportunity for distributors of financial products (SGI and SGO) to remobilize their customers in order to offer them the best possible profitability.

1683502721

#WAMU #government #securities #market #high #coverage #rates #Benin #Togo #papers