This is one of the most worrying consequences of the war in Ukraine: the soaring prices of raw materials of which the Russians and the Ukrainians are major producers. Energy, metals, cereals… most sectors are affected.

After hitting highs last week, prices have started falling once more but remain at high levels. And the uncertainties, both on the military conflict and on the talks and Western sanctions, might lead to further price fluctuations.

These increases might increase l’inflation record already recorded in 2021 due to the tensions in the energy market and bottlenecks in supply chains. The return to growth might thus turn into a return to “stagflation” : rising prices and lack of growth.

These shocks also raise risks, including famine in some parts of the world and political instability. Some graphs allow to visualize their extent.

Gas and oil still 30 to 40% more expensive

Gas and oil prices peaked early last week amid growing fears of a Western embargo on Russian hydrocarbons, or a halt in deliveries by Moscow. Russia is the world’s leading exporter of gas and the second of oil.

They have since started to fall once more, as concerns regarding Europe’s energy supplies eased, but also with the resumption of talks between Russian and Ukrainian officials. Prices were also affected at the beginning of the week by the new confinements in China .

The price of natural gas in Rotterdam, the benchmark contract in Europe, is still 40% higher than at the start of the year, following reaching an all-time high a week ago at 345 euros per MWh, almost double of its price in early January. It raises, by ricochet, the price of fertilizer whose gas is essential for their manufacture.

As for Brent, the European benchmark for oil, the price per barrel remained at the start of the week 30% more expensive than on the 1is January, following reaching a peak last Tuesday, close to the all-time high of 2008.

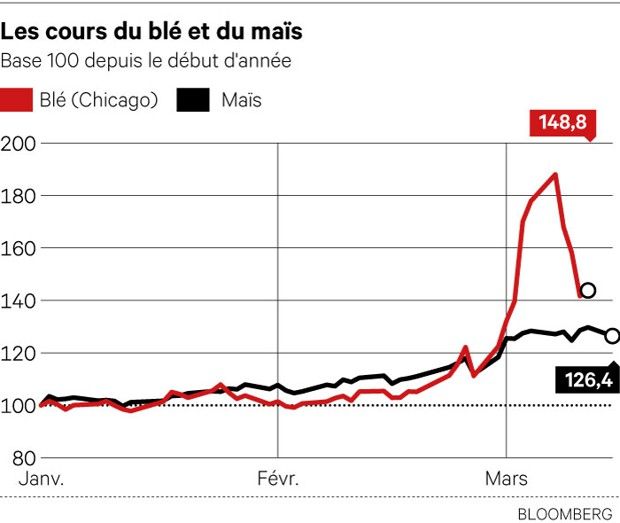

Wheat prices up 40%

The conflict has also caused a major shock for food commodities. Since the beginning of the year, the price of wheat has jumped: +44% on the Chicago futures market, +33% on the Paris market, a benchmark in Europe. Those of soybeans and corn have also increased by almost 30%.

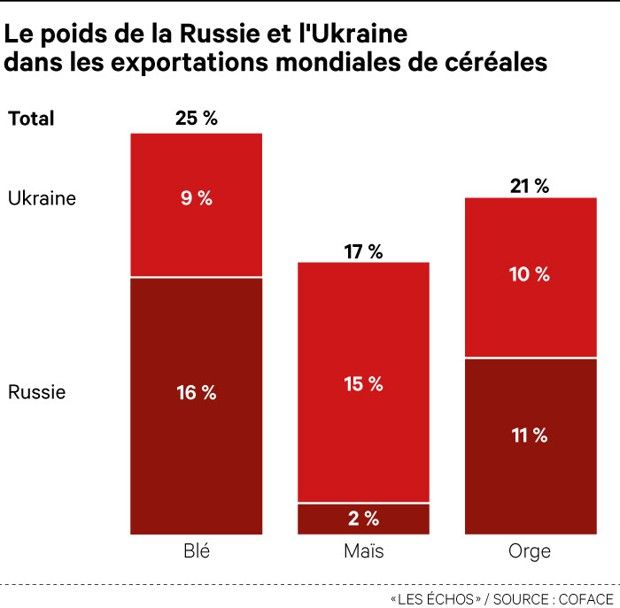

Russia and Ukraine are indeed very heavy in world exports of these commodities. The two countries alone produce a quarter of the wheat exported in the world, 21% of the barley and 17% of the corn. Fifteen countries, such as Finland and Turkey, buy more than 80% of their wheat imports from the two belligerents.

Ukraine announced last week grain export ban to reserve them for its own population. Russia has, for its part, prohibited the sale of cereals and fertilizers to countries which have taken sanctions once morest it, but also to many others to secure the supply of Russians. The G7 countries for their part asked on Friday the international community to avoid any measures restricting the export of foodstuffs.

Nickel trade still suspended

On the side of metals, the most spectacular jump concerns nickel of which Russia is the third largest producer in the world: the price per ton of this metal used in particular in electric car batteries was multiplied by three and a half in two days to reach 100,000 dollars per ton. Never seen.

The London Metal Exchange (LME) then suspended trading. It will not resume until Wednesday 16. The metal was trading for 80,000 dollars when trading stopped. An amount so disconnected from market fundamentals that the LME canceled all past trades on Tuesday morning – to bring the price back to 48,033 dollars – because such a price jeopardized the solvency of many brokers.

This sharp increase is not only explained by the conflict in Ukraine and the economic sanctions once morest Moscow, but also by a speculative operation by the Chinese metal magnate Xiang Guangda.

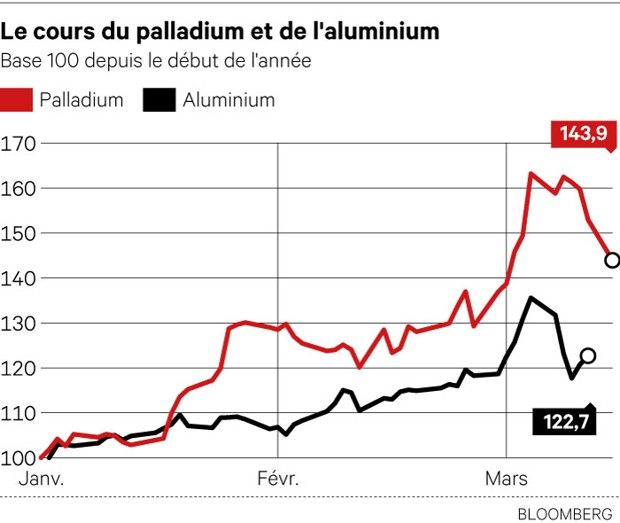

Palladium at a record high

Among the other metals affected by the war, palladium has also seen its price climb since the beginning of the year. This precious metal used by the automotive industry and for the manufacture of semiconductors is not, however, targeted by the Western sanctions taken once morest Russia. Corn its transport, which is usually done by plane, is disrupted by the ban on Russian aircraft entering European airspace. However, Russia today produces more than 40% of the world’s production of this metal.

After reaching a historic high of 3,442.47 dollars an ounce last Monday, the price of palladium has started to fall once more. It remains 44% higher than its price of 1is January.

Another record, aluminum, also dependent on Russian exports, exceeded for the first time in its history last Monday the bar of 4,000 dollars per ton. Its price is now 20% higher than at the start of the year. Copper also hit a new all-time high last week.