On the 22nd (local time), the major indices of the New York Stock Exchange plunged all at once. Strong hawkish remarks from US central bank (Fed) members (preferring monetary tightening) dragged the index down. There was widespread speculation in the market that the Fed might raise the benchmark interest rate by 75 basis points (0.75 percentage points) all at once.

The leading index, the S&P 500, closed at 4,271.78, down 2.77% from the previous day, the Nasdaq Composite, down 2.55%, at 12,839.29, and the Dow, down 2.82%, at 33,811.40, respectively. The Dow’s decline (981.36 points) was the biggest in regarding two years since June 11, 2020. The Dow was down for the fourth week in a row.

The followingshock came following Fed Chairman Jerome Powell said the day before that he might raise the rate by 50 basis points at one or more monetary policy meetings. Louis Federal Governor James Bullard and San Francisco Fed President Mary Daley previously said that a 75bp increase is possible. Moreover, Bullard is a member of the Federal Open Market Committee (FOMC) this year.

The market is considering the possibility of a 75bp increase in the May or June FOMC.

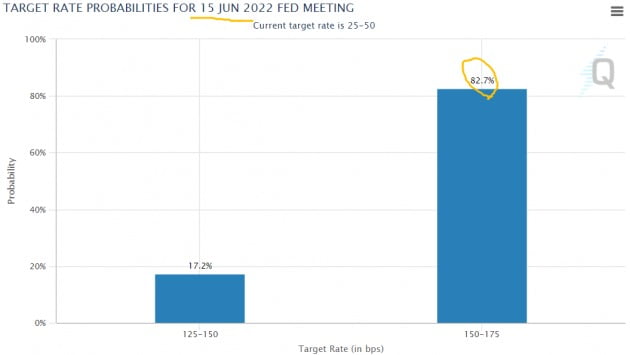

The probability of a 75bp (0.75% point) increase in the key interest rate at the same time at the US central bank’s monetary policy meeting in June is over 80%. US Fed Watch

Rob Serbaraman, head of global research at investment bank Nomura, said, “The Fed will raise the key interest rate by 50 basis points in May and then raise it by 75 basis points in June and July. This has become inevitable.” He predicts that the US benchmark interest rate will reach 3.75% to 4.0% per annum by the middle of next year.

Professor Jeremy Segal of the Wharton School said, “It is better not to take the (good for the body) drug every time, but to take it all at once.” Professor Segal explains that the market wants it too.

Citigroup’s economist Andrew Hollenhorst also said that “there’s a greater chance of a 75bp or longer 50bp hike.”

However, Krishna Guha, head of interest rate strategy at Evercore ISI, said, “The FOMC will raise interest rates by 50bps in May and July and then raise them by 25bps in September.

The possibility that the Fed will raise the key interest rate by 50 basis points at the Monetary Policy Meeting to be held on the 3rd and 4th of next month is a known fact. According to the Fed Watch, there is a 99.8% chance of a 50bp hike in May and an 82.7% chance of a 75bp hike in June.

Yields on the two-year Treasury bond, which are short-term bonds, have risen sharply. It was 2.72% per annum, up 4bp from the previous day. It is the highest since December 2018. While the 10-year Treasury yield remains unchanged, the long-term and short-term interest rate differential has narrowed (yield curve flattening) for a long time.

The Volatility Index (VIX), considered the Wall Street fear index in the United States, jumped sharply, breaking through the 28th on the 22nd (local time).

The first quarter performance of major companies was not very good.

American Express Card reported earnings per share (EPS) of $2.73 for the first quarter. It beat the market consensus of $2.44. However, the share price fell 2.8% when it announced its overall EPS forecast for this year to be between $9.25 and $9.65. It was below the market consensus of $9.72.

“There are clear signs of consumption growth now, but we cannot rule out the possibility of a recession at the end of the year,” said Amex CEO Steven Squarie.

Verizon, the largest wireless carrier in the US, reported first-quarter results in line with market expectations. However, the number of subscribers to the postpaid service decreased by 292,000. The company’s stock fell 5.79%.

On the other hand, consumer goods company Kimberly-Clark’s earnings were well above market expectations. Sales this year are expected to increase by 2-4%, he said. The company’s stock jumped more than 8%.

International oil prices fell. This is because of concerns regarding sluggish demand.

On the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) for June contract closed at $102.07 a barrel, down 1.7% from the previous day, and Brent crude from the North Sea closed at $106.65 a barrel, down 1.6%.

The impact of China’s decision to adhere to a total lockdown (coronavirus) policy was significant. A stronger dollar also contributed to the fall in oil prices.

photo = AP

Today’s ‘Global Market Now’ issues are as follows.

① The Dow, the biggest drop in regarding two years ② Why is the meme stock bed bath soaring? ③ Last remarks before FOMC “ once morest 75bp↑” ④ Highest two-year government bond since 2018 ⑤ European economy diagnosis, etc.

More details can be found on Hankyung Global Market YouTube and Hankyung.com broadcasts.

New York = Correspondent Jo Jae-gil [email protected]