Taiwan Semiconductor Manufacturing Co. (TSMC) is anticipating a substantial rise in revenue in the upcoming quarter, thanks to the surge in demand for advanced chips used in artificial intelligence (AI) development. TSMC, the world’s largest contract chipmaker supplying companies like Nvidia and Apple, expects its revenue to increase by regarding 30% in the June quarter, reaching approximately $19.6 billion to $20.4 billion. This projection comes on the heels of the company’s first profit rise in a year, indicating a significant revival in growth.

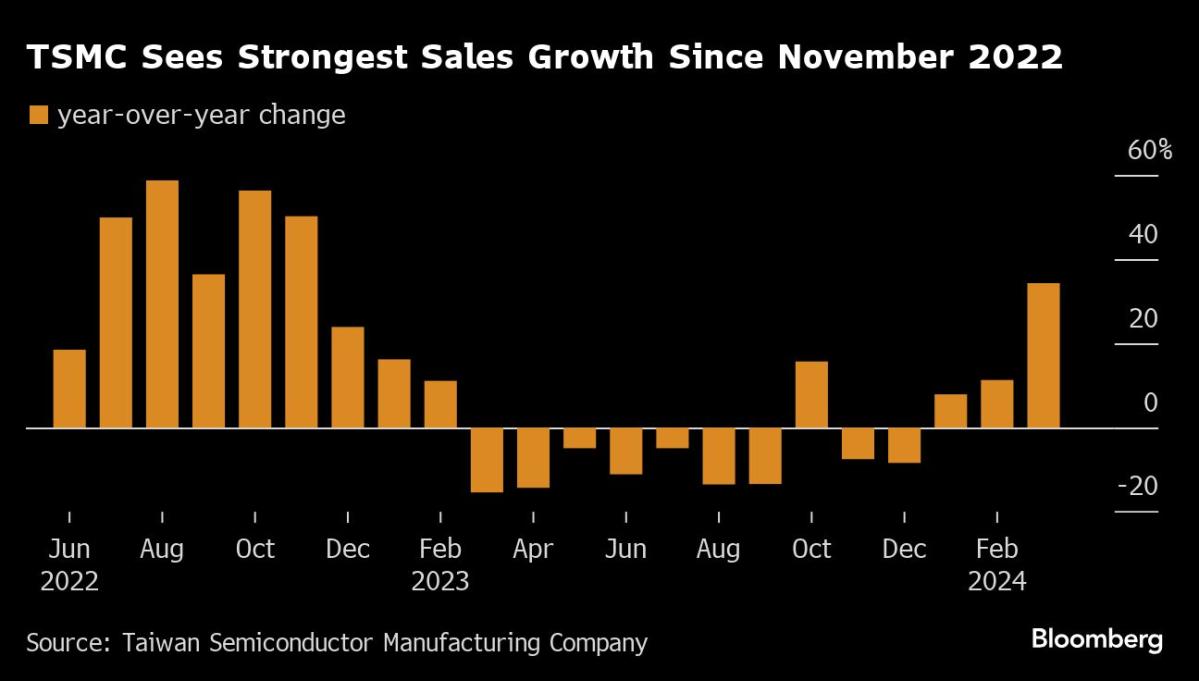

TSMC’s strong sales growth reflects the increasing demand for chips that accelerate AI development, offsetting the slump in the smartphone market. Despite a decline in Chinese iPhone sales, Apple still accounted for a quarter of TSMC’s revenue in 2023. The company’s recent sales growth has been its fastest since 2022, suggesting a positive trend in the semiconductor industry.

TSMC’s market value has skyrocketed by $340 billion since October 2022, fueled by optimism that it will be a major beneficiary of the global AI boom. The company has set its capital expenditure budget for 2024 at $28 billion to $32 billion, indicating its dedication to further growth and development.

While TSMC expects its revenue to grow by at least 20% this year, uncertainties remain due to the volatility of the global macroeconomic landscape. One potential hurdle is the recent 22% miss on first-quarter bookings by key supplier ASML Holding NV, the sole provider of the world’s most advanced chipmaking machines.

Looking further ahead, industry experts predict that revenue from AI-focused chips will gradually make up a larger proportion of TSMC’s overall revenue. The company stated in January that its AI revenue is growing at an annual rate of 50%. However, some investors have cautioned that the current level of AI chip demand may not be sustainable in the long run. Additionally, geopolitical tensions, particularly regarding the Taiwan Strait, which separates China and Taiwan, might introduce further uncertainties.

The implications of TSMC’s positive outlook and the overall growth in the AI chip industry are substantial. As AI continues to infiltrate various industries and drive technological advancements, the demand for advanced chips will only continue to rise. This signifies a promising future for TSMC and other companies involved in the semiconductor sector.

In light of these trends, it is crucial for the industry to focus on research and development to meet the evolving needs of AI applications. Companies should invest in innovation and collaboration to stay ahead of the competition and cater to the increasing demand for advanced chips.

As TSMC’s revenue soars and the semiconductor market recovers, it is clear that AI development will play a pivotal role in shaping the industry’s future. For investors and industry stakeholders, keeping a close eye on emerging AI-related trends and developments will be crucial for strategizing and making informed decisions.

In conclusion, TSMC’s positive forecast for the upcoming quarter highlights the growing demand for advanced chips in AI development. As the semiconductor industry continues to evolve and AI becomes more ingrained in our daily lives, companies must adapt and innovate to remain competitive. TSMC’s success is a testament to the potential future trends in this sector, and it is vital for players in the industry to stay informed and proactive to capitalize on the opportunities presented by the AI revolution.