Trump’s Meme coin Sees Dramatic Backlash After Glowing Debut

Table of Contents

- 1. Trump’s Meme coin Sees Dramatic Backlash After Glowing Debut

- 2. Will TRUMP Coin Repeat History? The Next few Days are Crucial

- 3. How dose the recent FOMC meeting influence investor sentiment towards TRUMP coin and its potential trajectory?

- 4. TRUMP Coin: Hype or Hope? An Exclusive Interview

- 5. Ryan Sterling, Crypto analyst at CoinPulse

- 6. Laura Chen, Blockchain Technology Expert at BlockVerse

Just a week ago,the cryptocurrency world was abuzz with the launch of Donald Trump’s officially sanctioned meme coin,TRUMP. The coin quickly soared, reaching a market capitalization of $15 billion in a single day, conveniently timed with Trump’s inauguration. This dramatic surge overshadowed the rest of the market,with Bitcoin even experiencing a dip while TRUMP captured the spotlight.

However,like many memecoins before it,the initial hype proved short-lived. The Relative Strength Index (RSI), a key indicator of market momentum, flashed ‘overbought,’ signaling a potential correction.As predicted, sell-side pressure quickly emerged, wiping millions off some investors’ portfolios while others walked away with considerable profits.

Since its peak, TRUMP has plummeted by a staggering 60%, with a massive 61.33% of its market value evaporating. Yet, amidst this downturn, a glimmer of hope remains. A recent 9% surge in the past 24 hours suggests a renewed interest from investors, who may see this dip as a buying prospect.

“TRUMP’s 9% jump in the last 24 hours signals that some investors are eyeing this as a buying opportunity,” one analyst notes. “But does the data point towards a trap?”

Whether this resurgence marks a genuine turnaround or simply another bump in the volatile ride that is the cryptocurrency market remains to be seen.But one thing is clear: the saga of TRUMP is a cautionary tale, reminding investors of the inherent risks associated with speculative assets and the importance of thorough research before jumping on the bandwagon.

The crypto market is at a crossroads. while the recent dip in TRUMP’s price has triggered a short squeeze, wiping out $6.86 million in short positions, the overall market sentiment remains cautious.

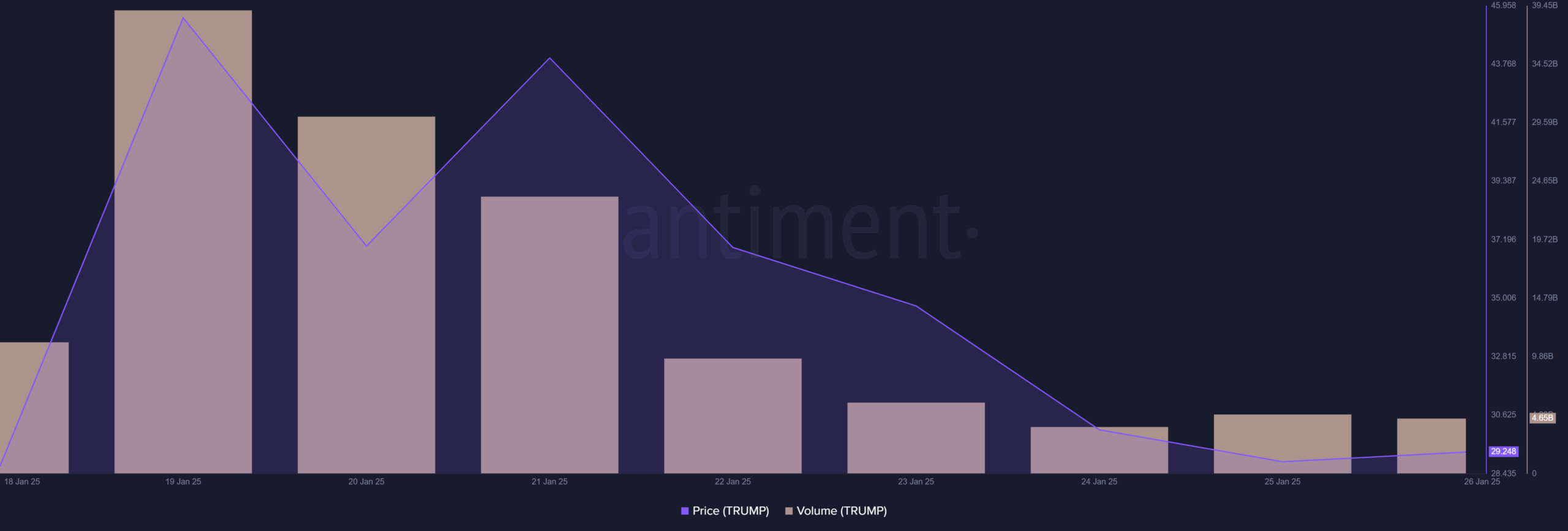

Trading volume, a crucial indicator of market health, is far from robust. It has plummeted from a staggering 39.06 billion at TRUMP’s all-time high to a mere 4.65 billion, a mere 7% increase from the previous day. This lackluster volume raises concerns about the sustainability of any potential rally.

“But is this really the opportunity it truly seems? Data suggests it might be a trap,” a seasoned crypto analyst recently cautioned.

The overall crypto market cap has only inched up by 0.40% from the previous day, highlighting the subdued investor confidence. Bitcoin, the bellwether of the crypto market, is caught in a tug-of-war between long-term holders cashing out their profits and new investors hesitant to enter the fray.

The upcoming FOMC meeting in just three days is keeping many on the sidelines, waiting for potential cues about future interest rate hikes.

In the meantime, some investors are seeking refuge in the memecoin market, where a few coins are experiencing triple-digit gains in a single day. This trend, however, is often viewed as a speculative bubble rather than a sustainable investment strategy.

The crypto world is buzzing with the emergence of TRUMP, a meme coin capturing investor attention. But with its short-term appeal comes the question: will history repeat itself?

TRUMP presents a tempting opportunity for fast gains, but its potential impact on the broader market remains unclear. While it’s unlikely to siphon liquidity away from major players like it did in the past, caution is still advised.

“It’s unlikely that TRUMP will pull liquidity away from the broader market again, though caution is definitely advised,” a crypto analyst states, emphasizing the need for a measured approach.

The coming days are crucial for TRUMP’s trajectory. The outcome of the Federal Open Market Committee (FOMC) meeting will likely influence investor sentiment. A positive market response could propel TRUMP, attracting a surge of capital and possibly challenging established cryptocurrencies like Bitcoin. Conversely, a bearish market reaction could see investors flee, leading to a rapid decline in TRUMP’s value.

“The next few days will be crucial. If the market goes against expectations, TRUMP could see liquidity dry up as investors exit,” the analyst warns.

Though, ”if the FOMC meeting boosts the market, TRUMP could gain serious traction, attracting a flood of capital and even posing a challenge to Bitcoin.Keep a close watch – this could be the turning point,” he adds, highlighting the potential for dramatic shifts in the market.The journey of TRUMP is still unfolding. Only time will tell if it becomes a fleeting meme or a formidable force in the crypto landscape.

How dose the recent FOMC meeting influence investor sentiment towards TRUMP coin and its potential trajectory?

TRUMP Coin: Hype or Hope? An Exclusive Interview

Amidst the whirlwind of the cryptocurrency market, the recent launch of TRUMP coin has sent shockwaves thru the digital asset space. To get a better understanding of this latest phenomenon, we sat down with Ryan Sterling, a seasoned crypto analyst at CoinPulse, and laura Chen, a blockchain technology expert at BlockVerse, to discuss TRUMP’s potential trajectory and its broader impact on the crypto landscape.

Ryan Sterling, Crypto analyst at CoinPulse

What are your initial thoughts on the emergence of TRUMP coin?

Ryan Sterling:

TRUMP’s meteoric rise is certainly a testament to the power of meme culture in the crypto world. It’s engaging to see how a coin directly linked to a controversial political figure can attract so much attention and generate such explosive gains. However, history has shown us that many memecoins burn brightly but fade quickly.

Do you see TRUMP posing a challenge to established cryptocurrencies like Bitcoin?

Ryan Sterling:

It’s unlikely that TRUMP will pull liquidity away from the broader market again, though caution is definately advised. The crypto market is much more complex now. While TRUMP might generate hype and attract some investors seeking swift profits, it’s unlikely to have a notable, lasting impact on the dominant players like Bitcoin

Laura Chen, Blockchain Technology Expert at BlockVerse

Laura, what are your technical insights into TRUMP coin?

laura Chen:

From a purely technical perspective, TRUMP, like many memecoins, lacks the robust fundamentals and underlying technology often found in more established cryptocurrencies. Its value proposition is primarily driven by speculation and market sentiment.

How do you assess the risks associated with investing in TRUMP coin?

Laura Chen:

The risks associated with meme coins like TRUMP are significant.Their value can be exceptionally volatile, driven by hype and speculation rather than underlying value. A single tweet or news story can send the price skyrocketing or crashing. Investors need to be extremely cautious and understand they could lose their entire investment.

Looking ahead, do you have any predictions for the future of TRUMP coin?

Ryan Sterling:

Predicting the future of any cryptocurrency is notoriously difficult. While TRUMP has captured the attention of many investors, it remains to be seen weather it can sustain its momentum. The next few days will be crucial, as the outcome of the FOMC meeting will likely influence investor sentiment. If the market goes against expectations, TRUMP could see liquidity dry up as investors exit. Conversely, if the FOMC meeting boosts the market, TRUMP could gain serious traction, attracting a flood of capital and even posing a challenge to Bitcoin.Keep a close watch – this could be the turning point.

The road ahead for TRUMP coin remains uncertain. Will it become a lasting force in the crypto world or fade into obscurity?