Bitcoin, which had surged sharply on the expectation that Republican presidential candidate Donald Trump would advocate for it, has once again declined, dipping below the $68,000 mark.

In anticipation of Trump’s speech, Bitcoin’s price peaked at $69,000 on the 27th, but started to drop after his comments prompted a wave of selling.

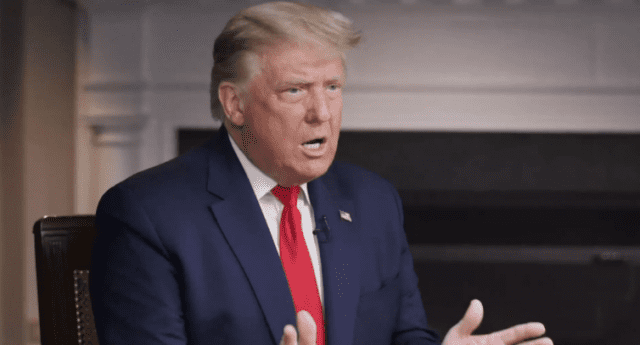

Former U.S. President Donald Trump (Photo = CNET)

According to CoinMarketCap, a global cryptocurrency market platform, Bitcoin was trading at $67,984 at 7 p.m. (Eastern Standard Time) on the 27th, a decrease of 0.90% from the previous day, and briefly fell below the $68,000 mark. After fluctuating, Bitcoin was trading at $68,016 as of 6 p.m. on the 28th (7 a.m. on the 29th, Korean Standard Time).

Earlier, during his keynote address at the Bitcoin 2024 Conference in Nashville, Tennessee, Trump stated that the Bitcoin held by the federal government “will form the foundation of a strategic national Bitcoin reserve,” and advised investors against selling their Bitcoin.

The U.S. government currently possesses approximately 210,000 bitcoins, making up about 1% of the global total of 21 million. Most of these bitcoins were confiscated from criminals. Trump also created a Presidential Advisory Council on Bitcoin and Virtual Assets and pledged to halt any plans to introduce digital currencies issued by central banks.

(Photo = Image Today)

The American business media outlet CNBC noted that while Trump’s speech was supportive of virtual assets, it was not as revolutionary as anticipated. Trump’s commitments are less bold than those of another candidate, Robert F. Kennedy Jr., as they focus on maintaining the current Bitcoin holdings of the U.S. government.

Related Articles

Robert F. Kennedy Jr., speaking at the same Bitcoin conference, announced his intention to sign an executive order mandating that the federal government purchase 550 bitcoins daily, starting with those already held through criminal seizures, aiming to create a strategic reserve of 4 million bitcoins.

However, this approach would significantly alter the regulation and valuation of cryptocurrencies, and implementing it would require more than just presidential action; it would necessitate legislation and congressional approval, according to CNBC.

Bitcoin Price Volatility Following Trump’s Remarks

Bitcoin, the world’s leading cryptocurrency, has been experiencing significant price fluctuations. Recently, it surged amid speculation that Republican presidential candidate Donald Trump would advocate for Bitcoin’s adoption. However, this optimism was short-lived as Bitcoin’s price fell again, breaking below the critical $68,000 mark.

Bitcoin’s Roller Coaster Ride

On the evening of the 27th, ahead of Trump’s highly anticipated speech at the Bitcoin 2024 Conference in Nashville, Tennessee, the price of Bitcoin peaked at $69,000. Following Trump’s remarks, however, investors reacted swiftly, leading to a decline in Bitcoin’s value. By 7 p.m. EST on the 27th, Bitcoin was trading at $67,984, reflecting a 0.90% drop from the previous day.

Key Highlights from Trump’s Speech

During his address, Trump revealed that the Bitcoin held by the federal government would form the foundation of a strategic national Bitcoin reserve. He encouraged investors to hold their Bitcoin rather than sell during market fluctuations.

U.S. Government’s Bitcoin Holdings

The U.S. government currently possesses about 210,000 bitcoins, representing approximately 1% of the total supply of 21 million bitcoins in existence. The majority of these bitcoins were seized from criminal activities, making them an interesting aspect of governmental cryptocurrency involvement.

Trump’s Cryptocurrency Position: A Friendly Approach, But Not Radical

While Trump’s stance seemed favorable to virtual assets, CNBC noted that it was less revolutionary than expected. Unlike another presidential hopeful, Robert F. Kennedy Jr., who proposed a more aggressive Bitcoin adoption strategy, Trump’s approach focuses on maintaining the current Bitcoin holdings without drastic changes to regulatory frameworks.

Comparative Analysis: Kennedy vs. Trump

| Candidates | Bitcoin Strategy | Radical Changes Proposed |

|---|---|---|

| Donald Trump | Strategic national Bitcoin reserve with current holdings | No |

| Robert F. Kennedy Jr. | Purchase 550 bitcoins daily, creating a strategic reserve of 4 million | Yes |

What Kennedy Proposed

At the same conference, Robert F. Kennedy Jr. unveiled his ambitious plan to require the federal government to acquire 550 bitcoins daily, aiming for a strategic reserve that eventually totals 4 million bitcoins. This proposition would drastically alter the landscape of cryptocurrency regulation and valuation.

Challenges to Implement Kennedy’s Plan

While Kennedy’s vision could redefine the U.S. approach to cryptocurrencies, experts suggest that such sweeping changes would require extensive legislative support and congressional approval, making implementation a complex task.

The Current Bitcoin Market Landscape

As of the evening of the 28th, Bitcoin was trading at approximately $68,016. The market’s response to political speeches reflects the volatile nature of cryptocurrency investments, where sentiments can quickly shift based on external factors.

Understanding Bitcoin Price Volatility

Price changes in Bitcoin can be influenced by several factors, including:

- Market Sentiment: Investor sentiment plays a significant role in driving the price of Bitcoin up and down.

- Regulatory Changes: Political announcements and government policies directly impact market confidence.

- Technological Developments: Advances in blockchain technology can affect Bitcoin’s utility and value.

Case Studies: Bitcoin and Political Announcements

Historical trends show that political events often lead to volatility in Bitcoin prices. Notable instances include:

- 2017 Bitcoin Rally: The price soared during the anticipation of regulatory clarity from the SEC.

- China’s Cryptocurrency Ban: A sudden dip in Bitcoin prices occurred post-announcements from Chinese authorities about cracking down on crypto trading.

Practical Tips for Bitcoin Investors

For investors looking to navigate the ups and downs of Bitcoin trading, here are some practical tips:

- Diversify Your Portfolio: Spread your investments across different assets to reduce risk.

- Stay Informed: Follow cryptocurrency-related news and announcements closely.

- Utilize Technical Analysis: Learn how to read market signals and trends to make informed trading decisions.

Final Thoughts on Bitcoin’s Future

As Bitcoin continues to capture public attention and undergo rapid changes, understanding the dynamics of the cryptocurrency market is essential for both novice and experienced investors.