The American Bitcoin conference has reignited optimism in the market at the week’s end following a mid-week downturn.

The week’s most significant cryptocurrency news in one place

Spot Ethereum ETFs began trading in the US on July 23. The SEC finally approved the S-1 registration permits after months of anticipation, and trading commenced on Tuesday on platforms such as Nasdaq, the New York Stock Exchange, and the Chicago Board Options Exchange. The issuers include major players like BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy.

Proton, the company recognized for its secure email, VPN, and storage services, announced the launch of its first crypto wallet. The Swiss-based company’s Proton Wallet will initially support only Bitcoin, but it plans to add other cryptocurrencies in the future. This new product is a self-custody wallet, allowing users to maintain their own private keys.

KraKen CEO Dave Ripley announced on Tuesday that they successfully distributed Bitcoin and Bitcoin Cash to customers impacted by the Mount Gox exchange collapse nearly a decade ago. Kraken was one of five exchanges selected to return funds to 127,000 creditors affected by the 2014 crash. Other impacted exchanges include Bitstamp, SBI VC Trade, Bitbank, and Coincheck. The exact timeline for when lenders will receive their funds from these exchanges remains uncertain, and none of the exchanges have commented on the issue.

HSBC Bank’s Australian subsidiary has informed its customers that it will block transfers to cryptocurrency exchanges starting July 24. The bank cited customer protection in its notification as the reason for this action. Customers wishing to deposit on crypto exchanges should seek alternative solutions.

On July 24, 2024, the Bitcoin rollups protocol, BitcoinOS (BOS), successfully validated the first zero-knowledge proof on the main Bitcoin blockchain. This achievement allows the Bitcoin mainnet to achieve new levels of functionality and scalability without needing further modifications to the underlying blockchain layer.

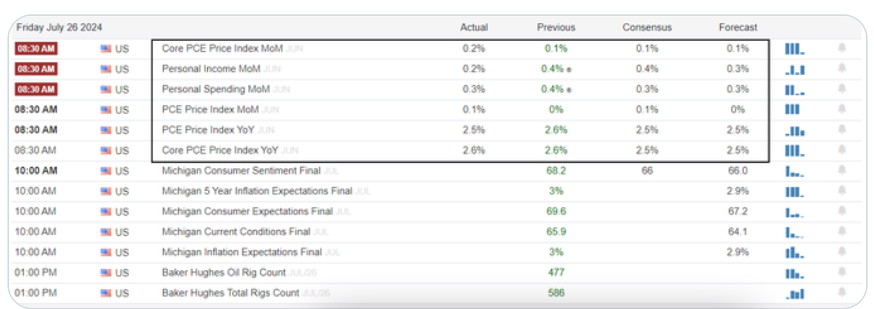

Inflation will persist, but the market has stopped reacting to the data

BTC price action dismissed mixed US inflation data.

Inflation data in the form of the personal consumption expenditure (PCE) index exceeded expectations. Additionally, strong unemployment data published a day earlier paints a rather bleak picture of the American economy.

Despite this backdrop, Bitcoin aligned with the US stock market, which experienced a notable surge, even though the data isn’t considered favorable. The BTC/USD pair rose nearly 7% from the previous day’s low.

Inflation will remain with us, and analysts did not foresee these figures either. However, the market did not respond as anticipated. There were indeed declines and collapses, but all risk assets, including stocks and Bitcoin, turned positively.

Analysts predict a Bitcoin exchange rate above $70,000

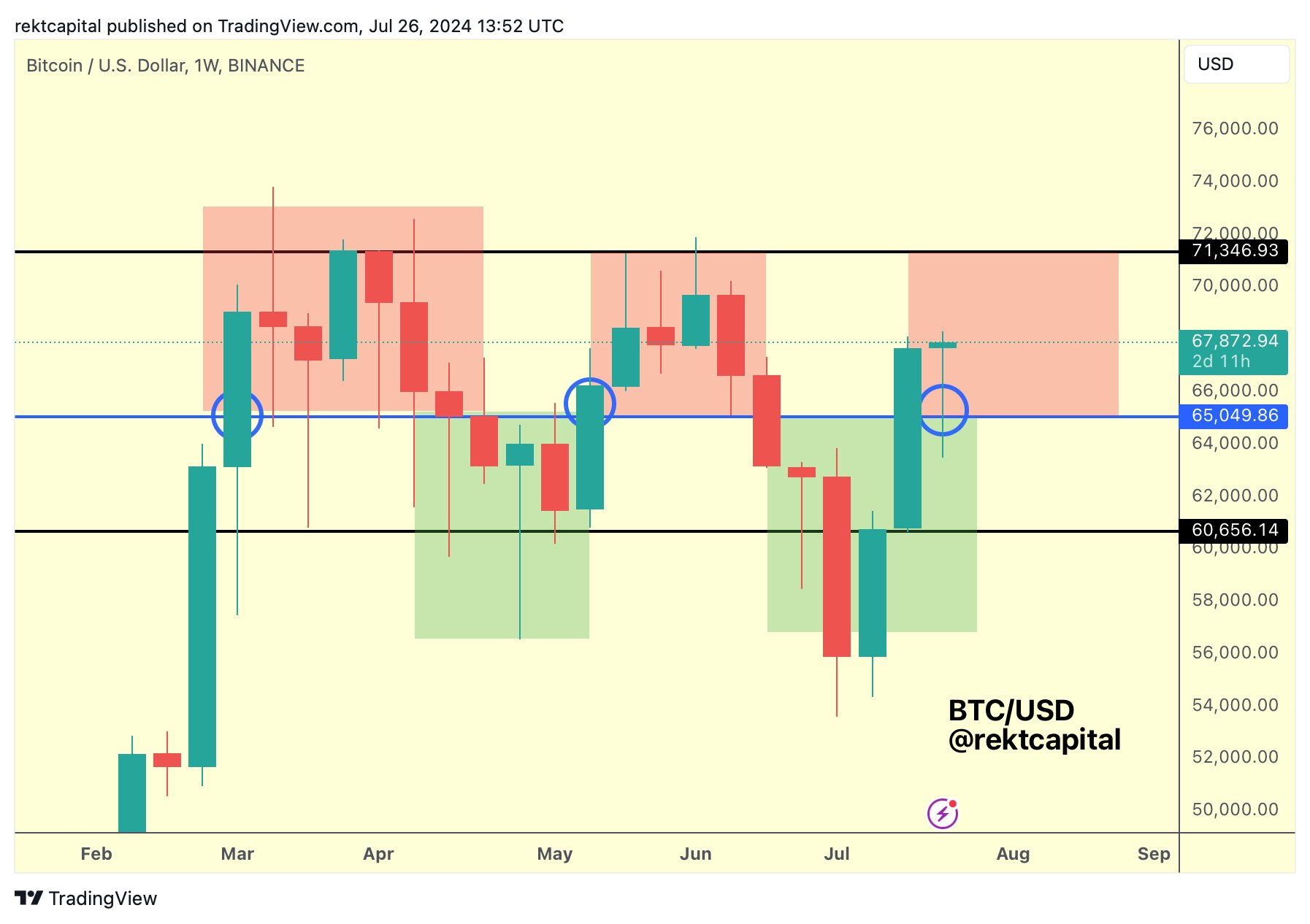

As price movements remained constrained in the short term, traders began considering the broader time frame.

“Bitcoin has formed a massive descending wedge, right around the highs of the previous cycle!” wrote popular trader Jelle in one of his posts on X.

“It appears the price is poised to break out – and if that movement occurs, it will be a significant shift. The first price target is $85,000.”

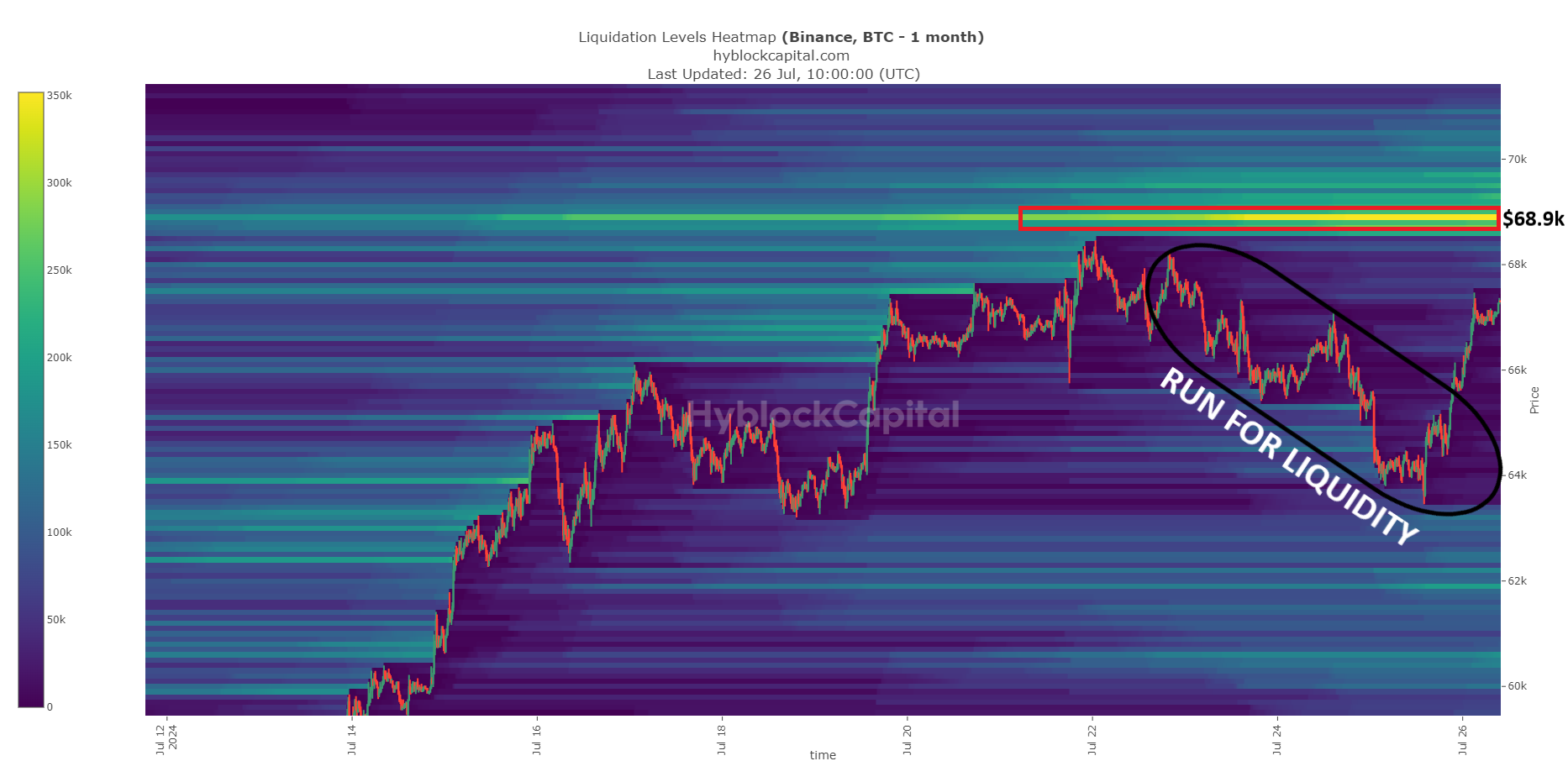

The primary price target for crypto trader CrypNuevo is set at $68,900. This area lies just below the psychologically significant price level and aligns with the previous highs of Bitcoin price from 2021.

“At $68,900, liquidations spiked significantly this week. We can confirm our expectations from Sunday: this week’s decline was merely a minor blip, and a rally is anticipated as liquidity diminishes,” he added in another post on X based on liquidation data from analyst CoinGlass.

Bitcoin price fluctuations are anticipated this weekend

Even with a lack of institutional trading, an eventful weekend is expected for the cryptocurrency sector as US presidential candidate Donald Trump takes the stage at the Bitcoin 2024 conference in Nashville, Tennessee.

At 2:00 PM ET on July 27, Trump could become a key factor for the crypto markets. A prominent element of his campaign is his commitment to supporting cryptocurrencies.

As the weekly and monthly close approaches, popular trader and analyst Rekt Capital indicated that the upcoming weekend might be pivotal.

“Bitcoin fell to $65,000 and has successfully bounced back since. Now let’s see what occurs as Bitcoin aims for $71,500,” he stated in a post on X.

Traders are preparing for former President Donald Trump’s address at the Bitcoin 2024 conference. Many anticipate that Trump will announce his intention to use Bitcoin as a strategic reserve currency if he is re-elected president.

On July 26, the day before the conference speech, Bitcoin’s price surged nearly 3% to over $67,000 within 24 hours. This reflects a 6.40% recovery from the mid-week low of around $64,425. The setbacks due to Mt. Gox payments were therefore entirely erased from the charts by the week’s end.

Social media is rife with speculation that Trump might promise to establish a Bitcoin reserve for the United States if he is re-elected in November. The prospect of the world’s leading economy becoming a Bitcoin purchaser heightens the market’s optimistic sentiment.

“No one wants to short Bitcoin this weekend,” noted Markus Thielen, CEO of 10x Research, adding:

“Undoubtedly, the world is paying attention to the strong crypto lobby.”

Bitcoin has surged more than 16.50% since the July 13 assassination of Trump, enhancing his prospects for winning the forthcoming election.

The American Bitcoin conference brought optimism back to the market at the end of the week after the mid-week decline.

The Most Important Cryptocurrency News of the Week

Spot Ethereum ETFs were allowed to trade in the US on July 23rd. The SEC finally granted the S-1 registration permits after months of waiting, resulting in trading beginning on Tuesday on exchanges such as the Nasdaq, the New York Stock Exchange, and the Chicago Board Options Exchange. Notable issuers include:

- BlackRock

- Fidelity

- 21Shares

- Bitwise

- Franklin Templeton

- VanEck

- Invesco Galaxy

Proton, a company known for its secure email and VPN services, has announced the launch of its first crypto wallet. The Swiss-based company’s Proton Wallet currently supports only Bitcoin, with plans to add more cryptocurrencies in the future. This self-custody wallet gives users complete control over their private keys.

On July 23, Kraken CEO Dave Ripley announced that they successfully paid out Bitcoin and Bitcoin Cash to customers affected by the Mt. Gox exchange collapse nearly a decade ago. Kraken was one of five exchanges selected to return funds to 127,000 creditors affected by the 2014 crash.

In other news, HSBC Bank’s Australian subsidiary notified customers that it will block transfers to crypto exchanges from July 24. The bank cited customer protection as the reason behind this decision, advising customers to seek alternative solutions for crypto deposits.

On July 24, 2024, the Bitcoin rollups protocol, BitcoinOS (BOS), successfully authenticated the first zero-knowledge proof on the main Bitcoin blockchain, paving the way for enhanced functionality and scalability.

Market Reactions to Inflation Data

BTC price action shrugged off mixed US inflation data, with the personal consumption expenditure (PCE) index exceeding expectations. Despite not-so-rosy economic indicators, Bitcoin’s performance improved, mirroring significant gains in the US stock market, with the BTC/USD cross up nearly 7% from previous lows.

Inflation persists, and analysts were surprised by recent data. Yet, the market did not react negatively, with all risk assets, including stocks and Bitcoin, gaining strength.

Analysts Predict Bitcoin Price Above $70,000

As Bitcoin remained within a narrow price range, traders began focusing on longer time frames. Noteworthy insights from popular trader Jelle suggest:

“Bitcoin has formed a huge, descending wedge, right around the highs of the previous cycle! It looks like the price is just waiting to break out – and if that move happens it will be a sharp change. The first price target is at $85,000.”

Crypto trader CrypNuevo identified the main price target for Bitcoin at $68,900, below a psychologically significant price level that aligns with previous highs from 2021. The demand for Bitcoin intensified as liquidations surged this week, reinforcing expectations for a rally following liquidity decreases.

Bitcoin Liquidity Heatmap

| Price Level | Liquidity | Change in Liquidations |

|---|---|---|

| $65,000 | High | Minimal |

| $68,900 | Moderate | Significant Increase |

| $71,500 | Low | Potential Spike |

Anticipated Bitcoin Price Fluctuations This Weekend

Despite limited institutional trading, excitement surrounds the weekend as Donald Trump speaks at the Bitcoin 2024 conference in Nashville, Tennessee. Scheduled for 2:00 PM ET on July 27, Trump could serve as a catalyst for the crypto market.

Traders anticipate possible announcements regarding Bitcoin as a strategic reserve currency should Trump secure another presidential term. As the conference date approaches, Bitcoin’s price has already shown promising signs of growth, jumping nearly 3% to surpass $67,000 within a 24-hour window.

Market Sentiment Leading Up to the Conference

“No one wants to short Bitcoin for the weekend,” noted Markus Thielen, the CEO of 10x Research, highlighting a growing interest in Bitcoin.

“Undoubtedly, the world is paying attention to the strong crypto lobby,” he added.

Notably, Bitcoin has experienced a 16.50% surge since the events surrounding Trump’s assassination on July 13, positively influencing his prospects for the upcoming election.

With expectations riding high, analysts and traders alike are closely monitoring any developments during the conference, reinforcing the collective sentiment that Bitcoin’s momentum may continue its upward trajectory.