“I will tighten the financial belt”… “Takes the lead of the government and the public sector for the vitality of the private sector”

The government raises the duty-free limit for travelers’ carry-on items from the current $600 to $800 for the first time in eight years.

A plan is also being pursued to avoid taxation on the income earned by foreigners from buying and selling Korean government bonds.

Deputy Prime Minister and Minister of Strategy and Finance Choo Kyung-ho held a meeting with reporters covering the meeting of finance ministers and central bank governors of the G20 countries held in Bali, Indonesia on the 16th (local time), saying, “We are going to strengthen support for the tourism industry that has been struggling with COVID-19. To this end, we will push for an upward adjustment of the duty-free limit for travelers’ carry-on items that have been fixed since 2014.”

Currently, the duty-free scope of carry-on items per person is 1 bottle of alcohol, 60 ml of perfume, 200 cigarettes, and other items under $600 in total.

The duty-free limit for traveler’s carry-on items was raised from 100,000 won in 1979 to 300,000 won in 1988, 400 dollars in 1996, and 600 dollars in September 2014.

The government abolished the duty-free purchase limit for Koreans, which was originally $5,000 from March 18, but did not change the duty-free limit.

The government explained at the end of last year that it took into account that the average duty-free limit of the Organization for Economic Cooperation and Development (OECD) is in the mid-$500 range.

Deputy Prime Minister Choo said, “There are many countries that are similar to the current level of $600,” but “I plan to raise it to $800 in order to stimulate tourism because of the recent difficulties in the tourism industry, considering the changes in various circumstances, since the period of setting it at $600 has been long.” said

The government said that the tax exemption limit needs to be raised in consideration of the fact that per capita income has increased by 30% from 39.5 million won in 2014 to 42.5 million won last year, and support for the tourism industry, which has been slow to recover, and the need to strengthen the competitiveness of the duty free industry. position.

The number of overseas travelers decreased from 28.71 million in 2019 to 4.28 million in 2020 and 1.22 million last year.

Duty-free shop sales increased from 24.9 trillion won in 2019 to 15.5 trillion won in 2020 and 17.8 trillion won last year.

The average duty-free limit of the OECD and the European Union (EU) is $566 and $509, respectively, but the duty-free limits of neighboring countries, China (5,000 yuan, regarding $776) and Japan (200,000 yen, regarding $1821) are lower. higher than Korea.

In addition, Deputy Prime Minister Choo announced that he would promote a plan to avoid taxation on interest and capital gains earned by non-residents and foreign corporations from trading Korean government bonds and monetary stabilization securities.

As it is promoting incorporation into the World Government Bond Index (WGBI) to induce foreign investors to invest in government bonds, the system will be revised in line with global standards.

Most WGBI-incorporated countries do not tax foreign government bond investment interest income.

The government explained that if foreign investment in government bonds increases, the government can expect stability in the government bond and foreign exchange markets, such as lowering the interest rate on government bonds and lowering the exchange rate.

Deputy Prime Minister Chu said, “If we become tax free on our government bond investment, it will be an incentive for foreign investors, and then investment will increase and interest expenses will decrease relatively.” The current estimate is that the tax revenue reduction effect from income tax exemption will not exceed 100 billion won.”

In 2009, the government enforced non-taxation on bond investment by foreigners and non-residents, but in January 2011, the tax-free benefit was abolished and returned to taxation as capital outflows became more volatile.

Regarding budgeting for next year, Deputy Prime Minister Chu said, “Overall, fiscal management will tighten the belt.”

When asked if there is a specific target for tying the growth rate of total expenditure in next year’s budget, he replied, “As the budget is in the final stages, we will review it.”

Deputy Prime Minister Choo said, “We are looking forward to providing support for the future and vulnerable groups, but the overall framework is that the government and the public sector must take the lead and overcome this difficulty.” We are reviewing the budget issue thinking that it is the right thing to do,” he said.

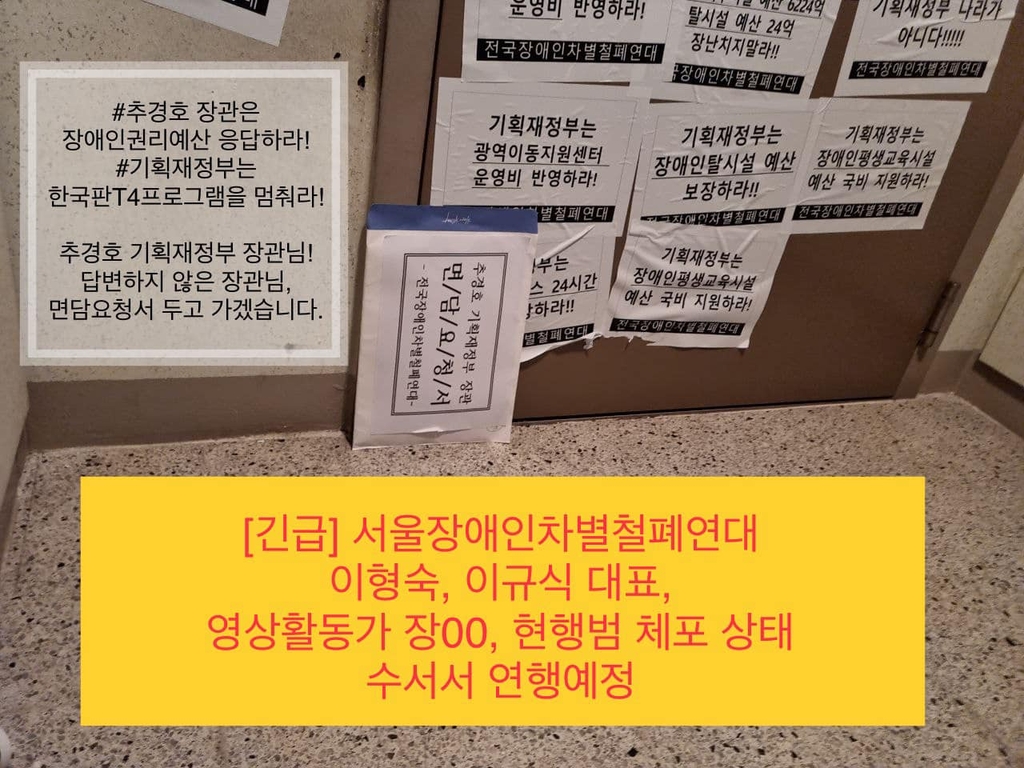

Regarding the continued subway protests and home visits by the National Solidarity for the Elimination of Discrimination once morest Persons with Disabilities (Jeon Jang-yeon) to secure a budget for the disabled and to meet with the deputy prime minister, Chu said, “When I am not in the apartment, at night, right in front of the apartment door, sticking something and protesting late at night. I am very sorry,” he said.

On the night of the 14th, Jeon Jang-yeon was charged with trespassing on the front door of the house of Deputy Prime Minister Choo, asking for an interview with the words ‘Korea is not a country of the Ministry of Strategy and Finance’ and ‘The Ministry of Strategy and Finance must guarantee a budget for deinstitutionalization of the disabled’. The current offender was arrested.

However, it was reported that he was not actually arrested and that he would receive a police investigation later.

At the time, Deputy Prime Minister Chu was on a flight to Bali, Indonesia to attend the G20 finance ministers and central bank governors meeting.

Deputy Prime Minister Chu said, “I think the process of listening to the story has gone through enough, and how we can project (Jeonjangyeon’s requirements) in the overall budget is something that needs to be comprehensively reviewed along with other aspects.”

He said, “I fully understand the meaning of[Jeon Jang-yeon]but I would like you to think carefully regarding whether the method of carrying out the budget is really appropriate and effective.”

/yunhap news