Trading with the Swallowing Candles: Key Talking Points

ingestion pattern in forex market prepare A useful way for Traders enter the market in anticipation of possibilities. reversal in trend. This article explains what a swallow candlestick pattern is. The trading environment that produces that pattern and how to trade the swallow candlestick in exchange rate.

Read on for information on:

- What is a swallow candle and how can it signal a reversal of the current trend in the market?

- There are two engrossing patterns to be aware of: a bullish engulfing pattern and a bearish engulfing pattern.

- Swallowed Candle Trading Strategy

What is a swallow candlestick?

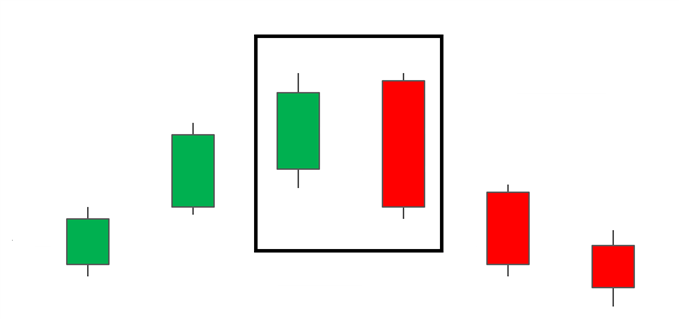

The swallow candle tends to signal a reversal of the current trend in the market. This particular pattern involves two candles with the latter ‘swallowing’ the entire body of the previous candle. A swallow candle can be an uptrend or a downtrend. It depends on where it forms in relation to the existing trend. The image below shows a bullish candlestick.

Not familiar with candlestick charts? read: How to read candlestick charts

Types of Forex Swallow Patterns

There are two engulfing candle patterns: a bullish engulfing candle and a bear engulfing candle.

1) Bullish engulfing pattern

the bullish engulfing candle give the strongest signal when appearing at the bottom of the downtrend and Indicative of increased buying pressure, bullish engulfing patterns often trigger a reversal of the existing trend. As more buyers enter the market and push prices even higher. This pattern involves two candles, with the second candle completely enveloping the ‘body’ of the previous red candlestick.

Interpretation: Price action must show a clear downtrend when a bullish pattern appears. bullish candle Shows that buyers are making a huge inroads into the market. And this creates an initial bias for further upward momentum. Traders will look for confirmation that the trend is reversing by using indicatorscritical level of support and resistance and the subsequent price movement following the engulfing pattern.

2) bear swallowing pattern

the bear swallowing pattern It’s just the opposite of a bullish pattern. It gives the strongest signal when it appears at the top of an uptrend and indicates an increase in selling pressure. A bearish engulfing candle will often trigger a reversal of the more existing trend. seller Enter the market and push the price further down. This pattern involves two candles with the second candle completely enveloping the ‘body’ of the previous green candlestick.

Interpretation: The price action must show a clear uptrend when the bearish pattern appears. A large bearish candle shows that sellers are advancing into the market. And this provides an initial bias for further downward momentum. Traders will look for confirmation that the trend is reversing by using the indicator. level of support and resistance and the subsequent price movement that occurs following the swallowed pattern.

Why are Engulfing Candles Important for Traders?

Swallowing candles help traders spot a reversal. indicating a stronger trend and help traders with exit signals:

- Reversal: The reversal is self-explanatory – it allows traders to enter trades at the best possible level and complete the trend drive.

- Continuing trend: Traders can look to engulfing patterns to support the continuation of existing trends. For example, spotting a bullish engulfing pattern during an uptrend gives more confidence that the trend will continue.

- exit strategy: This pattern can also be used as a signal to exit an existing trade if the trader holds a position in an existing trend that is ending.

The constraint of a swallow candlestick may occur when the pattern becomes a reversal rather than a definite change in direction. But traders can look for subsequent price action to reduce the chances of this undesirable outcome.

Swallowed Candle Trading Strategy

Using the Swallowed Candlestick Reversal Strategy

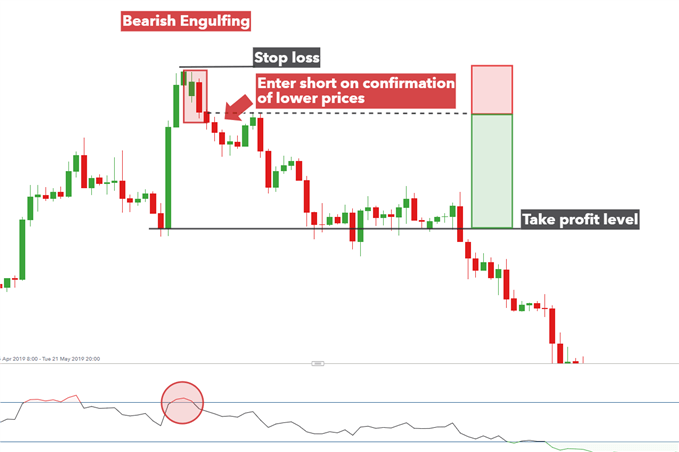

Traders can look for a bearish pattern trade by either waiting for confirmation of the move by observing the subsequent price action or waiting for a pullback before initiating the trade.

See below for a guide on how to trade the swallow candlestick patterns observed on GBP/USD four hour chart

- list: Look for a successful close below the low of the bearish engulfing candle. Alternatively, traders can look for a momentary retracement. (go towards the dotted line) before entering the short trade.

- stop: stop It can be placed above a swing high that forms a bearish engulfing pattern.

- Target Level / Take Profit: The target can be set at the previous level of support while ensuring it is positive. Reward Risk Ratio. The reward risk ratio is shown by green and red squares.

Using the Swallowing Candles When Trend Trading

The swallow candle doesn’t always have to appear at the end of the trend. When looking at a strong trend Traders can collect data from candle patterns that point to continuous momentum in the direction of the existing trend.

For example, the chart below shows a strong uptrend in S&P 500 With the appearance of multiple engulfing patterns (in the direction of the trend) add confidence to long A trader can enter a long trade following observing the close above the bullish candle.

This example also includes the existence of a bearish swallow pattern (red square) that appears at the top of the trend signaling a potential reversal. However, the subsequent price action does not monitor this movement. This is because consecutive candles cannot close below the lows of the candles that engulf the bear market and the market continues to rise. Thus, it underscores the importance of pattern validation.

Learn more regarding candlestick trading.

internal elements Element. This may not be what you intend to do! Load your application’s JavaScript bundle inside. substitute elements