Altcoins Surge as Bitcoin Takes a Backseat: What’s Driving the Shift?

The cryptocurrency market is witnessing a engaging shift as altcoins rally while Bitcoin experiences a dip, defying conventional market expectations.Analysts suggest that this trend could signal the beginning of a full-fledged altcoin season, with over 75% of the top 100 cryptocurrencies outperforming Bitcoin.Though, the market remains highly speculative, with rapid price swings underscoring the need for cautious investment strategies.

Bitcoin’s Dominance Wanes,Altcoins Gain Momentum

Recent data indicates a notable decline in Bitcoin’s market dominance,dropping from 58.5% to 57.3% during a relief rally on January 15. This shift has sparked optimism among traders,who are now positioning themselves for a potential altcoin surge. According to Coinbase analysts, this trend suggests that investors are anticipating a critically important rally in choice cryptocurrencies, driven by positive catalysts for risk assets and the broader crypto market.

“Meanwhile, the drop in BTC dominance from 58.5% to its support level of 57.3% during the inflation print relief rally on January 15 suggests to us that traders may be positioning for an outsized altcoin market rally on the back of positive catalysts for risk assets and crypto.”

Expert Insights: A Long-Term Perspective

Chris Burniske, a partner at crypto venture capital firm Placeholder and former ARK Invest crypto lead, has also weighed in on the trend.He highlights the gradual decline in Bitcoin’s dominance since late November 2024, suggesting that this could pave the way for a vibrant altcoin market.

“Importantly for the long tail,$BTC dominance has been slowly fading as late November ’24 – fireworks if that continues.”

What Does This Mean for Investors?

While the altcoin rally presents opportunities for short-term gains, seasoned traders emphasize the importance of thorough research before diving in.The crypto market’s inherent volatility means that rapid price swings can occur at any moment, making it crucial to evaluate the fundamentals of each project. Investors should also consider diversifying their portfolios to mitigate risks associated with market fluctuations.

Key Takeaways

- Bitcoin’s Dominance Declines: A drop from 58.5% to 57.3% signals a potential shift in market dynamics.

- Altcoin Rally: Over 75% of the top 100 cryptocurrencies are outperforming Bitcoin, hinting at an altcoin season.

- Expert Opinions: Analysts and industry leaders suggest that the trend could continue, driven by positive catalysts.

- Caution Advised: The market remains speculative, and investors should approach with careful evaluation.

Looking Ahead

As the crypto market continues to evolve, the interplay between Bitcoin and altcoins will remain a key area of focus. While Bitcoin’s dominance might potentially be waning, its role as a market leader is far from over. For now, the altcoin rally offers a glimpse into the potential of alternative cryptocurrencies, but only time will tell if this trend marks the beginning of a new era or a temporary blip in the market’s trajectory.

Stablecoins are emerging as a key indicator of market sentiment, and recent data suggests a potential surge in altcoin performance. Analysts David Duong and David Han from Coinbase have highlighted a significant trend: stablecoin inflows are pointing toward a bullish outlook for alternative cryptocurrencies.

Over the past week, stablecoin supply surged by $1.3 billion, marking a continuation of a two-month trend.This influx of capital stands in stark contrast to the outflows observed in Bitcoin (BTC) and Ethereum (ETH) spot etfs, which saw net withdrawals of $457 million and $206 million, respectively. As duong and Han noted, “Stablecoin supply – perhaps the most clear proxy for capital flows to these long tail assets in our view – increased by $1.3B last week, a continuation of trends we’ve observed over the past two months.”

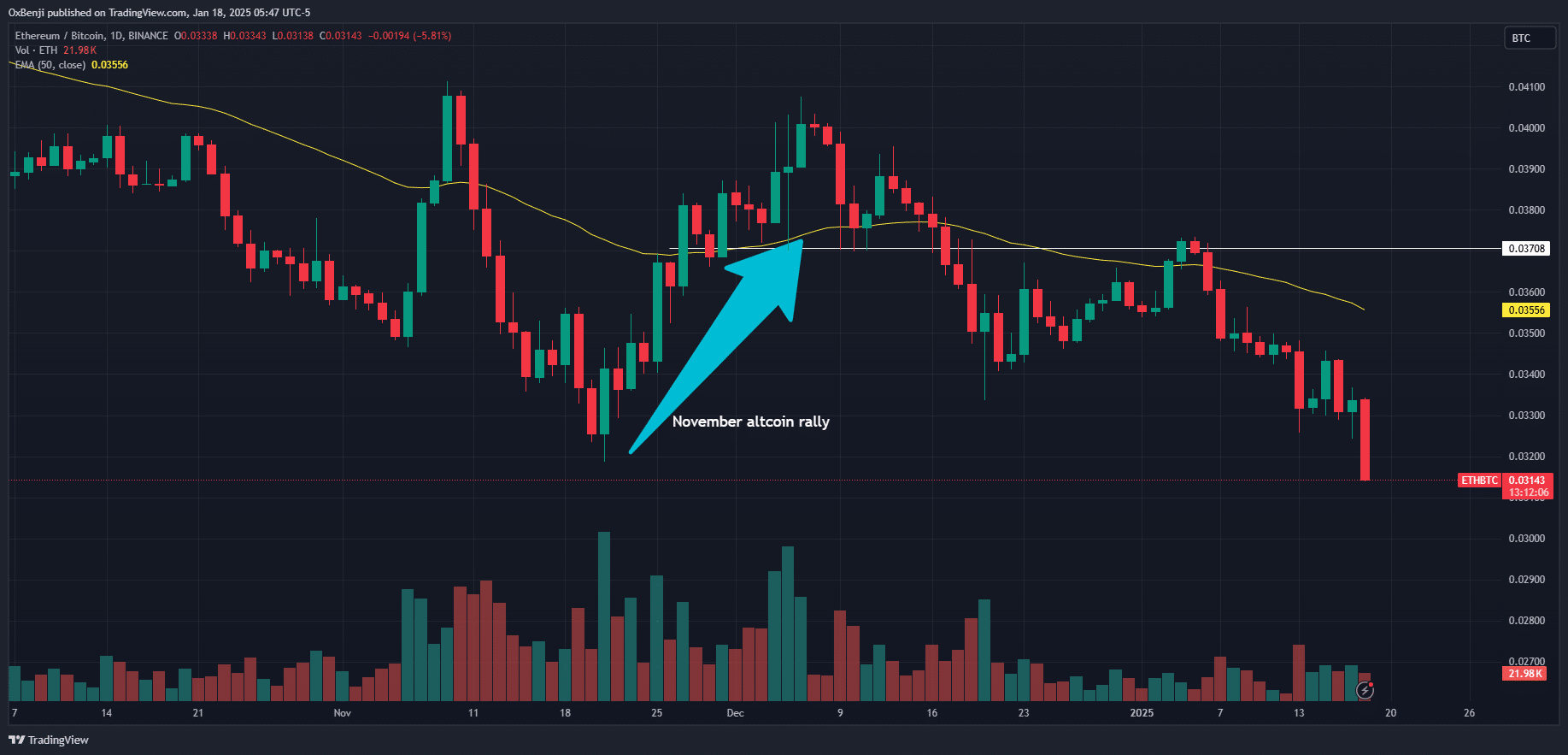

This shift in capital allocation suggests that investors are increasingly favoring altcoins over the two largest cryptocurrencies. However, not all indicators align with this optimistic narrative. The ETH/BTC ratio, which measures Ethereum’s performance relative to Bitcoin, has yet to reflect the same bullish momentum seen during November’s altcoin rally.

The ETH/BTC ratio is a critical metric for understanding market dynamics. When this ratio rises, it indicates that Ethereum is outperforming bitcoin, often signaling a broader altcoin rally. Conversely,a declining ratio suggests Bitcoin dominance. At the time of writing, the ratio has not mirrored the strong altcoin season observed earlier, leaving some analysts cautious about the immediate future of altcoins.

Despite this discrepancy,the steady increase in stablecoin inflows remains a compelling signal. Stablecoins, frequently enough used as a bridge between fiat and crypto, provide liquidity and adaptability for traders. Their growing supply indicates that investors are positioning themselves for potential opportunities in the altcoin market, even as Bitcoin and Ethereum experience outflows.

As the crypto market continues to evolve, these trends underscore the importance of monitoring multiple indicators to gauge investor sentiment. While the ETH/BTC ratio may not yet align with the broader bullish outlook, the surge in stablecoin inflows offers a promising sign for altcoin enthusiasts.Whether this momentum will translate into sustained growth for alternative cryptocurrencies remains to be seen, but the data suggests that the market is primed for potential shifts in the coming weeks.

The cryptocurrency market has been a rollercoaster lately, and the ETH/BTC ratio is no exception. Recently,this key metric plunged to a historic low of 0.31, signaling potential turbulence for the altcoin market. This development casts a shadow over the much-anticipated altcoin rally,especially if history repeats itself and mirrors the trends observed in November.

Despite the gloomy outlook, some altcoins managed to defy the odds and post impressive gains. Fartcoin, for instance, surged by nearly 100%, while XRP climbed by 30%.Solana (SOL) also joined the winners’ circle with a 30% increase,and Hedera wasn’t far behind,notching a 22% rise. These standout performances highlight the unpredictable nature of the crypto space, where even in downturns, opportunities emerge.

Interestingly, Hedera and XRP were also among the top performers during November’s altcoin rally. Their ability to replicate such success this time around remains uncertain, but their recent gains have certainly reignited interest in their potential.Whether they can maintain this momentum is a question on every investor’s mind.

As the market continues to evolve, one thing is clear: the altcoin sector remains a high-stakes game. While the ETH/BTC ratio’s decline raises concerns,the resilience of certain altcoins offers a glimmer of hope.Investors should tread carefully,keeping an eye on both market indicators and standout performers to navigate this volatile landscape.