Real estate prices have been rising for years, while wages are lagging behind. If you’re a hairdresser, salesperson or carpenter and you dream of owning your own home, you can forget it.

The most important things in brief

- You have to dig deeper and deeper into your pockets to buy your own home.

- A real estate expert calculates for whom the dream is realistic.

- Even for top earners, it is no longer so easy to acquire home ownership.

Ad

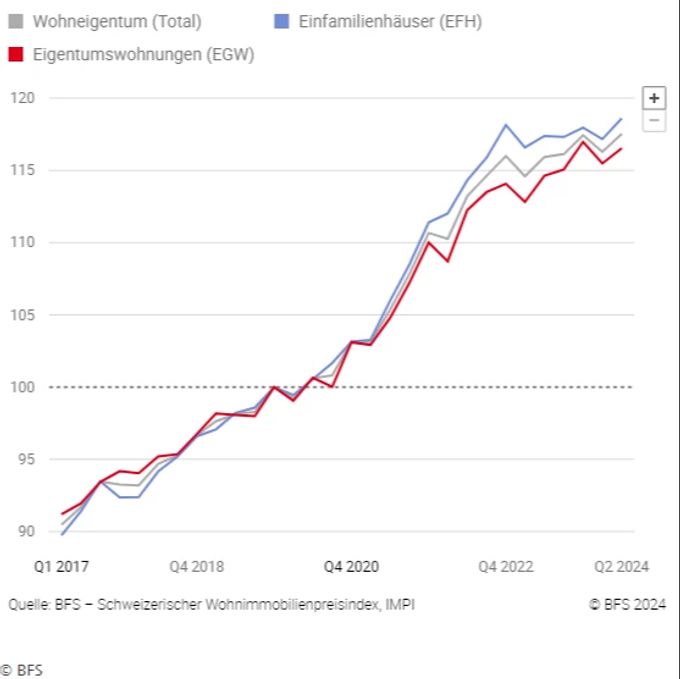

A steep upward curve describes the development of residential property prices in Switzerland: for years, condominiums, single-family homes, etc. have become increasingly expensive.

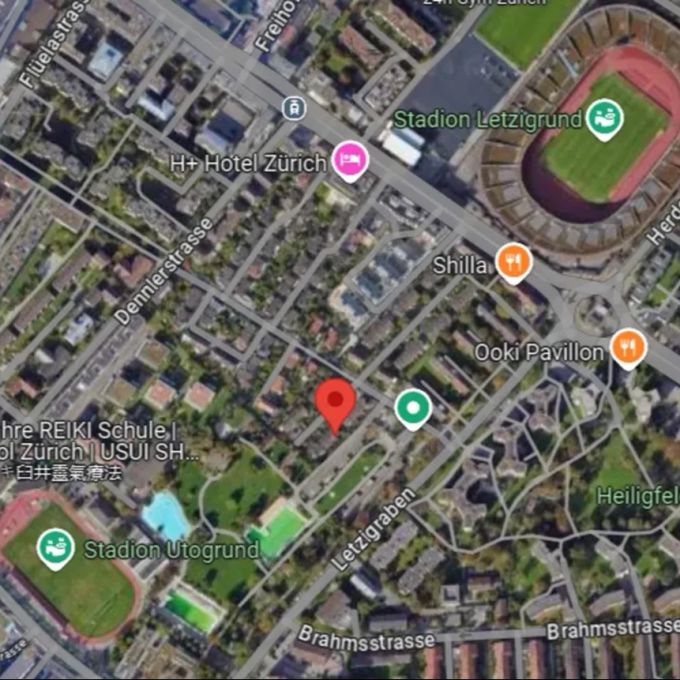

Just recently, an auction in Zurich-Altstetten caused a stir. An inconspicuous gray terraced house was sold for a whopping 2.25 million.

You need to contribute 450,000 francs of equity. And to be able to afford the mortgage, you need an annual income of 359,000 francs.

The curve is pointing steeply upwards: This is how real estate prices have developed in recent years. – BFS

These are sums that the average Swiss person can hardly imagine. As a reminder: according to the Federal Statistical Office (FSO), the median wage in Switzerland is just over 81,000 francs per year (per person). That is less than a quarter of what you would need to earn for a terraced house in Altstetten. Even for a couple where both partners work, that is not enough.

This raises the question: Is the dream of owning your own home still realistic for normal people today?

At least 168,000 francs annual salary required

First, let’s look at the numbers. Real estate expert Claudio Saputelli from UBS explains to Nau.ch: “Today, you have to expect to pay at least a million for a single-family home.” In sought-after locations, and especially in the city centers, the properties are much more expensive.

Anyone who wants to buy such a house must first pay 20 percent directly, i.e. 200,000 francs in equity. That leaves 800,000 francs in debt in the form of mortgages.

You have to pay seven percent of that per year – the expert calculates: “For the affordability calculation, banks usually use an imputed interest rate of around five percent. In addition, one percent each is added for the amortization of the mortgage and maintenance costs.”

That costs 56,000 francs a year or over 4,600 francs a month. “And you have to be able to afford that.”

The rule of thumb according to Saputelli: House costs must not be more than a third of income. 56,000 times three – now we have a proud salary of 168,000 francs.

Not even employed doctors earn enough

Figures from the employer rating platform Kununu show that not even employed doctors in Switzerland earn that much on average. They earn an average of 138,500 francs per year – making them the best-paid employees.

Software architects in second place also do not come close to the required 168,000 with an average salary of 134,700 francs. In third and fourth place are program managers with an annual salary of 129,000 francs and lawyers with 128,300.

However, the figures only reflect the earnings of employees without management positions. And in the case of doctors, employed specialists are not taken into account – that is, doctors with additional training in a specific field.

If you look at the salaries of employed and self-employed specialists or the upper management, things look different.

Do you dream of owning your own home?

10%

Yes, I’m already saving diligently.

1

Yes, I’m already saving diligently.

55%

I already have one.

19%

I can’t possibly afford it.

3

I can’t possibly afford it.

16%

No, you are more flexible with a rental apartment.

4

No, you are more flexible with a rental apartment.

According to the Federal Office of Public Health (FOPH), self-employed specialists have a median income of 257,000 francs. However, certain specialist areas pay significantly more: in neurosurgery, the median salary is 697,000 francs, and in gastroenterology (gastrointestinal) it is 672,000.

The median salary for employed specialists is 197,000. This is enough – at least – to buy a modest home.

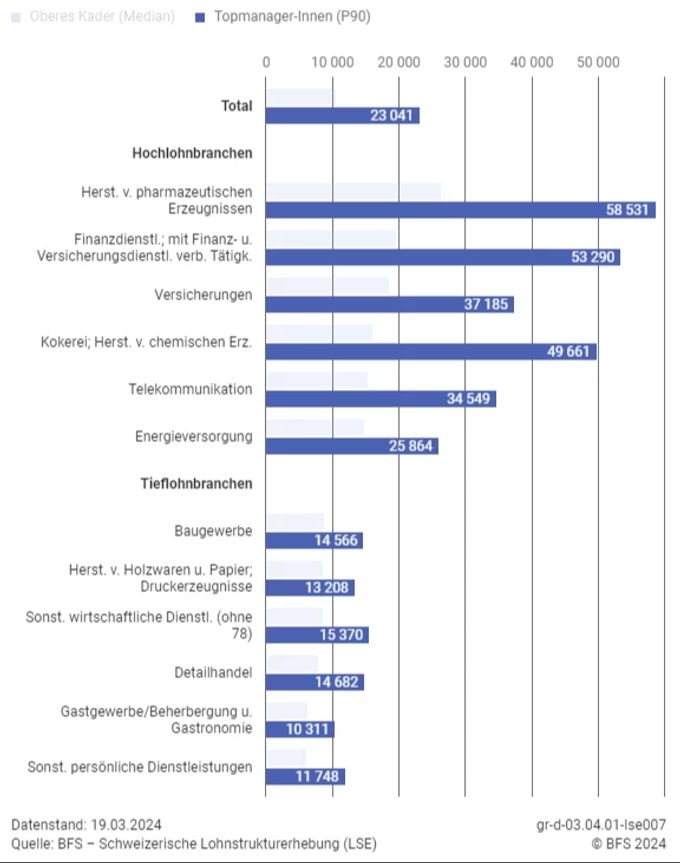

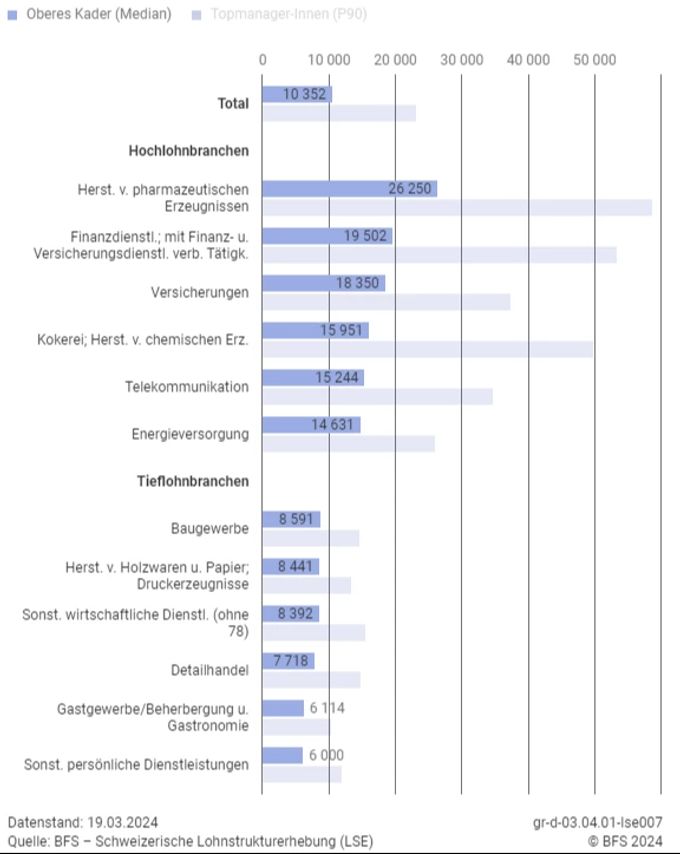

Top manager salaries are not sufficient in all industries

The median salary list of the BFS’s upper management makes a distinction between upper management and top managers. And it turns out that in the catering, personal services or wood and paper production sectors, even a job at the highest level is not enough.

In retail, you have to be a top manager; upper management is not enough. The same applies to the construction industry and other economic services.

The monthly median wages of top managers by industry. – BFS

A member of the upper management in the energy supply sector comes closest to achieving the necessary salary: he earns 175,572 francs.

The house would also be affordable for senior management in the telecommunications, chemical, insurance, financial and pharmaceutical industries.

In the centre? With average wages “practically no chance”

Now the good news: “If you only look at the median wages, that often doesn’t go far enough,” says real estate expert Saputelli. “Many people buy a house together with their partner, can still inherit or take an early inheritance.”

For households with two incomes or for those whose parents have saved something and want to pay, the situation is different.

Saputelli’s conclusion: “In the city centers, you have practically no chance of owning your own home with an average wage. But if you go a little further, it’s certainly realistic.”

There are cheaper offers, for example, in the rural areas of the cantons of Thurgau, Schaffhausen or Glarus. But also partly in the canton of Zurich, for example in the lowlands or in the wine country.

Without an inheritance it will be difficult

But is it cheap enough that average earners can continue to dream even without an inheritance in sight?

“Then it becomes rather difficult,” admits Saputelli. “If the prospects are not there, there are two options: Either you look for a condominium instead of a single-family home – or you stick with renting.”

Do you have an inheritance in sight?

20%

Yes, I expect a good sum!

1

Yes, I expect a good sum!

19%

A small one perhaps.

2

A small one perhaps.

61%

No, there’s nothing to be gained there.

3

No, there’s nothing to be gained there.

After all, the standard of rental apartments in Switzerland is becoming increasingly high. “It’s not like in Italy, where there is a real caste mentality. There, rental apartments are of significantly lower quality than owner-occupied homes.”

Our tenancy law is well-developed and there is no social stigma for tenants. “Even many rich people decide to rent because they value the flexibility.”

Natalie Imboden from the Unia union stressed at Nau.ch: “Since buying a house is hardly realistic, rents are all the more important for the majority of employees. But here we have the problem that rents continue to rise.”

Wages, however, cannot keep up. Unia is therefore calling for “significant increases.”

Ad

Ad

More on the topic:

BFSServicesTrade unionMortgageCoiffeurFrancePartnerChemistryUniaUBS