2023-05-01 19:01:27

I published it already 0 minutes

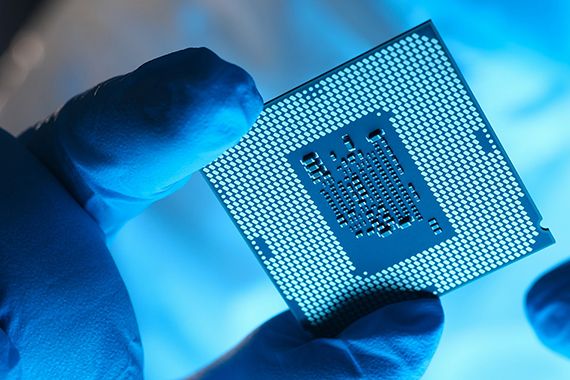

Some stocks stand out due to long-term positives such as cloud computing and demand for semiconductors. (Photo: 123RF)

2022 has been a tough year for tech stocks. The US Morningstar Technology Index ended the year down more than 31%. But already, the tide has turned. In the first quarter of 2023, tech stocks saw a 22% rally.

And while the rally in tech stocks won’t continue, notably due to weak demand for PC computers, Android smartphones and an economic slowdown in the second and then third quarters, some stocks stand out.

For what? Due to long-term positive factors such as cloud computing and demand for semiconductors.

With that in mind, here are three undervalued tech stocks to consider:

ASML Holding (ASML, 635,39$ US)

In the semiconductor industry, ASML is one of our favorite titles. This company is dominant among suppliers of photolithographic equipment for semiconductor manufacturers. We believe it should benefit from the proliferation of extreme ultraviolet lithography among advanced chipmakers. In fact, we expect ASML’s growth to outpace that of the wafer fabrication equipment industry in the coming years as the technology leaders in this process purchase its tools. We give ASML a wide moat rating and believe that its shares, which are worth US$608 today, should be worth US$760 instead.

Salesforce (CRM, 197,58$ US)

Then there is Salesforce. Our analysts believe that Salesforce represents one of the best examples of long-term growth in large-cap software companies. This is largely due to its rapidly expanding portfolio of complementary solutions that enable clients to fully embrace their customer needs, build relationships, strengthen retention and drive revenue. We expect Salesforce to benefit even more from cross-selling between its cloud businesses and selling more features within its product lines. We also expect it to reap the rewards of its ongoing international growth and acquisitions exemplified by its recent deals with Slack and Tableau. We give Salesforce a wide moat rating and think its stock is worth US$245, whereas today it’s around US$191.

ServiceNow (NOW, 450,01$ US)

ServiceNow has mastered what can be called an acquisition and expansion strategy. How? Using its strength in the area of workflow automation to deepen its relationship with clients through additional IT, HR, and other administrative and client services. In fact, we believe ServiceNow has become an essential partner in digital transformation. We are also impressed with ServiceNow’s excellent balance between strong and highly visible revenue growth and strong margins. We give ServiceNow a wide moat rating and think its stock is worth US$600. They are worth around US$445 today.

1682968011

#top #stocks #buy #hold

:strip_icc():format(jpeg)/kly-media-production/medias/4293087/original/032057900_1673917421-088723300_1662604716-iPhone_14_Pro.jpg)