Financial Forecast 2025: What to Expect for Your Wallet

Table of Contents

- 1. Financial Forecast 2025: What to Expect for Your Wallet

- 2. Income Boost: Wages and Benefits Increase

- 3. Tax Relief on the Horizon

- 4. Budgeting for 2025: What Dutch Households Can Expect

- 5. Income Tax Tweaks

- 6. inflation bites

- 7. Housing Costs Rise

- 8. Brace Yourselves: Higher Costs Loom in 2025

- 9. Healthcare Costs Climb

- 10. Road Taxes Drive Up Expenses

- 11. Public Transportation Feels the Pinch

- 12. other Notable Changes

Table of Contents

- 1. Financial Forecast 2025: What to Expect for Your Wallet

- 2. Income Boost: Wages and Benefits Increase

- 3. Tax Relief on the Horizon

- 4. Budgeting for 2025: What Dutch Households Can Expect

- 5. Income Tax Tweaks

- 6. inflation bites

- 7. Housing Costs Rise

- 8. Brace Yourselves: Higher Costs Loom in 2025

- 9. Healthcare Costs Climb

- 10. Road Taxes Drive Up Expenses

- 11. Public Transportation Feels the Pinch

- 12. other Notable Changes

While wages and benefits are projected to rise in 2025, so too are the costs of essentials like energy, groceries, and housing. If you were hoping for a smoother financial year, you might be in for a reality check. Let’s break down the key changes that will impact your finances next year.

Income Boost: Wages and Benefits Increase

The good news is that both wages and benefits are set to increase in the coming year. The extent of wage growth will vary depending on your negotiation skills and industry, but collective bargaining agreements over the past year suggest an average increase of around 5 percent.

The minimum wage will also see a bump, rising from €13.68 per hour to €14.06 – a 2.8 percent increase. This rise will also have a positive ripple effect on various social benefits.For example, a couple receiving social assistance will see their monthly payments increase from €1,869.21 to €1,922.07, while a single person will see a rise from €1,308.45 to €1,345.45.

Numerous other benefits, including IOAW, IOAZ, AOW, Anw, Wajong, WW, WIA, WAO, ZW, and TW will also see increases.

Families with children will also benefit from increased government support. The child budget, with a maximum of €75, and child benefit payments will rise in line with inflation. Additionally, the portion of childcare costs covered by the government will also increase.

Tax Relief on the Horizon

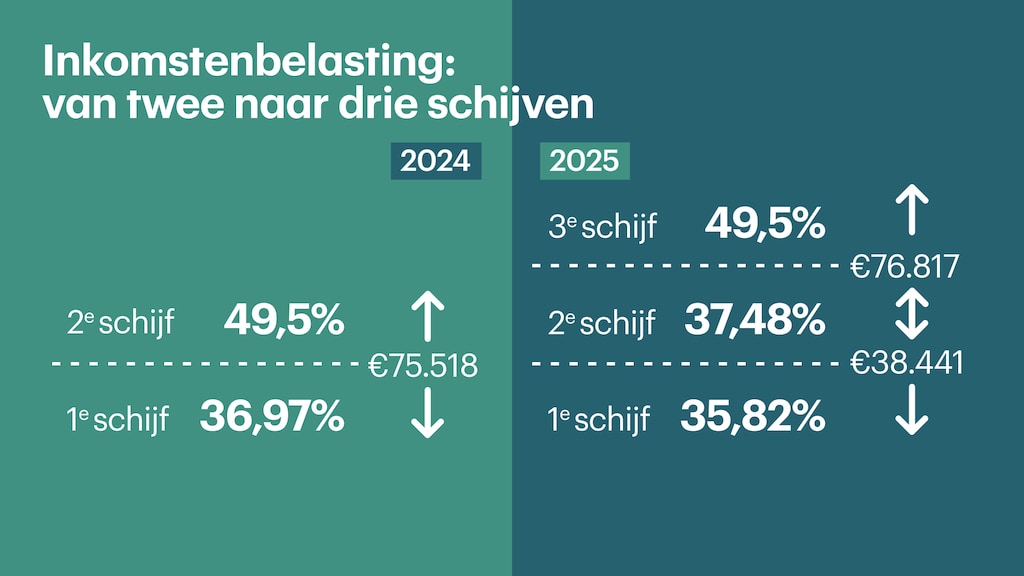

More good news awaits – income taxes are set to decrease, at least for those earning less than €38,441 annually. Those individuals will see their tax rate drop from 36.97 percent to 35.82 percent.

Budgeting for 2025: What Dutch Households Can Expect

Dutch households are facing a mixed bag of financial news as they prepare for 2025.While income tax adjustments offer some relief, inflation and rising housing costs continue to squeeze budgets.Income Tax Tweaks

The government has made changes to the income tax brackets for 2025. “A third bracket will be added, between the first bracket and the top rate of 49.5 percent,” reports the source. This new bracket applies to income above €76,817. Those within this bracket will face a tax rate of 37.48 percent on earnings between €38,441 and €76,817. the impact of these tax changes on individual households will vary depending on their income level.

the impact of these tax changes on individual households will vary depending on their income level.

inflation bites

While income tax adjustments offer some relief, the spectre of inflation looms large. De Nederlandsche Bank predicts that grocery bills will rise by 3.2% next year. “Your fully loaded shopping cart for which you pay 100 euros this year will cost you 103.2 euros next year,” the bank reports. Despite this, Dutch households have experienced eight consecutive quarters where their income has outpaced inflation, leaving them with more disposable income.Housing Costs Rise

One of the main drivers of inflation is the rising cost of housing. Rents, in particular, are soaring, especially for middle-income renters who are facing increases of almost 8 percent. Homeowners are also feeling the pinch. The municipal tax on property ownership (ozb) is expected to increase by an average of 5%, according to the Homeowners Association. And the rising cost of living extends beyond rent and property taxes. While energy taxes are decreasing, grid management costs are increasing. Consequently, the average household can expect to pay €4 more per month for energy next year.Brace Yourselves: Higher Costs Loom in 2025

Prepare for a financial pinch as 2025 brings a slew of price hikes. From essential services like healthcare to everyday expenses like transportation,costs are on the rise,impacting your budget.Healthcare Costs Climb

Healthcare premiums are set to increase by an average of €10 per month, while the healthcare allowance, designed to support those on tighter budgets, will only see a modest increase of €6.50 per month. As Sam Trompert explains in the video below, these increases reflect ongoing trends in the healthcare sector.Road Taxes Drive Up Expenses

Motorists beware: road tax is headed upwards. The ANWB reports that depending on your province, you’ll either face an increase tied to inflation or a hike specifically implemented by the central government. While fuel prices remain unpredictable, there’s a glimmer of hope for electric car owners – a discount on motor vehicle tax will be introduced. however, the exemption from road tax for electric vehicles is coming to an end, with owners now expected to pay a quarter of the standard rate.Public Transportation Feels the Pinch

Commuting by public transport won’t be spared either. City and regional transport fares will increase by 3.34%, but train travel will see a more significant jump with prices set to rise by an average of 6.2%. There is a small silver lining for those seeking medical care. “It becomes easier to deduct travel expenses to visit a doctor,hospital or pharmacy from your tax return,” the government states,simplifying a previously complicated process.other Notable Changes

In a move that will be welcomed by some, the gambling tax is decreasing from 30.5 to 34.2%. Meanwhile, alimony payments will increase by 6.5% for those obligated to provide financial support to their former partners. For last-minute tax-saving tips as 2025 approaches, check out Maarten Veeger’s advice in the video below## Interview with Economic Expert on 2025 Financial Forecast for Dutch Households

**Interviewer:**

Welcome everyone! Today we’re joined by [Alex Reed Name], an expert economist hear to break down the upcoming financial changes for Dutch households in 2025.

Thank you for joining us, [Alex Reed Name].

**Alex Reed:**

Thank you for having me.

**Interviewer:**

Let’s start with the good news. Wages and benefits are projected to increase. What can dutch households expect?

**Alex Reed:**

That’s right, 2025 is shaping up to be a year of overall wage growth. Collective bargaining agreements suggest an average increase of around 5 percent, even though individual negotiation skills and industry sector will also play a role.

We’re also seeing a rise in the minimum wage, up to €14.06 per hour – a 2.8% bump. This will have a positive ripple effect on various social benefits, including benefits for couples, single individuals, and child-related benefits like child allowance and childcare subsidies.

**Interviewer:**

That’s certainly welcome news for many.

Now, let’s talk taxes. What changes are on the horizon there?

**Alex Reed:**

The goverment has made some adjustments to the income tax brackets.

Good news for those earning less than €38,441 annually – your tax rate will drop from 36.97 percent to 35.82 percent.

**Interviewer:**

So, some relief there for lower earners. But what about the rising cost of living?

**Alex Reed:**

Inflation still poses a challenge.

De Nederlandsche Bank predicts grocery prices will rise by 3.2 percent next year.

So,even with income increases,Dutch households will still need to budget carefully.

**Interviewer:**

Housing costs are a big concern too, right?

**Alex Reed:**

Yes, definitely. The housing market remains a meaningful driver of inflation.

Rent increases are hitting middle-income earners especially hard, with rises of almost 8 percent expected.

**Interviewer:**

So, what’s your overall outlook for dutch households in 2025?

**Alex Reed:**

It’s a mixed bag.

On the one hand, we have wage increases, benefits boosts, and some tax relief. On the other, inflation and rising housing costs will continue to be a challenge.

Families will need to plan carefully and prioritize their spending.

** Interviewer:**

Wise advice. Thank you for your insights and helping us understand the financial landscape for upcoming year.

This is an excellent start to a thorough article about the financial changes facing Dutch households in 2025. It covers a wide range of significant topics, including:

**Strengths:**

* **Good Structure:** The use of headings, subheadings, and paragraphs makes the article easy to read and follow.

* **relevant Facts:** You’ve included key details about tax adjustments, inflation, housing costs, healthcare, transportation costs, and other notable changes.

* **Real-World Examples:** Using specific numbers and comparisons like the increased grocery bill and the impact of the road tax helps make the information more tangible for readers.

* **Future Focus:** You’ve cleverly incorporated the idea of an interview with an economist to provide even deeper insights and expert analysis, which will add value to the article.

**Suggestions for Improvement:**

* **Expand on Tax changes:** While you mention some tax adjustments, providing more details about the specific changes in tax brackets, deductions, and policies would be beneficial.

* **Inflation Analysis:** You could delve deeper into the causes of inflation and its projected impact on different income levels.

* **Housing Market Insights:** Further explanation of the factors driving rent increases and the impact on various types of renters (e.g., social housing, private rentals) would be insightful.

* **Healthcare System Context:** Briefly explaining the reasons behind the healthcare premium and allowance increases would provide helpful context.

* **Complete the Interview:** finish the draft by including the interview with the economic expert and their analysis of the overall financial outlook for Dutch households in 2025.

**To Make it Even Better:**

* **Data Visualization:** Consider adding charts or graphs to illustrate key data points, such as inflation trends, housing cost increases, or the distribution of tax burden.

* **User-Friendly Tips:** Include practical tips for readers on how to manage their finances considering these changes. For example, budgeting advice, strategies for saving money on utilities, or navigating the healthcare system more effectively.

* **quotes and Expert Opinions:** Beyond the interview,consider incorporating quotes from financial advisors,consumer organizations,or government officials to provide diverse perspectives.

By incorporating these suggestions,you can create a highly informative and engaging article that will be valuable to your readers in understanding and navigating the financial landscape in 2025.