This week’s trading notes: U.S. retailers, Chinese stocks announced financial reports, Fed officials made speeches,EURRegional first quarter GDP and April inflation data, US April retail sales data.

This week’s trading notes (0516-0520)

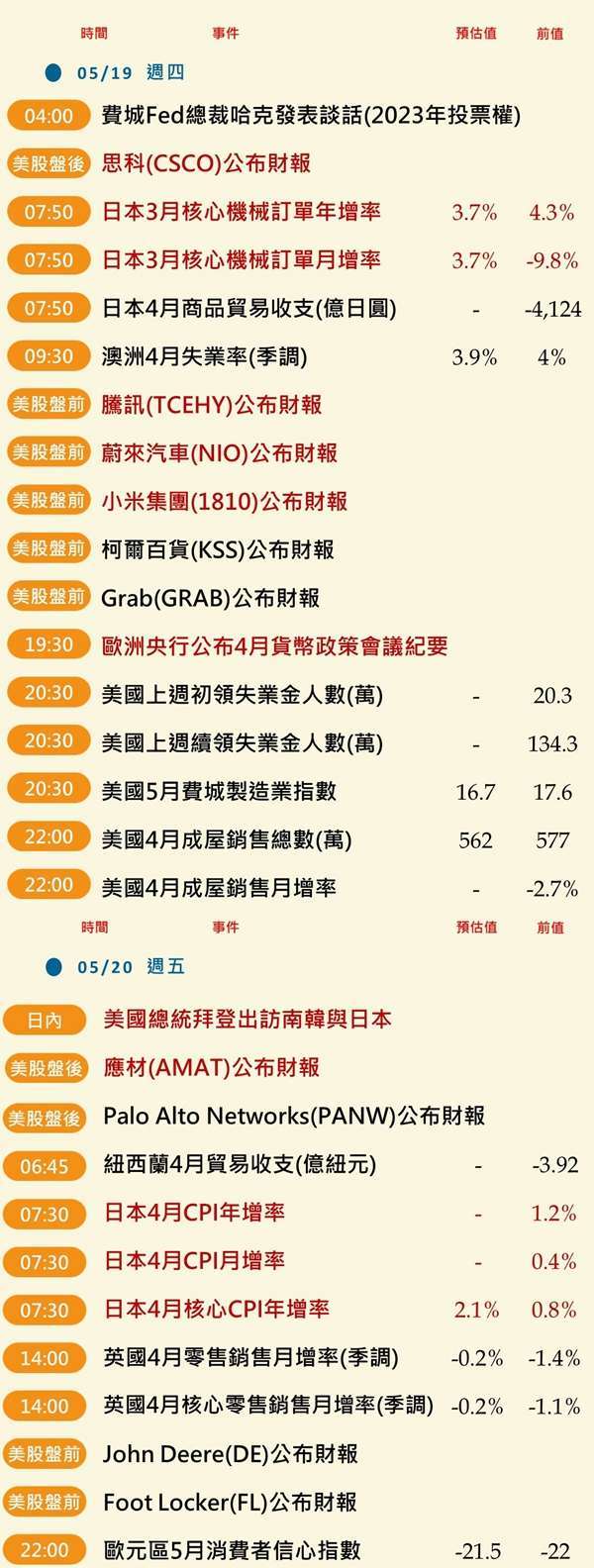

1. U.S. retailers and Chinese concept stocks announce financial reports

American retailer Walmart (WMT-US),The Home Depot (HD-US), Lowe’s (LOW-US), Target Department Store (TGT-US) and other companies are regarding to report earnings before the opening bell on Tuesday (17th).

FactSet analysts estimate that Walmart’s revenue last quarter was regarding $138.84 billion and earnings per share were $1.48; Home Depot’s revenue last quarter was regarding $36.7 billion and earnings per share were $3.69; Lowe’s revenue last quarter For $23.77 billion, earnings per share were $3.22; Target Department Store reported revenue of $24.46 billion and earnings per share of $3.07 last quarter.

In addition, the network equipment giant Cisco (CSCO-US) will also report following-hours earnings on Wednesday (18th), with FactSet analysts expecting the company to report earnings of $0.86 per share on revenue of $13.34 billion last quarter. Semiconductor equipment leading applied materials (AMAT-US) will report earnings following the market closes on Thursday (19th).

At the same time, some Chinese concept stocks will also announce their earnings this week, including Tencent (0700-HK), NIO (NIO-US), Baidu (START US),IQIYI (IQ-US), JD.com (JD-US), and Chinese phone maker Xiaomi Group (1810-HK)。

2. Statement by a Federal Reserve official

Fed Chairman Powell will make a speech on Wednesday following he first relented when he attended the Senate appointment vote and media interviews, frankly saying that high inflation and weak overseas economies may hinder the Fed’s goal of achieving a soft landing. He also hinted that in order to keep inflation down , the future does not rule out a 3-yard rate hike (75 basis points).

The Fed’s most hawkish official, James Bullard, will also make a speech. He once threw out the idea that this year may rise by 3 yards in one breath, and said a few days ago that the current monetary policy is not behind the inflation situation, and the forward guidance has been have a significant effect. Economic data show inflation is likely to remain high for most of the year and the economy shrank in the first quarter.

In addition, speeches from Cleveland Fed President Loretta Mester, New York Fed President John Williams and Philadelphia Fed President Patrick Harker will follow this week.

The April inflation data released by the United States last week is still heating up. Although there are some signs of peaking, it is still near a multi-decade high. This official talk can give a glimpse of the Fed’s future tightening of monetary policy.

3. EURDistrict Q1 GDP and April Inflation Data

EURThe district will announce the first-quarter gross domestic product (GDP) data this week. The market estimates that the quarterly GDP growth rate following the Q1 quarterly adjustment is 0.2%, and the previous value is 0.2%. The value is 5%, the previous value is 5%.

EURThe district will also announce the final value of the non-seasonally adjusted April core consumer price index (CPI), which is estimated by the market at 3.9%, compared with the previous value of 3.9%. .

In addition, European Central Bank President Christine Lagarde will speak on Wednesday. She said last week that the European Central Bank (ECB) may end its bond-buying program at the beginning of the third quarter of this year, and then start it “in a few weeks”. The first rate hike in more than a decade. The remarks echo recent statements by several policymakers that interest rates might be raised as soon as July.