A researcher interviewed by Kitco said that the world gold price in the first half of 2024 will likely fall below the support mark of 1,940 USD/ounce, but will then rebound, the target may be 2,400 USD /ounce.

Gold price today January 31: World gold is forecast to continue to decline in the first half of 2024

The gold market remains in a solid holding trend as it awaits further guidance from the Federal Reserve. One market strategist is warning potential precious metals investors to be patient as 2024 will be the year of nuanced trading.

In a recent interview with Kitco News, Michele Schneider, Director of Trading Education and Research at MarketGauge, said that while she is optimistic regarding gold and silver prices in the new year, the precious metals market might see Expect some volatility and weakness in the first half of 2024.

The comments come as gold remains stuck below resistance at $2,050 an ounce. February gold futures last traded at $2,037.10 per ounce, up 0.28% on the day.

Evolution of world gold prices. Source: Tradingeconomics

Even though the Federal Reserve is expected to cut interest rates this year, Schneider still thinks that the gold market appears to be ahead of itself as it has priced in aggressive easing at five or six rate cuts. . She added that the Federal Reserve will likely cut interest rates three times, with the first cut coming in June.

Schneider said the Federal Reserve remains focused on inflation because the threat has not gone away as economic activity remains quite strong, driven by solid consumer demand. At the same time, consumers are living beyond their means, spending on credit, which might significantly threaten future growth.

She noted that inflation is currently following the same pattern created in the 1970s. Historically, she does not expect that the US economy has seen a significant change in inflationary pressures. She said this is also the reason why the Fed is being two-faced on monetary policy because there are reasons to cut and reasons to maintain higher levels for a longer period of time.

Forecasting the gold market, Schneider believes that world gold prices may fall below 2,000 USD/ounce and test the initial support level of regarding 1,980 USD/ounce, potentially even falling back to 1,940 USD/ounce. in the first half of this year.

However, she added that she expects this to be a significant buying opportunity as the weakening economy forces the Federal Reserve to lower interest rates, abandoning its fight once morest inflation.

Looking ahead to the second half of this year, to 2025 and beyond, Schneider said she expects any current sell-off to be a bottoming move for gold and then she expects a long-term uptrend. with prices pushing up to 2,400 USD/ounce.

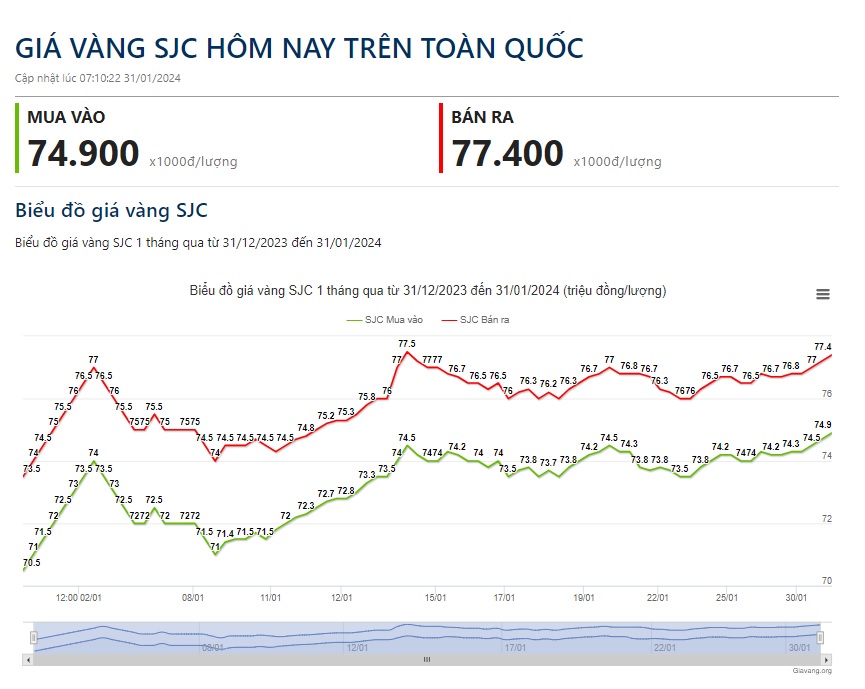

Gold price today January 31: SJC gold increased “shockingly”

SJC gold price was adjusted to increase sharply compared to yesterday morning’s opening session with the highest increase of 600,000 VND, exceeding the threshold of 77 million VND/tael. Currently, the prices of gold bars for brands are listed specifically as follows:

SJC gold price in Hanoi and Da Nang area is listed at 74.9 million VND/tael purchased and 77.42 million VND/tael sold. In Ho Chi Minh City, SJC gold is still buying at the same level as in Hanoi and Da Nang areas but selling is 20,000 VND lower. Thus, compared to yesterday morning, the price of SJC gold bars has been adjusted to increase by 600,000 VND in both directions.

Meanwhile, the price of SJC gold bars was listed by Phu Quy at 74.9 million VND/tael purchased and 77.35 million VND/tael sold, an increase of 500,000 VND on the buying side and 600,000 VND on the selling side.

DOJI in Hanoi area has adjusted the price of SJC gold by 700,000 VND on the buying side and 600,000 VND on the selling side to 74.85 million VND/tael and 77.35 million VND/tael, respectively.

SJC gold bars are being bought by the PNJ brand at 74.9 million VND/tael and sold at 77.4 million VND/tael, an increase of 500,000 VND in buying and 600,000 VND in selling compared to yesterday morning.

Meanwhile, Bao Tin Minh Chau is selling and buying respectively at 74.95 million VND/tael and 77.3 million VND/tael, an increase of 500,000 VND on the buying side and 450,000 VND on the selling side.

Domestic SJC gold price developments. Source: giavang.org

Unit: x1000 VND/tael

| Area | System | Buy into | Sold out |

|---|---|---|---|

| City. Ho Chi Minh | SJC | 74.900 | 77.400 |

| PNJ | 72.500 | 75.200 | |

| Mi Hong | 75.600 | 76.600 | |

| Hanoi | SJC | 74.900 | 77.420 |

| PNJ | 72.500 | 75.200 | |

| Bao Tin Minh Chau | 74.400 | 76.700 | |

| wealth | 74.050 | 76.500 | |

| Danang | SJC | 74.900 | 77.420 |

| PNJ | 72.500 | 75.200 | |

| Nha Trang | SJC | 74.900 | 77.420 |

| Ca Mau | SJC | 74.900 | 77.420 |

| Hue | SJC | 74.870 | 77.420 |

| Bien Hoa | SJC | 74.900 | 77.400 |

| West | SJC | 74.900 | 77.400 |

| Quang Ngai | SJC | 74.900 | 77.400 |

| Bac Lieu | SJC | 74.900 | 77.420 |

| Ha Long | SJC | 74.880 | 77.420 |

| West | PNJ | 72.100 | 75.100 |

| Ben tre | Mi Hong | 75.600 | 76.600 |

| Tien Giang | Mi Hong | 75.600 | 76.600 |

| Updated at 07:10:22 January 31, 2024 | |||